Australian Dollar rebounds broadly after the larger than expected rate hike by RBA, and takes up New Zealand Dollar too. But there is no clear follow through buying yet. Swiss Franc is currently the weakest one for the day, followed by Dollar and Yen. Apparently, overall development suggests steady risk sentiment, but that may not last long. Euro and Sterling are mixed, together with Canadian.

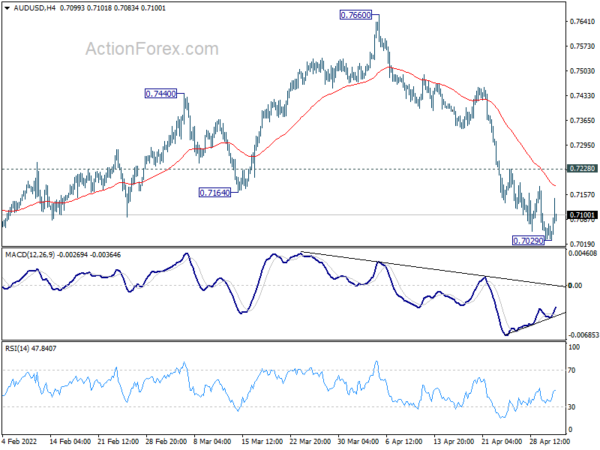

Technically, for Aussie to confirm its underlying strength, some levels need to be taken out with conviction. The levels include 0.7228 minor resistance in AUD/USD, and 1.4682 minor support in EUR/AUD. Otherwise, overall tone in Aussie will remain bearish and selloff could come back any time soon. In particular, Aussie would be back in disadvantage if US 10-year yield could break through 3% decisively, and Germany 10-year yield could power through 1%.

In Asia, at the time of writing, Hong Kong HSI is up 0.12%. Singapore Strait Times is up 0.65%. Japan and China are on holiday. Overnight, DOW rose 0.26%. S&P 500 rose 0.57%. NASDAQ rose 1.63%. 10-year yield rose 0.109 to close at 2.996, after breaching 3% to 3.002.

RBA hikes by 25bps to 0.35%, more to come

RBA raises cash rate target by 25bps to 0.35% today, larger than expectation of 15bps to 0.25%. The interest rate on Exchange Settlement balances is also lifted by 25bps to 0.25%. In the forward guidance, RBA said it’s committed to “ensure that inflation in Australia returns to target over time”. That will “require a further lift in interest rates over the period ahead”.

In the accompanying statement, RBA said the economy has “proven to be resilient and inflation has picked up more quickly, and to a higher level, than was expected” while “wages growth is picking up”. It’s appropriate to start the process of normalizing monetary conditions.”

Unemployment rate is expected to decline to around 3.5% by early 2023, hitting the lowest level in almost 50 years. GDP is projected to grow by 4.25% over 2022 and 2% over 2023. Headline expected to rise further from current 5.1% to 5% this year. Underlying inflation is also expected to rise from current 3.7% to 4.75%. By mid-2024, headlines and underlying inflation are projected to have moderated back to around 3%, with assumption of further rate hikes.

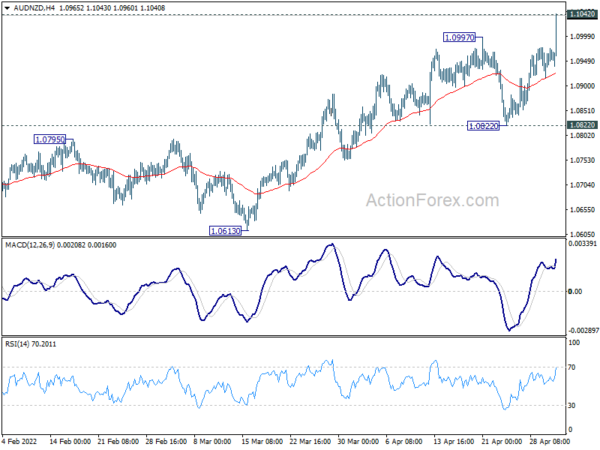

AUD/NZD breaches 2020 high after RBA rate hike

AUD/NZD rises sharply after the larger than expected rate hike by RBA, and breach a key resistance level at 1.1042 (2020 high). Decisive break of this level would be a significant medium term development and should confirm resumption of whole up trend from 0.9992 (2020 low). That should set the stage for further rise to 100% projection of 0.9992 to 1.1042 from 1.0278 at 1.1328, which is slightly above 1.1289 (2017 high). In any case, outlook will stay bullish as long as 1.0822 support holds.

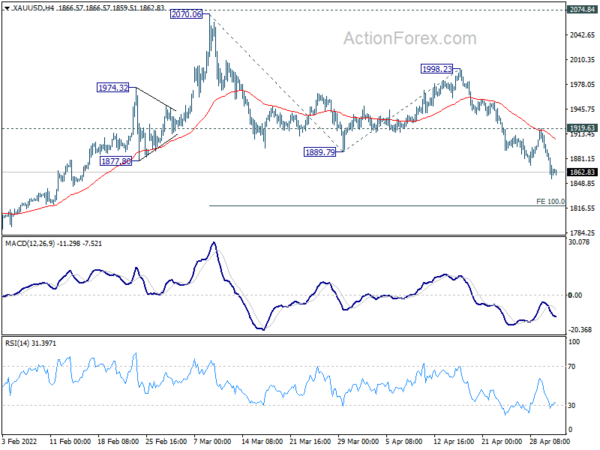

Gold resume decline, heading to 1817 first

Gold dropped notably this week on the back of strong Dollar. Rising treasury yield, with 10-year yield breaching 3% handle for the first time since 2018, also weigh on the precious metals.

Gold’s fall from 1998.23 resumed after slightly stronger than expected recovery last week. Such fall is seen as the third leg of the decline from 2070.06, and should target 100% projection of 2070.06 to 1889.79 from 1998.23 at 1817.86 next. In any case, more downside is expected for the near term as long as 1919.63 resistance holds.

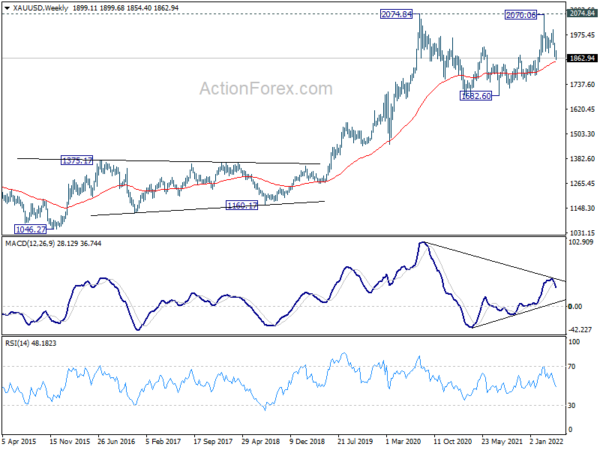

Also, such decline is seen as the third leg of the corrective pattern from 2074.84 (2020 high). Sustained trading below 55 week EMA (now at 1843.71) would pave the way back to 1682.60 support, where is should finish the pattern and bring long term up trend resumption.

Looking ahead

Germany unemployment, Eurozone unemployment and PPI, UK PMI manufacturing final will be featured in European session. US will release factory orders later in the day.

AUD/USD Daily Report

Daily Pivots: (S1) 0.7027; (P) 0.7055; (R1) 0.7079; More…

Intraday bias in AUD/USD is turned neutral first with current recovery. But further decline is expected as long as 0.7228 minor resistance holds. As noted before, fall from 0.7660 is seen as the third leg of the larger correction from 0.8006. Below 0.7029 will target 0.6966 low first. Firm break there will confirm this bearish case and target 0.6756 medium term fibonacci level next. Nevertheless, considering bullish convergence condition in 4 hour MACD, break of 0.7228 should indicate short term bottoming, and turn bias back to the upside for stronger rebound.

In the bigger picture, price actions from 0.8006 are seen as a corrective pattern to rise from 0.5506 (2020 low). Fall from 0.7660 should be the third leg of this pattern. Break of 0.6966 will target 50% retracement of 0.5506 to 0.8006 at 0.6756. On the upside, break of 0.7660 will revive that case that the correction has already completed at 0.6966.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Mar | 5.80% | 10.50% | 12.20% | |

| 04:30 | AUD | RBA Interest Rate Decision | 0.35% | 0.25% | 0.10% | |

| 07:55 | EUR | Germany Unemployment Change Apr | -15K | -18K | ||

| 07:55 | EUR | Germany Unemployment Rate Apr | 5.00% | 5.00% | ||

| 08:30 | GBP | Manufacturing PMI Apr F | 55.3 | 55.3 | ||

| 09:00 | EUR | Eurozone Unemployment Rate Mar | 6.80% | 6.80% | ||

| 09:00 | EUR | Eurozone PPI M/M Mar | 4.90% | 1.10% | ||

| 09:00 | EUR | Eurozone PPI Y/Y Mar | 36.30% | 31.40% | ||

| 14:00 | USD | Factory Orders M/M Mar | 1.20% | -0.50% |