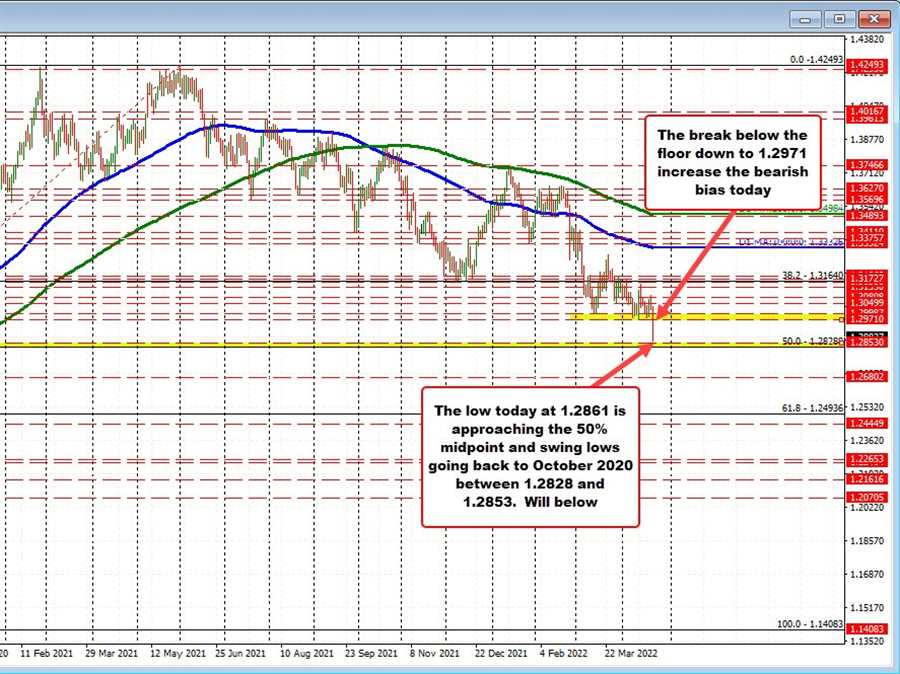

The GBPUSD moved sharply lower after retail sales came in much weaker than expected -1.4% versus -0.3% estimate. The price also got a kick to the downside after breaking below the 1.300 level and the low price from April 1.2971. The pair traded down to a low price of 1.2861, and got closer to the 50% midpoint of the move up from the 2020 low. That midpoint level comes in at 1.2828.

Looking back to October 2 2022 November 1, 2020, the swing lows came in between 1.2835 and 1.2853. Those levels are just above the 50% midpoint at 1.2828 creating a key floor that would need to be broken to increase the bearish bias.

Drilling all way down to the five minute chart on the trend move lower, the 38.2% retracement of the tumble to the downside comes in at 1.29266. Meanwhile the falling 100 bar moving average is just above that level (and moving toward it). If the buyers are to take more control back from the sellers on the intraday chart, getting above both those levels is required (along with the 50% of the same move lower at 1.29468).

Absent that and the sellers remain in full control in the short term.

The high corrective price reached 1.29157 which got within about 10 pips of the 38.2% retracement. However the price has since reversed back to the downside and currently trades at 1.2881.

SUMMARY: There is key support below from 1.2828 to 1.2853 on the daily chart. That area may give some traders cause for pause, with stops on a break below.

Conversely, looking at the intraday 5- minute chart, the sellers remain in full control below the falling 100 bar moving average (at 1.2927) and below the 38.2% (the minimum corrective target) of the trend move lower today (at 1.29266).

With the price near 1.2881, the price is near-ish the midpoint of those support and resistance levels from the two respective charts. Overall, the tilt still goes to the sellers as they are the ones losing most recently with the pair trading at the lowest level since November 2020.