The IMF’s chief economist spoke in an interview with Reuters.

This follows the latest report, covered here:

Main point from the follow-up interview (Headlines via Reuters):

-

says sees signs of higher inflation expectations increasing, may

require more forceful tightening moves by central bankers - says if inflation

remains elevated for more than a couple more months in advanced

economies and wage pressures continue to rise, will likely see more

aggressive monetary policy tightening - says war is ‘piling

on’ an already elevated inflation environment, increases risk of

‘jolt’ away from stable price environment - says tight US labor

market creates demand for more ‘catch-up’ wage increases, raising

risk of wage-price spirals - says fiscal support

has been greater than needed coming out of the pandemic - IMF’s baseline

forecasts project inflation peak in second quarter, anticipate that

supply chain disruptions ease and withdrawal of fiscal support cools

demand - March slowdown in

china economic data greater than expected, but there is room for

Chinese authorities to counter this with fiscal, monetary stimulus

From earlier:

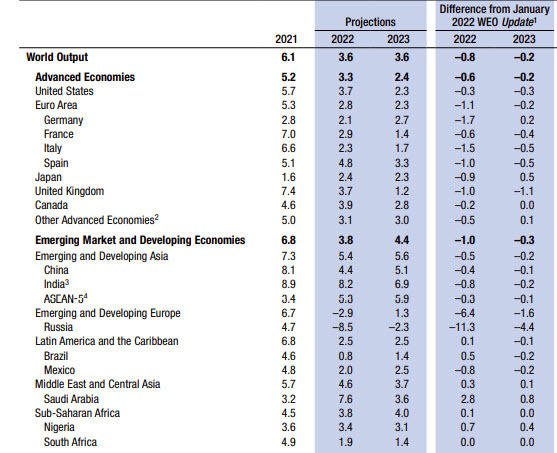

All countries except one group saw their outlooks revised lower: commodity exporters.That’s a good reminder of the state-of-play in markets.

This article was originally published by Forexlive.com. Read the original article here.