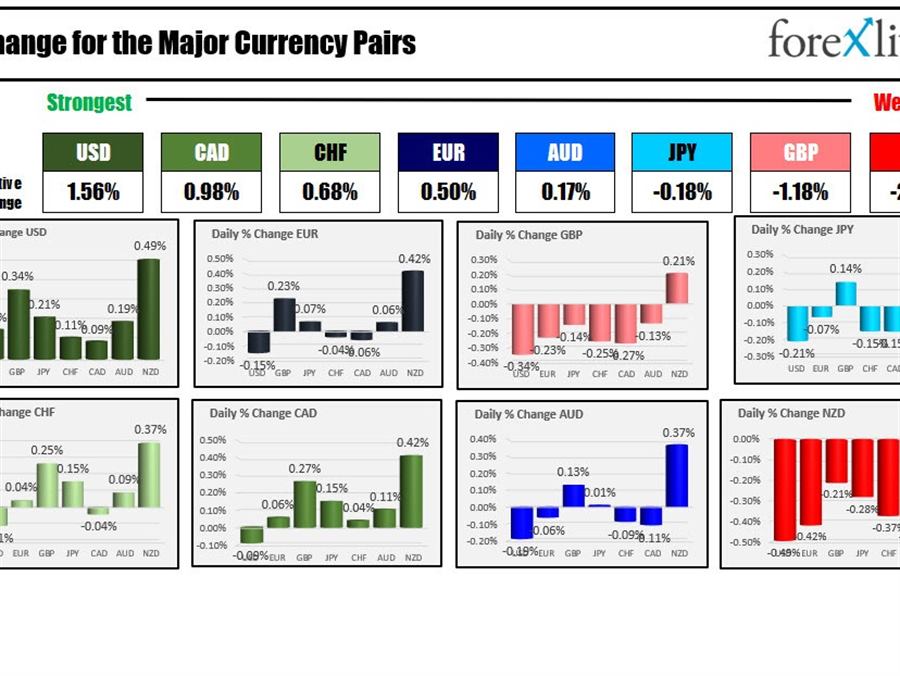

The strongest currency is the US dollar while the weakest of the NZD as North American traders enter for the day. It’s Friday. TGIF. Market activity can be more volatile at the end of the week going into the weekend when the markets are closed.

Russia cut the rates by 300 basis points to 17% is the economy shifts from fears of inflation to economic recession and financial stability. In Ukraine, Russian forces bombed civilians at a train station killing over 30 people. The pressure from global sanctions continued to escalate yesterday with the EU banning the import of Russian coal. They continue to refrain from bans on Russian oil with Germany firmly against that idea for fears of an immediate recession if enacted.

Stocks are higher in premarket trading after yesterday’s gains snapped a two day losing streak. US yields are higher with the 10 year continued to push toward the 3.0% level. The 10 year yield trades at three year highs. I don’t know if it’s good news, but the two – 10 year spread as moved from inverted (a prelude to a recession) to positive this week. The current spread is around 16 basis points after closing near 19 basis point yesterday. The spread moved to around -9 basis points at the most inverted level.

The first round of presidential elections in France is projected to advance Pres. Macron and right wing, anti EU populist Le Pen who he is advocating for greater state intervention to help in the rise in inflation. The next round would be in 2 weeks time. Polls have narrowed markedly as rising inflation are weighing on Macron’s popularity.

Canada will release their jobs report at 8:30 AM ET. with expectations of a gain of 80K after last months 336.6K surge. US wholesale inventory data will be released at 10 AM along with weekly Baker Hughes oil rig data later this afternoon.

A snapshot of the markets as North American traders enter for the day shows:

- Spot gold is trading up $3.30 or 0.16% $1934

- Spot silver is trading up two cents or 0.13% at $24.61

- Spot crude oil is trading up $0.37 or 0.39% at $96.40

- Bitcoin is trading near unchanged at $43,350

The major US stock indices snapped a 2 day down day yesterday and are trading higher in premarket activity.

- Dow industrial average up 134.43 points after yesterday’s 87.06 point gain

- S&P index up up 16 points after yesterday’s 19.04 point gain

- Nasdaq index is 8.48 points after yesterday’s 8.48 point gain

In the European equity markets, the major indices are also rebounding for the 2nd consecutive day..

- German DAX, up 1.5%

- France’s CAC, up 1.5%

- UK’s FTSE 100 up 1.0%

- Spain’s Ibex, up 1.8%

- Italy’s FTSE MIB up 2.0%

In the US debt market, the yields are higher, with a flatter yield curve . Talk of 3% 10 year yield becoming part of the projections as job market continues to be tight, tight, tight, and housing market is too high.

European 10 year yields are also higher at the start of the North American session: