Canadian Dollar rises slightly after solid job data, but Dollar is also firm. The greenback is on track to end as the strongest one for the week, with help from extended rally in treasury yields. On the other hand, Sterling is under some selling pressures but Euro is still the worst performing one. Aussie is pressing a near term support against the greenback and break there could erase more of this week’s gains.

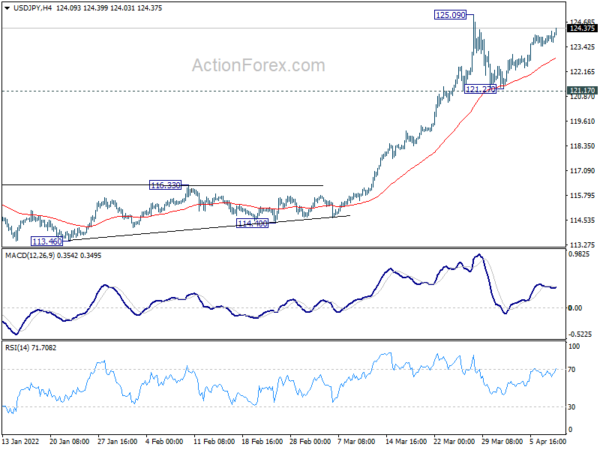

Technically, technically, a focus will be on USD/JPY before weekly close. Rebound from 121.27 is extending and should be targeting 125.09 resistance. Firm break there will resume larger up trend from 102.58. There is prospect for that to happen even before close, if the pre-market rally in US yields would sustain and extend.

In Europe, at the time of writing, FTSE is up 1.09%. DAX is up 1.06%, CAC is up 0.95%. Germany 10-year yield is up 0.027 at 0.710. Earlier in Asia, Nikkei rose 0.36%. Hong Kong HSI rose 0.29%. China Shanghai SSE rose 0.47%. Singapore Strait Times dropped -0.62%. Japan 10-year JGB yield dropped -0.0071 to 0.238.

Canada employment grew 73k in Mar, unemployment rate dropped to record low 5.3%

Canada employment grew 73k, or 0.4% mom, in March, slightly below expectation of 78k. The growth was driven by 93k rise in full-time jobs. Services-producing jobs rose 42k while goods-producing jobs rose 31k.

Unemployment rate dropped -0.2% to 5.3%, lowest on record since 1976. Total hours worked rose 1.3% mom. Average hourly wages rose 3.4% yoy.

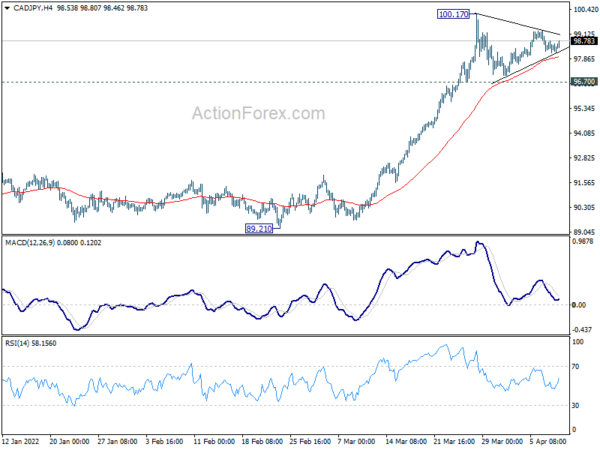

CAD/JPY recovers mildly, but stays in consolidation

CAD/JPY recovers mildly after better than expected Canadian job data. But it’s just staying well inside consolidation pattern from 110.17. More sideway trading could still be seen. But outlook remains bullish with 96.70 support intact. Larger up trend is expected to resume sooner or later through 100.17 short term top.

In case of upside breakout, next target will be 100% projection of 73.80 to 91.16 from 84.65 at 102.01.

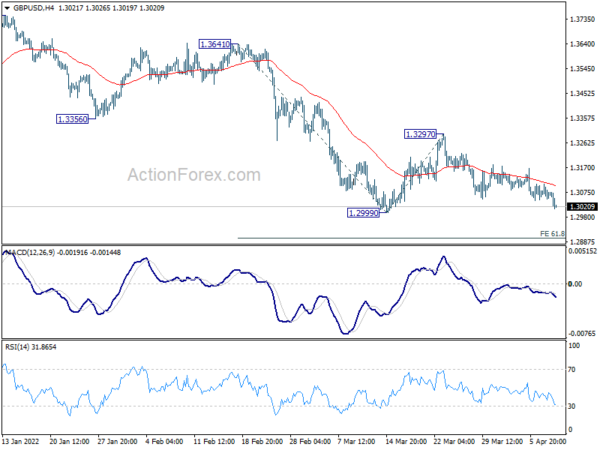

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3049; (P) 1.3077; (R1) 1.3103; More…

GBP/USD drops notably today and focus is now on 1.2999 low. Firm break there will resume larger down trend from 1.4248. Next target is 61.8% projection of 1.3641 to 1.2999 from 1.3297 at 1.2900. In any case, outlook will stay bearish in case of recovery.

In the bigger picture, current development suggests that the up trend from 1.1409 (2020 low) has completed at 1.4248. Decline from 1.4248 could still be a corrective move, or it could be the start of a long term down trend. In either case, deeper decline would be seen back to 61.8% retracement of 2.1161 to 1.1409 at 1.2493. In any case, break of 1.3748 resistance is needed to indicate medium term bottoming, or outlook will stay bearish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Current Account (JPY) Feb | 0.52T | 0.27T | 0.19T | 0.18T |

| 05:00 | JPY | Consumer Confidence Index Mar | 32.8 | 35.9 | 35.3 | |

| 06:00 | JPY | Eco Watchers Survey: Current Mar | 47.8 | 45 | 37.7 | |

| 08:00 | EUR | Italy Retail Sales M/M Feb | 0.70% | 0.20% | -0.50% | -0.60% |

| 12:30 | CAD | Net Change in Employment Mar | 72.5K | 77.5K | 336.6K | |

| 12:30 | CAD | Unemployment Rate Mar | 5.30% | 5.40% | 5.50% | |

| 14:00 | USD | Wholesale Inventories Feb F | 2.10% | 2.10% |