Yen’s selloff resumes in early US session as selloff in bonds resume. Dollar picks up some buying after strong job data. But Swiss Franc is stronger with help from selloff in Euro. On the other hand. commodity currencies are turning weaker together with Euro, but pressure on them is still far from that on Yen.

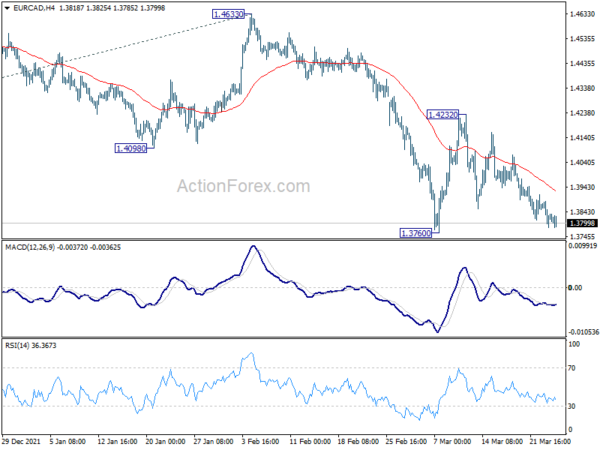

Technically, both EUR/CAD and EUR/AUD are now getting closer to near support levels of 1.3760 and 1.4561 respectively. Firm break of these levels will resume larger down trend. If that happens, we’ll see if EUR/USD would finally make up its mind to fall through 1.0899 minor support, or even 1.0805 low.

In Europe, at the time of writing, FTSE is up 0.12%. DAX is down -0.14%. CAC is up 0.08%. Germany 10-year yield is up 0.0060 at 0.526. Earlier in Asia, Nikkei rose 0.25%. Hong Kong HSI dropped -0.94%. China Shanghai SSE dropped -0.63%. Singapore Strait Times rose 1.05%. Japan 10-year JGB yield rose 0.0144 to 0.240.

US initial jobless claims dropped to 187k, lowest since 1969

US initial jobless claims dropped -28k to 187k in the week ending March 19, much better than expectation of 210k. That’s also the lowest level since September 6, 1969, when it was 183k. Four-week moving average of initial claims dropped -12k to 212k.

Continuing claims dropped -67k to 1350k in the week ending March 12. That’s the lowest since January 3, 1970, when it was 1332k. Four-week moving average of continuing claims dropped -31k to 1432k, lowest since February 28, 1970, when it was 1421k.

US durable goods orders dropped -2.2% mom in Feb, ex-transport orders dropped -0.6% mom

US durable goods orders dropped -2.2% mom in February to USD 271.5B, worse than expectation of -0.6% mom. Ex-transport orders dropped -0.6% mom, below expectation of 0.6% mom. Ex-defense orders dropped -2.7% mom. Transportation equipment dropped for the third straight month, by -5.6% mom to USD 82.6B.

SNB keeps rate at -0.75%, upgrade inflation forecasts

SNB keeps sight deposit rate unchanged at -0.75% as widely expected. It reiterated that is is “willing to intervene in the foreign exchange market as necessary, in order to counter upward pressure on the Swiss franc”. The Swiss franc remains “highly valued”.

SNB said, “the war in Ukraine has had an effect on the Swiss economy above all via the strong increase in commodity prices”, and are likely to “weigh on consumption and increase companies’ production costs”. Trade is likely to be affected by “albeit not severely given Switzerland’s limited direct economic ties to Ukraine and Russia”. Supply bottlenecks “could deteriorate further” and uncertainty could have an “adverse impact on investment activity.”. 2022 growth forecasts was revised lower to around 2.5%.

The inflation forecast, conditioned on policy rate at -0.75%, was raised in general. But inflation is projected to peak at 2.2% in Q2 2022, then slow gradually to 0.7% in Q2 2023, then climb back to 1.1% in Q1. For the year as a whole, inflation is projected to be 2.1% in 2022 (upgraded from 1.0%), 0.9% in 2023 (up graded from 0.6%), and then 0.9% in 2024 (new).

UK PMI manufacturing dropped to 55.5, but services rose to 61.0

UK PMI Manufacturing rose dropped from 58.0 to 55.5 in March, below expectation of 57.7, a 13-month low. PMI Services rose from 60.5 to 61.0, above expectation of 58.0, a 9-month high. PMI Composite dropped from 59.9 to 59.7.

Chris Williamson, Chief Business Economist at S&P Global said: “The survey indicators point to potentially sharply slower growth in the coming months, accompanied by a further acceleration of inflation and a worsening cost of living crisis, which paints an unwelcome picture of ‘stagflation’ for the economy in the months ahead.”

ECB Elderson: War impacts outlook through channels of confidence and energy prices

ECB Executive Board member Frank Elderson said in a speech that there are two channels through which Russia invasion of Ukraine weighs Eurozone outlook. They are “negative confidence effects, which have an impact on both international trade and on financial markets, and high energy prices.”

But he noted that outlook prevailing the invasion was “quite favorable”. And, “this implies that in our updated baseline outlook, and also in more adverse and severe scenarios for the impact of the war, stagnation is not foreseen.”

“It is a well-established practice in monetary policy that in times of uncertainty prudent policy calls for gradualism,” Elderson said. “This holds particularly true when we approach potential turning points in the monetary policy cycle.”

“If the evolution of the inflation outlook supported by incoming data allows a further normalisation of monetary policy, we stand ready to adjust our instruments accordingly.”

Eurozone PMI manufacturing dropped to 57.0, war having immediate and material impact

Eurozone PMI Manufacturing dropped from 58.2 to 57.0 in March, above expectation of 55.9. But that’s still a 15-month low. PMI Services dropped from 55.5 to 54.8, above expectation of 54.3. PMI Composite dropped from 55.5 to 54.5.

Chris Williamson, Chief Business Economic at S&P Global said: “The survey data underscore how the Russia-Ukraine war is having an immediate and material impact on the eurozone economy, and highlights the risk of the eurozone falling into decline in the second quarter…

“The war has aggravated existing pandemic-related price pressures and supply chain constraints, leading to record inflation rates for firms’ costs and selling prices, which will inevitably fee through to higher consumer prices in the months ahead…

“Businesses are themselves bracing for weaker economic growth, with expectations of future output collapsing in march as firms growth increasingly concerned about the impact of the war”.

Germany PMI Manufacturing dropped from 58.4 to 57.6 in March, above expectation of 55.9. PMI Services dropped from 55.8 to 55.0, above expectation of 54.3. PMI Composite dropped from 55.6 to 54.6.

France PMI Manufacturing dropped from 57.2 to 54.8 in March, below expectation of 55.1. That’s also a 5-month low. PMI Services rose from 55.4 to 57.4, above expectation of 55.2, a 4-month high. PMI Composite rose from 55.5 to 56.2, an 8-month high.

BoJ Kataoka: Pay attention to downside risks to economy, upside risks to prices

BoJ board member Goushi Kataoka warned in a speech to business leaders, “disruptions in Russia-related trade will weigh not just on Russia’s economy but global growth by prolonging worldwide supply constraints.” And for the time being, “we must pay attention to downside risks to Japan’s economy…as well as upside risks to prices.”

Separately, meeting of January BoJ meeting noted one member said, “We’re seeing stock prices rise for companies that hike prices. Price hikes may broaden, and heighten medium- to long-term inflation expectations.”

Another member said, “many companies are feeling the limit of sticking to a business model that was effective deflation. As they change their price-setting behaviour, inflationary pressure may heighten.”

However, “nominal wage growth must exceed 2per cent for Japan to stably meet the BOJ’s price target,” on member was quoted.

Japan PMI manufacturing rose to 53.2 in March, PMI services rose to 48.7

Japan PMI Manufacturing rose from 52.7 to 53.2 in March. Manufacturing output rose from 49.3 to 50.6. PMI Services rose from 44.2 to 48.7. PMI Composite rose from 45.8 to 49.3.

Usamah Bhatti, Economist at S&P Global, said: “Flash PMI data indicated that activity at Japanese private sector businesses fell for the third month running during March. The decline in output eased from the previous survey period however, and was only marginal as companies noted that COVID-19 cases had continued to reduce, allowing the lifting of the quasi-state of emergency across Japan. By sector, manufacturers noted a renewed rise in output in at the end of the first quarter, while service providers indicated a softer deterioration in business activity.

Australia PMI composite rose to 57.1, 10-mth high

Australia PMI Manufacturing rose from 57.0 to 57.3 in March. PMI Services rose from 57.4 to 57.9, a 10-month high. PMI Composite rose from 56.6 to 57.1, also a 10-month high.

Jingyi Pan, Economics Associate Director at S&P Global said: “The Australian economy continued to expand strongly in March… reflecting robust business conditions post the COVID-19 Omicron wave. Price pressures worsened, however, unsurprisingly aggravated by the slew of issues including floodings in Australia, the Ukraine war and broader supply chain constraints…

“Higher employment levels in March had been a positive sign, though firms also widely reported higher wages. Meanwhile the reopening of the international borders led to the first new export business growth in the service sector since June 2021.”

IMF: RBNZ should continue swift policy normalization

In a report, IMF urged RBNZ to have “significant increases” in interest range in the near term to address inflation as a priority.

IMF said, “with the recovery well-entrenched, tight labor market conditions, and elevated inflation, it is appropriate to withdraw fiscal and monetary support as envisaged.”

Fiscal policy should “remain agile”. “While the scheduled tightening of fiscal policy is appropriate, the authorities should calibrate the fiscal stance to the evolution of the pandemic and economic conditions, providing additional, targeted support where needed.”

As for monetary policy, IMF said it should remain “data dependent, and continued, swift policy normalization will be appropriate under baseline conditions.”

“Given New Zealand’s strong cyclical position and inflationary pressures, significant increases in the Official Cash Rate in the near term are appropriate, signaling the RBNZ’s commitment to addressing inflation as a priority.”

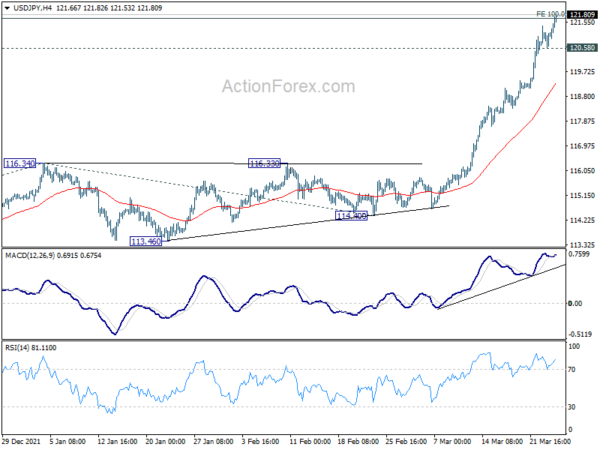

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 120.69; (P) 121.06; (R1) 121.51; More…

USD/JPY’s rally continues today and hit target of 100% projection of 109.11 to 116.34 from 114.40 at 121.63. There no sign of topping yet. Intraday bias stays on the upside for the moment. Sustained trading above 121.63 will pave the way to 125.85 long term resistance. On the downside, below 120.58 minor support will turn intraday bias neutral and bring consolidations first, before staging another rally.

In the bigger picture, the break of 118.65 resistance (2016 high) suggest that up trend from 98.97 (2016 low) is resuming, with rise from 101.18 (2020 low) as the third leg. Medium term outlook will remain bullish as long as 113.46 low. Next target is 125.85 (2015 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:00 | AUD | Manufacturing PMI Mar P | 57.3 | 57 | ||

| 22:00 | AUD | Services PMI Mar P | 57.9 | 57.4 | ||

| 23:50 | JPY | BoJ Minutes | ||||

| 00:30 | JPY | Manufacturing PMI Mar P | 53.2 | 52.7 | ||

| 07:45 | EUR | France Manufacturing PMI Mar P | 54.8 | 55.1 | 57.2 | |

| 08:15 | EUR | France Services PMI Mar P | 57.4 | 55.2 | 55.5 | |

| 08:30 | CHF | SNB Interest Rate Decision | -0.75% | -0.75% | -0.75% | |

| 08:30 | EUR | Germany Manufacturing PMI Mar P | 57.6 | 55.9 | 58.4 | |

| 08:30 | EUR | Germany Services PMI Mar P | 55 | 54.3 | 55.8 | |

| 08:30 | EUR | ECB Economic Bulletin | ||||

| 09:00 | EUR | Eurozone Manufacturing PMI Mar P | 57 | 56 | 58.2 | |

| 09:00 | EUR | Eurozone Services PMI Mar P | 54.8 | 54.3 | 55.5 | |

| 09:00 | GBP | Manufacturing PMI Mar P | 55.5 | 57.7 | 58 | |

| 09:30 | GBP | Services PMI Mar P | 61 | 58 | 60.5 | |

| 12:30 | USD | Initial Jobless Claims (Mar 18) | 187K | 210K | 214K | 215K |

| 12:30 | USD | Current Account (USD) Q4 | -218B | -218B | -215B | |

| 12:30 | USD | Durable Goods Orders Feb | -2.20% | -0.60% | 1.60% | |

| 12:30 | USD | Durable Goods Orders ex Transportation Feb | -0.60% | 0.50% | 0.70% | 0.80% |

| 13:45 | USD | Manufacturing PMI Mar P | 55 | 57.3 | ||

| 13:45 | USD | Services PMI Mar P | 56 | 56.5 | ||

| 13:45 | USD | Natural Gas Storage | -52B | -79B |