The major US stock indices are moving back to the upside with the NASDAQ index back near up 2.0%. The Dow and S&P are also well off session lows.

Are markets applauding the more hawkish of Fed?

The reactions are just that reactions. There is a full story ahead which also includes Russia/Ukraine and its impact on economic growth/employment/consumer confidence/ inflation . However, seven hikes in $2022 put the Fed and many “market analysts” on par with each other. The Fed will also look to shrink the balance sheet and all of which can impact sentiment and expectations.

A snapshot of the market currently shows:

- Dow industrial average up 97 points or 0.29% at 33641

- S&P up 32.6 points or 0.77% at 4294

- NASDAQ index up 231 points or 1.79% at 13182

- Russell 2000 up 32.31 points or 1.64% at 2001.28

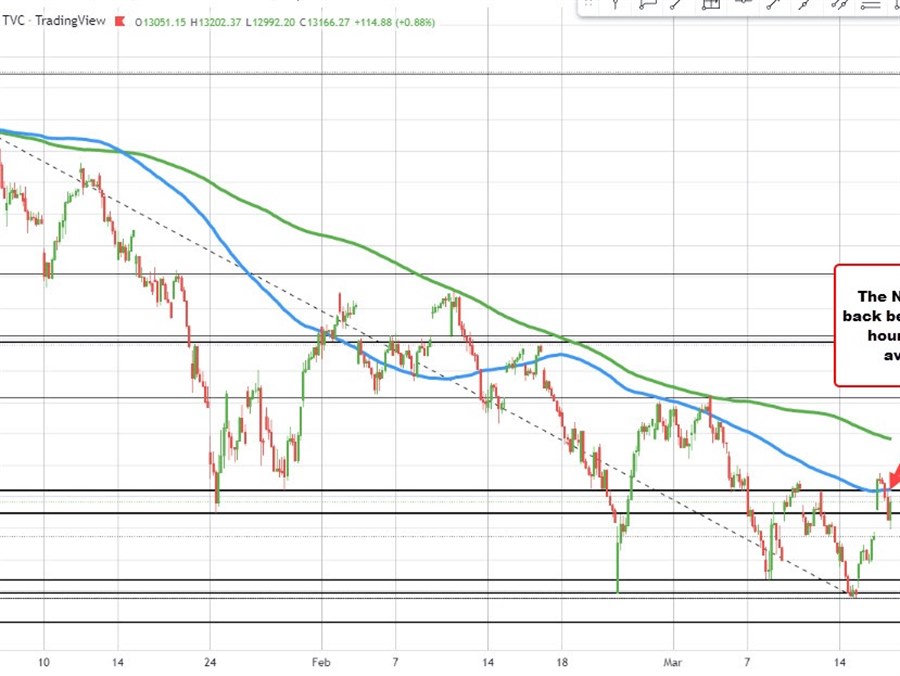

Looking at the NASDAQ index, the price move back below its 100 hour moving average at 13244.00. A move back above that level would be more positive technically. Stay below is more bearish.