GBP/USD Weekly Forecast: No reprieve amid Ukraine crisis, focus shifts to Fed and BOE

It was a brutal week for markets, as the tensions between the West and Russia intensified over the latter’s invasion of Ukraine. Risk-off trades dominated almost throughout the week, as investors dumped the higher-yielding currencies such as the pound while seeking safety in the US dollar and gold. Stagflation risks from the Ukraine crisis will continue to spook markets heading into a busy week. Top-tier economic releases from both sides of the Atlantic will be closely followed alongside the US Federal Reserve (Fed) and Bank of England (BOE) monetary policy announcements. Read more…

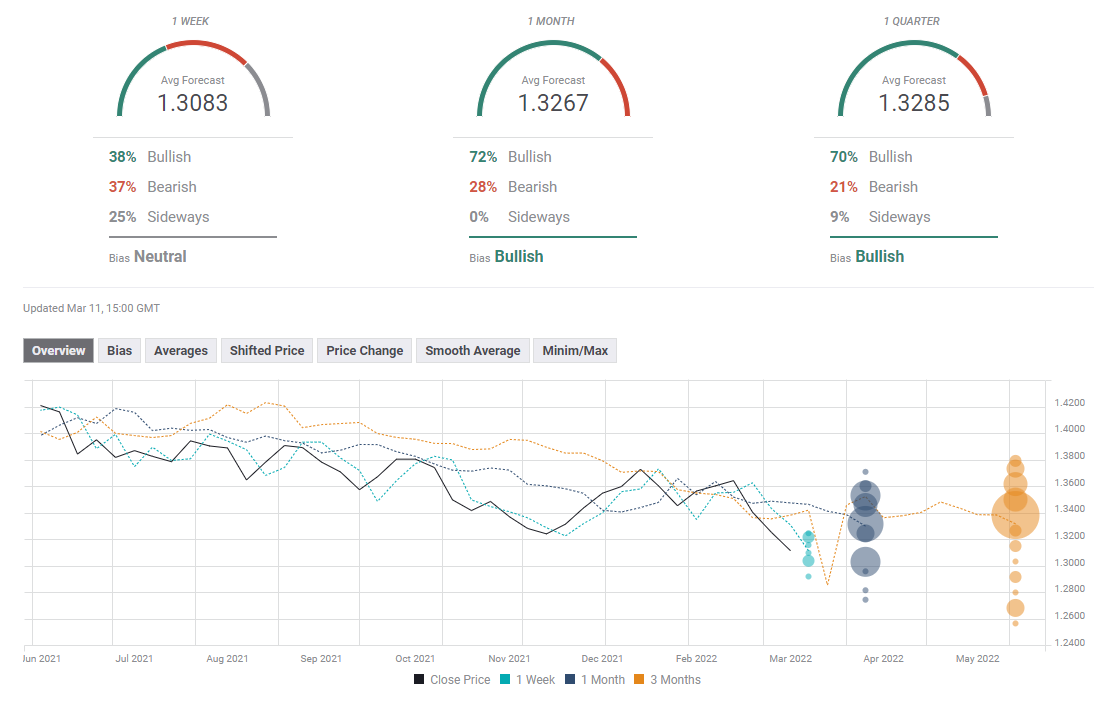

GBP/USD Forecast: Pound stays under bearish pressure despite upbeat UK data

The British pound has met fresh selling pressure early Friday and has slumped to its weakest level since November 2020 near 1.3050. Unless the pair manages to stage a rebound and hold above 1.3100, it is likely to extend its slide toward 1.3000 in the near term. Earlier in the day, the data published by the UK’s Office for National Statistics revealed that the economy grew by 0.8% on a monthly basis in January, compared to the market expectation of 0.2%. Additionally, Industrial Production and Manufacturing Production expanded by 0.7% and 0.8%, respectively, in the same period and both of these prints surpassed analysts’ estimates. Read more…

GBP/USD plunges and prints a new YTD low at 1.3027

The British pound heads into the weekend, set to record losses as Wall Street’s bell signals the end of a hectic week, mainly driven by market sentiment, leaving macroeconomics or, also sometimes, central banks aside. In tone with the week, Friday’s trading day fluctuated between risk-on/off, on reports from Russia saying that its President Putin seen “certain positive shifts” in talks with Ukraine, while Ukraine Foreign Minister, saying the opposite. That said, the GBP/USD is trading at 1.3035, down 0.39%.. Read more…