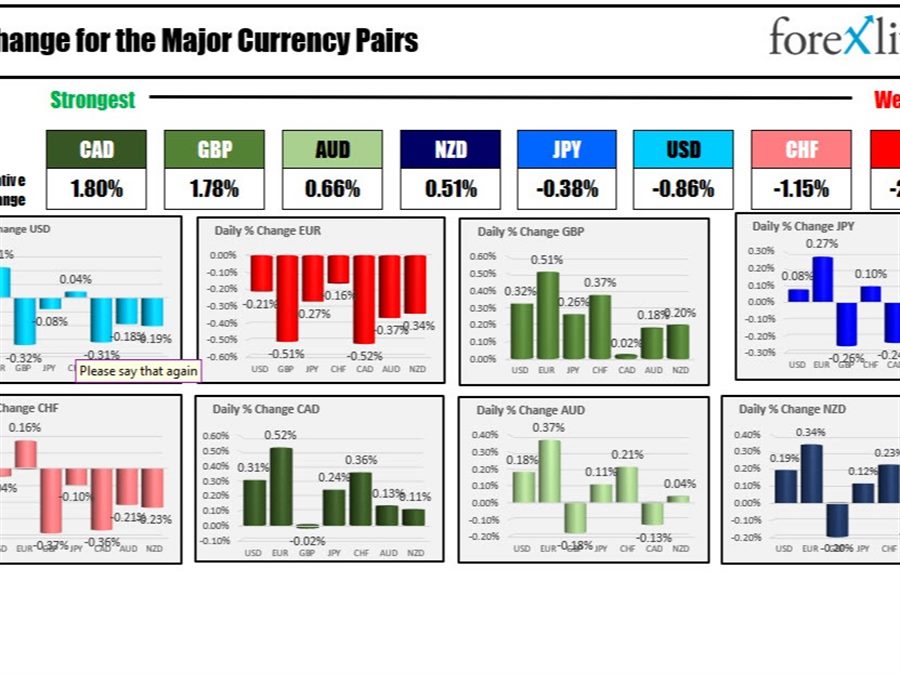

As the London/European traders look to exit for the weekend, the snapshot of the market currently shows the CAD and GBP as the strongest of the majors, while the EUR is the weakest.

The EURGBP is one of the weakest pairs with a decline of -0.51% on the day. However the pair is finding support buyers against a dual technical level on the four hour chart (see post here).

The EURUSD is trading in a narrow up and down trading range below its 100 day and 100 hour moving averages up to 1.14214, but above a support swing area between 1.1359 and 1.1368.

The USDCAD tried to hold support against its 100 and 200 hour moving averages near 1.2695, but that support has since given way and trades currently at 1.2678.

The GBPUSD is trading above and below the 61.8% retracement at 1.35987 (and also the 1.3600 level).

In the equity markets, the US stocks are trading lower after pushing higher earlier in the session. The NASDAQ index is the weakest at -0.71%. European shares close lower as well but higher for the week.

The US debt market, rates have moved back higher with the 10 year up 1.3 basis points at 2.042% after trading as low as 1.993%. The two year yield has had a fairly wide 12 basis point trading range and currently trades at 1.5816%

The European debt market, the benchmark 10 year yields close with mixed results. Spain and Italy yields fell modestly while UK yields were modestly higher. German France were near unchanged.

- Spot gold is trading higher up $13.40 or 0.74% at $1840.12

- Spot silver is trading up $0.16 or 0.66% $23.33

- WTI crude oil is back above the $92 level currently trading at $92.11. Reports that Russia may invade before the end of the Olympics is helping to push the price of crude oil higher

- Bitcoin is trading relatively steady $43,602