A stronger than expected US jobs report shocked the market. Nonfarm payroll jobs added 467K vs expectations of around 150K (and probably whispers of something less than that). The ADP employment change came in at -303,000 earlier this week, and Fed officials warned that the jobs report was likely to be weaker as well.

That was not the case.

In addition to the greater than expected number for January, the prior month were revised up 700K. The unemployment rate did move up to 4.0% from 3.9%, but the good news is you moved up because more people entered the workforce. The participation rate moved up to 62.2% from 61.9%. The pre-pandemic level was 62.8%. Average hourly earnings increase in the 0.7% which was greater than the 0.5% expected and rose 5.7% year on year.

Although omicron had an impact, employers held onto their Christmas workers, and did not have the seasonal layoffs that typically happen after the holiday season.

The better number put into motion, the typical reactionary forces:

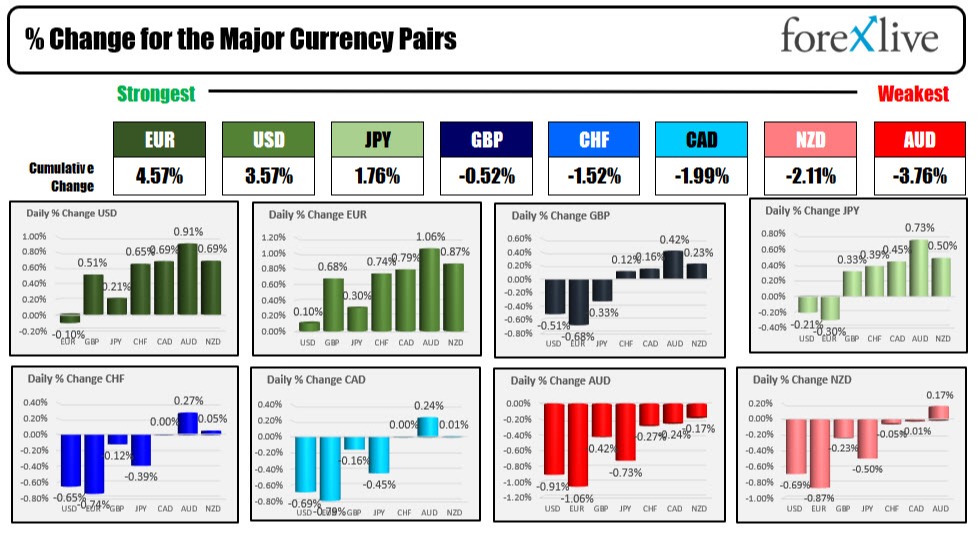

- Although the USD gave up the top spot for the strongest of the currencies ( the EUR was the strongest of the major), it still closed higher on the day and was stronger vs all the majors with the exception of the EUR

- US yields move higher with the two year up 12.4 basis points and moved above its 200 week MA in the process (at 1.28%). The yield is up to 1.316%. Further out the curve, the 10 year yield moved up to the highest level since December 2019 at 1.936% before settling at 1.916% near the close the day. The markets are now pricing in a greater than 56% chance of five hikes by the end of the year.

- Crude oil continued its move higher (and closer to the $100 level) as it traded to yet another 7 year cycle high of $93.17. The price of crude oil rose 5.8% for the week.

- US stocks ended the day with mixed results with the Dow down marginally while the broader S&P and NASDAQ index rose on hopes that stronger growth offsets higher inflation/Fed hikes. The Dow Jones fell -21.42 points or -0.06%. The S&P index rose 23.11 points or 0.52%. The NASDAQ index climbed 219.2 points or 1.58%. The major indices all closed higher for the week

- Even bitcoin got into the “happy means go higher mood”. The price of bitcoin extended above $40,000 for the first time since January 21. The low price in January reached $32,950.72.

Some technical levels in play going into the new week include:

- EURUSD: The EURUSD is closing above its 100 day moving average for the first time since June 15, 2021. That moving average comes in at 1.1428. Cautionary news is that the high price at 1.1483 stalled near the high price from January 1 .1482. Going into the new week, the 100 day moving average below at 1.1428, and the triple high at 1.1482 will be the next key levels to either get above or move back below. The EURUSD was supported this week by the ECB tilt toward tightening in 2022

- GBPUSD: The GBPUSD moved lower as EURGBP gains and dollar buying pushed it lower. This week the BOE raise rates by 25 basis points (and for the 2nd consecutive meeting) on Thursday (with dissenters leaning toward a 50 basis point rise as the reason to dissent) but the rally to the upside could not be sustained and the USD buying took control. Buyers in the EURGBP also helped to push down the GBPUSD. The pair did find support near its 100 day moving average at 1.35067. The pair is closing near 1.3535. In the new trading week, the 100 day MA will be a key barometer for the buyers and sellers. Move below would be more bearish. If the level holds, moving above the 100 hour MA at 1.3537 would increase the bullish bias.

- USDJPY. The USDJPY moved higher today helped by the stronger jobs report. The key level for the buyers is that the low today stalled right at the near converged 100 and 200 hour moving averages at 114.78. The pair is going out at 115.20. The next upside target area comes between 115.53 and 115.671. Get above that and traders will start to think about heading toward the January high at 116.347.

for beginner #shorts #crypto #forex #patterns #trading

for beginner #shorts #crypto #forex #patterns #trading