Headlines:

Markets:

- USD flat, AUD leads, Scandis lag

- European equities broadly higher; S&P 500 futures down small

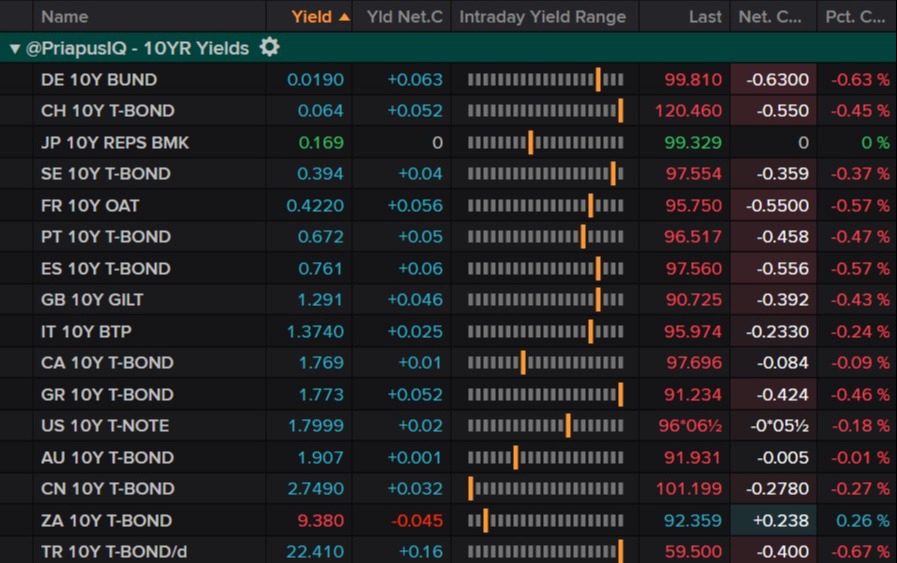

- US 10-year yields: 1.81%, up 3bps

- Gold: flat @ 1792

- WTI: up 80cents/0.9% @ $87.50

- Bitcoin: down 1.45% @ 37,250

It’s been a morning of digesting hawkish repricing with seemingly everyone on the Street looking to up their calls for BoE, ECB and Fed rate hikes. As such, 10yr yields are up everywhere (see below).

German inflation came in lower than the previous reading, with some happy to call the top as in, though it must be noted that it beat market estimates.

Geopolitically, there has been little change on the Russia/Ukrainian front.

In the UK, Boris Johnson will be in front of MPs in the House of Commons at 15:30 GMT to discuss the Sue Gray Report on the parties at Number 10 during the lockdown. We aren’t expecting to learn much, and even if we did, it’s very unlikely to impact GBP.

So far, and I’m at risk of a monster ‘Commentator’s Curse’ here, markets haven’t shown signs of a repeat of last week’s erratic behaviour.

10-Yr Yields: