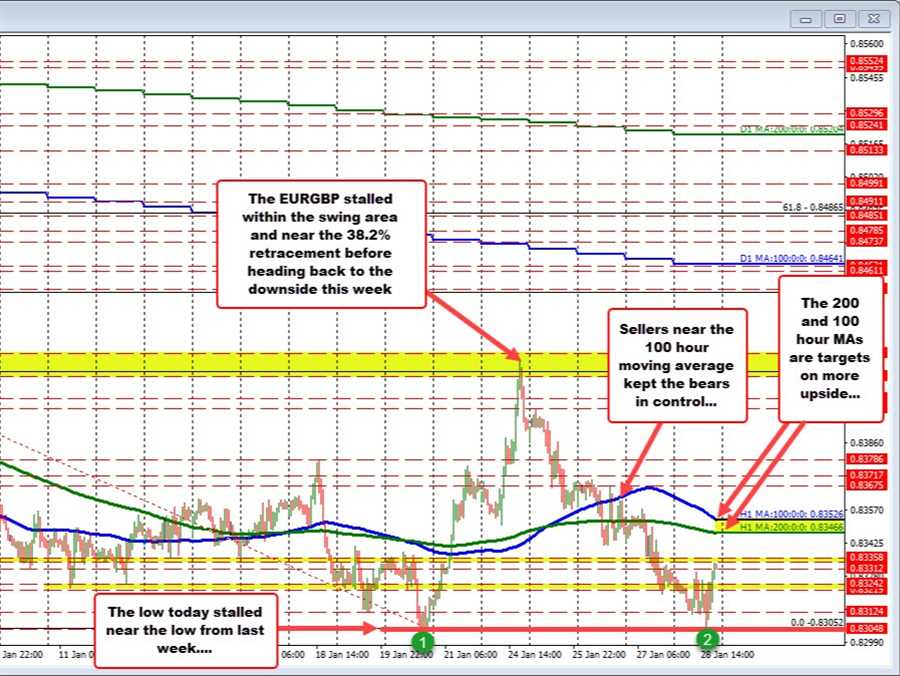

The EURGBP bottomed last week at 0.8305 (on Thursday), and shot higher peaking at 0.84218 on Monday of this week.

The high price on Monday, was able to extend briefly above the 38.2% retracement of the move down from the December 8 high to the low price reached on January 20. That level came in at 0.84172. The pair also stalled within a swing area between 0.84148 and 0.84251 (see red numbered circles). The pair last traded in that area back on January 3.

Sellers reemerged and pushed the price down for three straight lower closes. Today, the price bottomed right at the low from last week near 0.8305. There has been a bounce higher today and the pair is currently back above the closing level from yesterday’s trade, threatening to break the 3 day slide.

What next?

With the double bottom in place, the buyers have little more confidence.

There is a swing area between 0.83312 and 0.83358. A move above that level would next target the 200 hour moving average at 0.83466 and 100 hour moving average at 0.83526.

The price has been waffling above and below the 100 and 200 hour moving averages since January 13, with periods when the sellers made a play below (only to fail), followed then buyers trying to make THEIR play above (only to also fail).

The price has been below the moving averages for the last two trading days. Going forward, stay below would be more bearish. Move above and the pendulum swings more in the favor of the buyers once again. Of course a break of the double bottom would increase the bearish bias as well.

Looking at the daily chart below, the swing low from February 2020 came in at 0.8283. The December 201`9 swing low came in at 0.8259. Those would be targets on a break of the double bottom.