The snapshot of the market just ahead of the Fed decision saw:

- Spot gold is trading down $18.50 or -1% at $1829.40

- Spot silver is trading down one cent or -0.06% at $23.77

- WTI crude oil is trading up $1.74 at $87.34

- Bitcoin is trading at $38,096

- 2 year yield is at 1.03%

- 5 year yield is at 1.575%

- 10 year yield is at 1.785%

- 30 year yield is at 2.124%

In the US stock market:

- Dow Jones is up 304 points or 0.89% at 34599

- S&P is up 68.48 points or 1.57% at 4424.84

- NASDAQ index is up 344 points or 2.54% at 13883 point to zero

- Russell 2000 is up 33 points or 1.65% at 2037.07

At the end of the presser the numbers looked like the following:

- Spot gold -$29.44 or -1.59% at $1818.43

- SPot silver -$0.28 or -1.18% at $23.52

- WTI crude oil +$0.72 at $86.34

- Bitcoin at $36896

- 2 year 1.125%

- 5 year 1.657%

- 10 year1.837%

- 30 year 2.156%

In the US stock market the levels as he ended the presser showed:

- Dow -379 points or-1.11% at 33918.21

- S&P -43.53 points or -1.0% at 4312.93

- Nasdaq -117.16 points ro -0.87% at 13422.14

- Russell 2000 -42.97 points or -2.14% at 1961.05

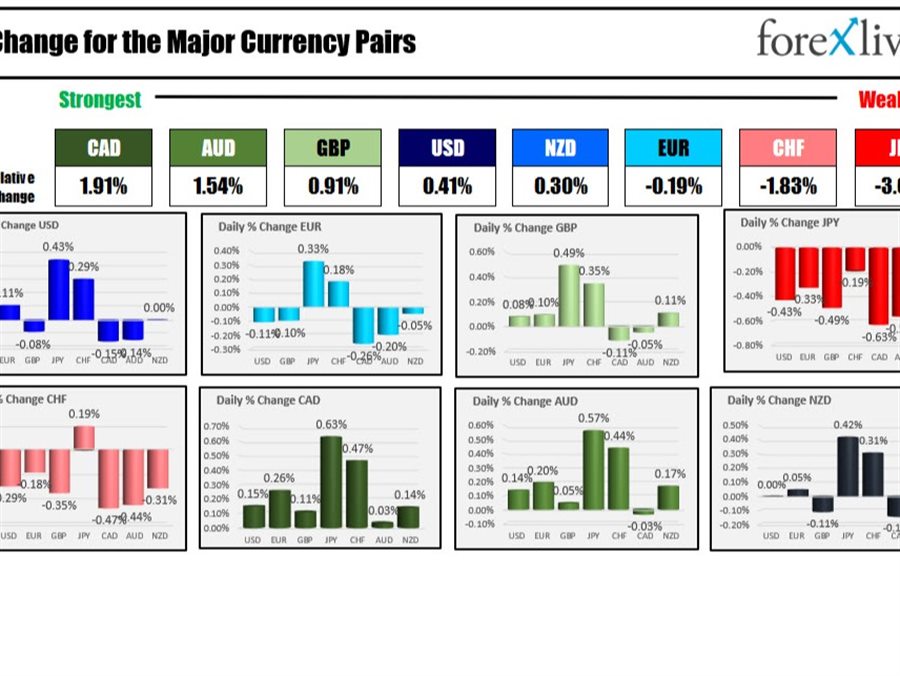

In the forex, the strongest to weakest before the decision showed the CAD as the strongest and the JPY as the weakest. The USD was mixed with a modest positive tilt.

At the end of the press conference, the strongest to weakest shows the USD has moved to the strongest of the major currencies while the CHF is now the weakest:

This article was originally published by Forexlive.com. Read the original article here.