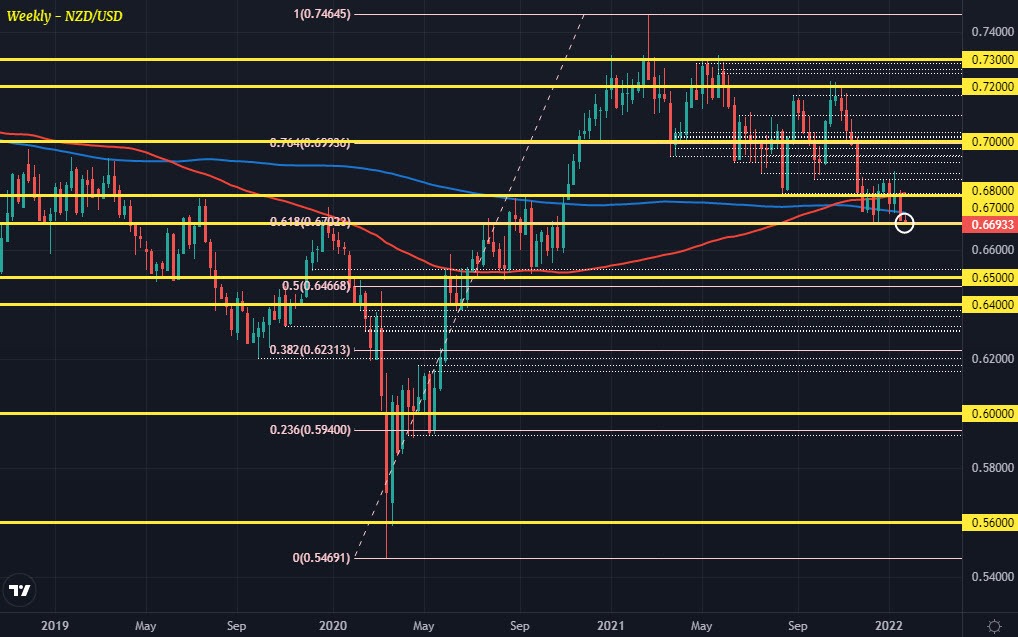

Sellers are looking to break key support near the 0.6700 level, which helped to stem the initial decline back in December. The 38.2 retracement level @ 0.6702 adds to the support layer but both appear to be giving way now in a drop to 0.6690. Of course, the daily/weekly close is still one that will determine the supposed breakdown but given prevailing risk sentiment, it may be tough to imagine a turnaround.

So, where does that leave us with NZD/USD?

The next plausible target on any drop from here would be 0.6500 first before getting stuck in to the 50.0 retracement level @ 0.6467.

Those will be key levels to watch in the event we do see a break to the downside run further in the sessions ahead.

For now, it’s all about the risk mood and since last week, there is a clear theme of dip buyers failing to be able to lift sentiment. That says a lot about the potential for this correction to run further, especially with the technicals also reaffirming that.

#optionbuying #optionstrading#trading#nifty #scalping #sharemarket #shorts #ytshorts

#optionbuying #optionstrading#trading#nifty #scalping #sharemarket #shorts #ytshorts