- Asian equities part ways from Wall Street as China cuts 5-year LPR.

- Australia jobs report, talks over US BBB also favor buyers.

- Omicron woes, Biden’s speech and firmer oil prices test bulls ahead of next week’s key FOMC.

Asian equities grind higher despite the downbeat performance of their US and European counterparts. The reason could be linked to China’s first-rate cut in 21 months, as well as hopes of more stimulus and upbeat Aussie data. However, US Treasury yields rebound joins fears of geopolitical tension and strong oil prices to challenge share markets.

That said, the MSCI’s index of Asia-Pacific shares ex-Japan rises 1.05% whereas Japan’s Nikkei 225 gains 1.43% daily by the press time of the pre-European session on Thursday.

Japan’s Nikkei benefits from a reduction in the trade deficit but risks of further virus-led activity restrictions loom on Tokyo and other 12 prefectures, which in turn probe bulls.

Australia’s Unemployment Rate dropped to the lowest in 14 years while Employment Change also rose past 30.0K forecast for December, which in turn favored ASX 200 to print mild gains by the press time.

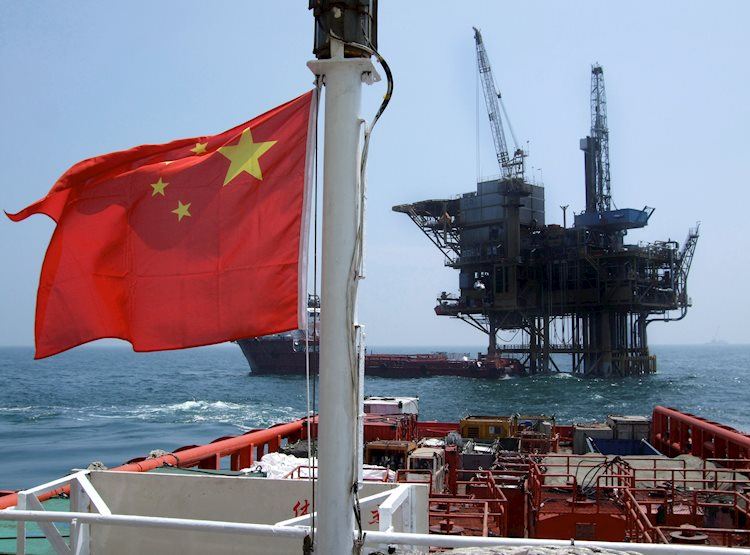

Also favoring the Aussie traders, as well as fueling the sentiment in Asia, is the People’s Bank of China’s (PBOC) first cut in the 5-year Loan Prime Rate (LPR), by 5 basis points (bps) to 4.60% in 21 months.

New Zealand’s NZX 50 fails to cheer the market optimism as PM Ardern sounds cautious on the arrival of Omicron in the Pacific nation. Additionally weighing the New Zealand investors are the clues of RBNZ rate hikes.

On a different page, Hong Kong’s Hang Seng becomes the biggest gainer of the region due to China’s rate hike whereas stocks in South Korea print mild gains at the latest.

It’s worth noting that equities in India and Indonesia print mild losses amid hopes of monetary policy consolidation as well as geopolitical tension and firmer crude prices.

That said, the US 10-year Treasury yields rose three basis points (bps) to 1.856% whereas the S&P 500 Futures rise 0.40% by the press time even as Wall Street benchmarks had to close in the red.

Moving on, US Jobless Claims, Philadelphia Fed Manufacturing Survey for January and December’s Existing Home Sales will decorate the calendar but major attention will be given to virus woes and Fed rate hike chatters.

Read: US Treasury yields rebound with stock futures on mixed concerns