Engineering a soft landing is one of the most-difficult tasks a macro policymaker can undertake but it’s what Chinese officials have been trying to do in housing.

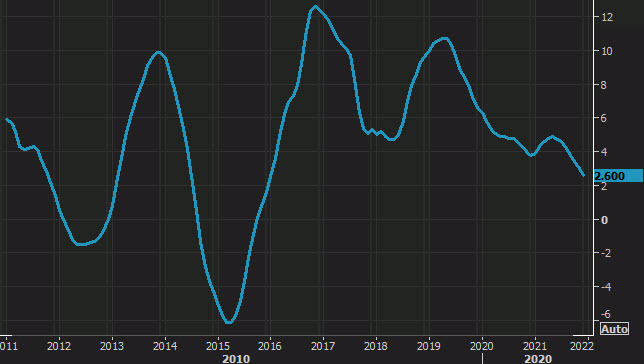

Saturday’s Chinese home price data underscores the risks with prices up 2.6% y/y in a deceleration from 3.0% y/y in November.

As recently as mid-2019, prices were rising at a 10% clip. But we’ve now seen several instances of officials attempting to gently deflate the bubble.

Evergrande is certainly the kind of thing that can change the psychology around housing and the large amounts of investment properties add to the risks.

This article was originally published by Forexlive.com. Read the original article here.

#optionbuying #optionstrading#trading#nifty #scalping #sharemarket #shorts #ytshorts

#optionbuying #optionstrading#trading#nifty #scalping #sharemarket #shorts #ytshorts