The markets are staying in holiday mood today, with little news flow and no important data release. There is nothing to stop Yen’s decline. But as risk sentiments turned steady, commodity currencies are paring some gains. Instead, Sterling is outshining others and it’s trading mildly higher broadly. Dollar is firm with Euro but there is no follow through buying in both for a noticeable rebound.

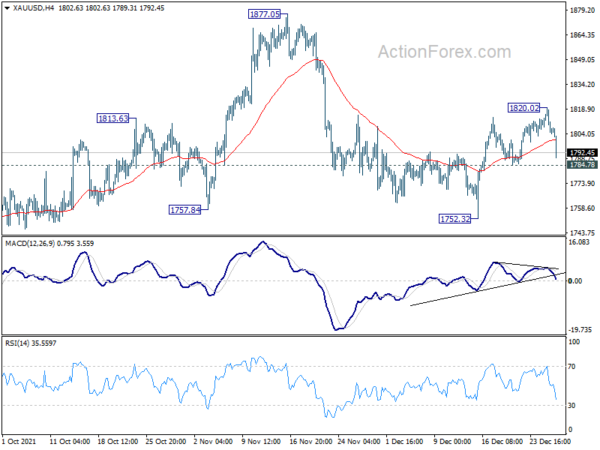

Technically, Gold’s decline is picking up momentum today and it’s now back below 1800 handle. Immediate focus is now back on 1784.78 support. Firm break there will argue that recovery from 1752.32 has completed with three waves up to 1820.02. Fall from 1877.05 is then ready to resume through 1752.32.

In Europe, at the time of writing, FTSE is up 0.80%. DAX is down -0.56%. CAC is down -0.21%. Germany 10-year yield is up 0.0376 at -0.210. Earlier in Asia, Nikkei dropped -0.56%. Hong Kong HSI dropped -0.83%. China Shanghai SSE dropped -0.91%. Singapore Strait Times rose 0.31%. Japan 10-year JGB yield dropped -0.0042 to 0.060.

US goods trade deficit widened to USD 97.8B in Nov

US goods exports dropped USD -3.3B to USD 154.7B in November. Goods imports rose USD 11.3B to USD 252.4B. Goods trade deficit came in at USD -97.8B, worse than expectation of USD -89.0B, comparing to Novembers’s USD -83.2B.

Wholesale inventories rose 1.2% mom to USD 769.9B. Retail inventories rose 2.0% mom to USD 616.9B.

Released earlier, Eurozone M3 money supply rose 7.3% yoy in November, below expectation of 7.6% mom.

Swiss Credit Suisse economic expectations rose from -10.8 to 0 in December.

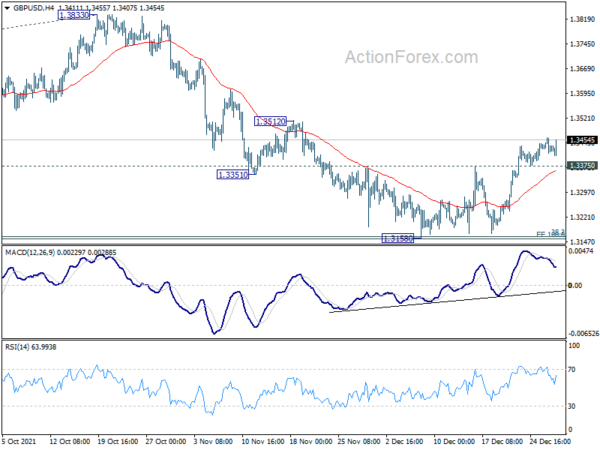

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3411; (P) 1.3437; (R1) 1.3457; More…

GBP/USD’s rise from 1.3158 is still in progress. Sustained trading above 55 day EMA (now at 1.3426) will be an early sign of bullish reversal. That is, correction from 1.4248 might have completed with three waves down to 1.3158, after hitting 1.3164 medium term fibonacci level. Further rally would be seen to 1.3570 support turned resistance next. On the downside, break of 1.3375 minor support will turn intraday bias neutral first.

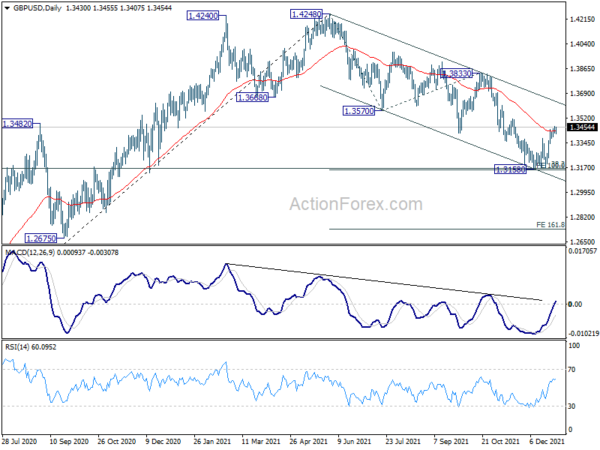

In the bigger picture, focus remains on 38.2% retracement of 1.1409 to 1.4248 at 1.3164. Sustained break there will argue that whole rise from 1.1409 has completed at 1.4248, after rejection by 1.4376 long term resistance. That will revive some medium term bearishness and and target 61.8% retracement at 1.2493. However, strong rebound from current level will revive argue that up trend from 1.1409 is still in progress, and probably ready to resume.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 09:00 | CHF | Credit Suisse Economic Expectations Dec | 0 | -10.8 | ||

| 09:00 | EUR | Eurozone M3 Money Supply Y/Y Nov | 7.30% | 7.60% | 7.70% | |

| 13:30 | USD | Goods Trade Balance(USD) Nov P | -97.8B | -89.0B | -82.9B | |

| 13:30 | USD | Wholesale Inventories Nov P | 1.20% | 1.80% | 2.30% | 2.50% |

| 15:00 | USD | Pending Home Sales M/M Nov | 0.60% | 7.50% | ||

| 15:30 | USD | Crude Oil Inventories | -2.7M | -4.7M |

#optionbuying #optionstrading#trading#nifty #scalping #sharemarket #shorts #ytshorts

#optionbuying #optionstrading#trading#nifty #scalping #sharemarket #shorts #ytshorts