Gold (XAU/USD) remains firmer around $1,812 during Tuesday’s Asian session, after refreshing the weekly peak the previous day. The yellow metal cheers the market’s risk-on mood, as well as downbeat US dollar prices, to keep buyers hopeful during the final days of 2021.

Easing fears of the South African covid variant and stimulus hopes could be cited as the major catalysts for the latest market optimism even as light calendar and holiday mood restricted the metal’s performance.

Traders believed in studies from South Africa and the UK showing fewer odds of hospitalization due to the Omicron covid variant to take a sigh of relief from the Omicron fears. Adding to the market optimism were the policymakers’ actions suggesting the receding challenges due to the virus outbreak. Recent, the US Centers for Disease Control and Prevention (CDC) reduced the isolation and quarantine period for the general population from the previous 10 to five.

Comments from US Vice President Kamala Harris who signaled to use her tie-breaking vote to pass President Joe Biden’s Build Back Better (BBB) stimulus plan also favored market sentiment. On the same line were headlines from the People’s Bank of China (PBOC) and the Chinese Finance Ministry that favored further easy money to help sustain the economic growth of Australia’s largest customer.

Additionally, ongoing talks over Iran’s denuclearization and a global push for peace between Russia and Ukraine also seem to have offered relief to the markets.

It should be noted that a downbeat print of the US Dallas Fed Manufacturing Index for December, 8.1 versus 13.2 expected and 11.8 prior, also weighed on the US dollar and favored the gold prices.

That said, Wall Street portrayed a positive start to the week with S&P 500 renewing all-time high while the US 10-year Treasury yields eased from the two-week high, down 1.7 basis points (bps) to 1.47%.

Given the holiday mood and an absence of major catalysts, Omicron headlines keep the driver’s seat. Also important are the US housing and Richmond Fed Manufacturing data.

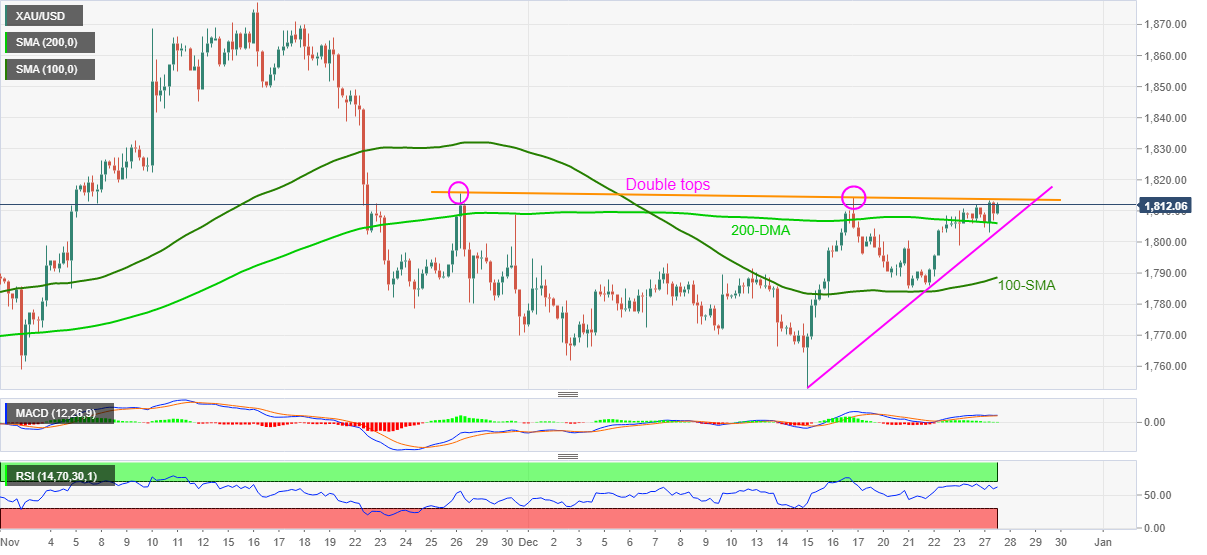

Technical analysis

Gold prices seesaw around 200-SMA, also below the double tops marked during the last one month. The year-end inaction could well be perceived from the sluggish MACD signals and lackluster RSI near the overbought territory.

It should be noted, however, that the gold buyers keep the reins, as portrayed by a two-week-old ascending trend line. However, a clear upside break of $1,816 will become necessary for the bulls to aim for highs marked during July and September, around $1,834.

Alternatively, gold sellers need a clear downside break of a two-week-old ascending trend line, near $1,802, for re-entry. Adding to the support is the $1,800 threshold.

Following the quote’s weakness past $1,800, the 100-SMA level of $1,787 will act as a buffer before directing the gold bears to $1,765 and the monthly low near $1,753.

Gold: Four-hour chart

Trend: Further upside expected

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!) breakout perfect entry #forex #crypto #trading #trending

breakout perfect entry #forex #crypto #trading #trending RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading