The USDTRY has had an extraordinary run over the last few days. That came after an huge run to the upside for the pair.

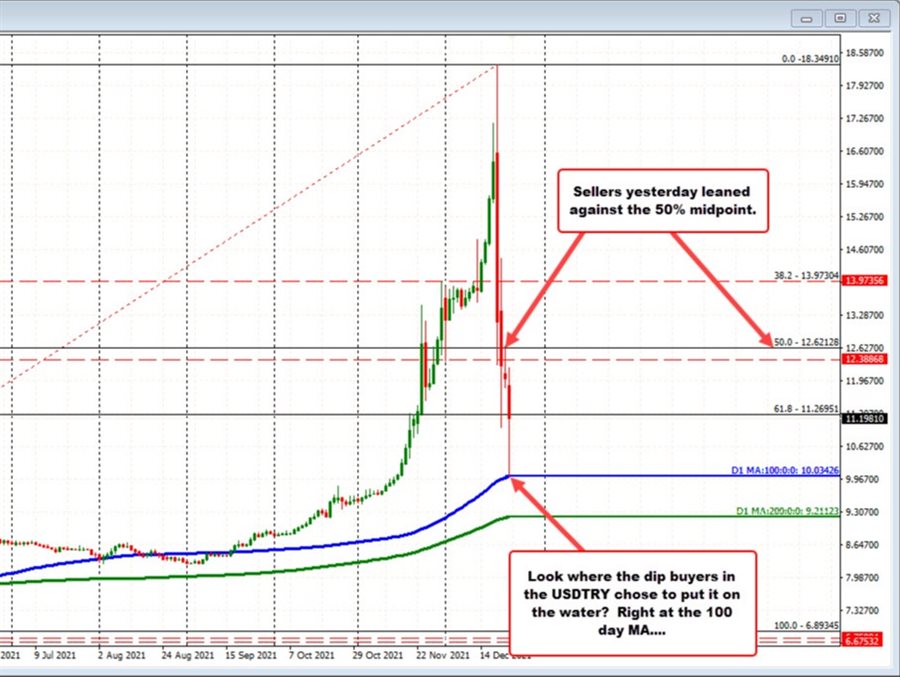

On Monday, the pair soared to a high of 18.349. That was up from 6.89345 back at the lows in February.

Since then the price has been tumbled back to the downside.

Technically, on Wednesday, the price move back below the 50% midpoint of the 2021 trading range at 12.62128. Then on yesterday, the high price stalled right near that midpoint level at 12.6702. Given the volatility in the USDTRY, that is close enough for that pair.

The subsequent fall today took the price right down to the rising 100 day moving average at 10.0342. The low price today reached 10.0321 just below that level.

The price has bounced back higher and currently trades right around the 61.8% retracement at 11.2695.

Now, I would not blame you if the volatility and risk in the USDTRY is not your cup of tea, but the fact the price bounced off the 100 day moving average so closely makes someone like me feel good about the main thesis of my analysis.

That is traders will lean against key technical levels as those levels allow traders to define, and limit risk.

If you know the 100 day MA should attract a “crowd” and that “crowd” is eyeing that level, a low risk trade can be made in what seems to be a high risk environment. Risk is simply a momentum move below the moving average level. The reward is the bounce like has happened.

I like to say, “Risk a little, to make more than a little”

It is not always as easy as it sounds – especially in fast-moving markets like the USDTRY – but it is the basis for risk focused trading.

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!) RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading