A holiday shortened week starts will risk-off sentiment. Selloff in notable in Japan with Nikkei back below 28k handle, while HK HSI also hits the lowest level this year. In the currency markets, Yen is currently the strongest one for today, followed by Euro and Swiss Franc. On the other hand, Aussie is the weakest, followed by Kiwi and Sterling. Overall, major currencies movements will depend on how the risk markets perform this week.

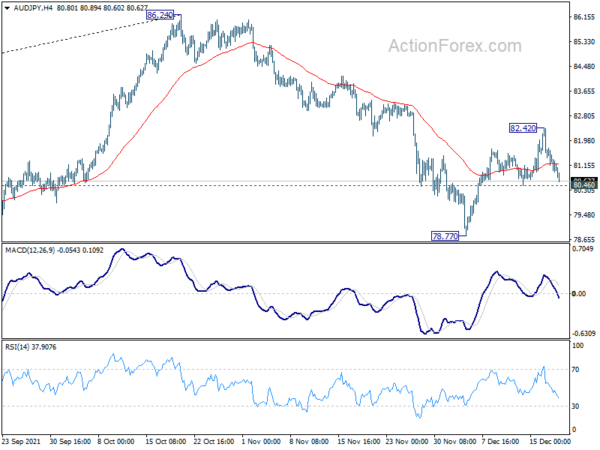

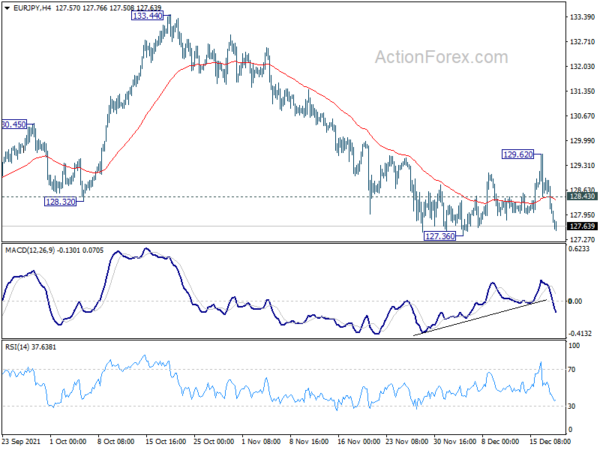

Technically, we’ll keep an eye on Yen crosses today. EUR/JPY and GBP/JPY are probably heading back to 127.36 and 148.94 support respectively. Break of these levels will resume larger decline. While AUD/JPY’s rebound from 78.77 was relatively strong, it’s also now eyeing 80.46 minor support. Break will suggest that such recovery has completed and bring retest of 78.77 low. Firm break there will also resume larger fall from 86.24.

In Asia, at the time of writing, Nikkei is down -2.23%. Hong Kong HSI is down -1.20%. China Shanghai SSE is down -0.68%. Singapore Strait Times is down -1.05%. Japan 10-year JGB yield is down -0.0068.

BoJ Kuroda: Too early to consider normalizing policy

BoJ Governor Haruhiko Kuroda said today, “there’s quite a distance from the 2% inflation target. It is still too early now to consider normalizing policy.” “Unlike the Western countries, inflation is extremely low and inflation expectations remain very low,” he added. “We’re in a phase to patiently continue large-scale monetary easing.”

BoJ’s balance sheet has grown the equivalent of 135% of GDO . But Kuroda said “I don’t think expansion of the BoJ’s assets will affect our ability to keep monetary policy and financial system stable.” Though, he added it’s important for the government market confidence on the country’s fiscal health in the medium- to long-term.

New Zealand goods exports rose 13% yoy in Nov, imports rose 37% yoy

New Zealand goods exports rose 13% yoy to NZD 5.9B in November. Goods imports rose 37% yoy to NZD 6.7B. Monthly trade balance was a deficit of NZD -864m, versus expectation of NZD -1867m.

China led rises in monthly exports across all top destinations, up 13% yoy. Exports to Australia were up 21% yoy, to USA up 5.5% yoy, to EU up 8.6% yoy, to Japan up 38% yoy.

Imports from all tot partners were also up, with China up 45% yoy, EU up 38% yoy, Australia up 28%, USA up 43%, Japan up 7.9% yoy.

US consumer confidence, durable goods orders, PCE inflation to watch in a light week

The economic calendar is light in a holiday shortened week. Nevertheless, RBA and BoJ will release meeting meetings. On the data front, main focuses will be on US consumer confidence, durable goods orders and PCE inflation. Canada GDP and Japan CPI will also catch some attention.

Here are some highlights for the week:

- Monday: New Zealand trade balance; Eurozone current account.

- Tuesday: RBA minutes; Germany Gfk consumer confidence; Swiss trade balance; UK public sector net borrowing; US current account; Canada retail sales.

- Wednesday: BoJ minutes; UK current account, Q3 GDP final; US Q3 GDP final, consumer confidence, existing home sales.

- Thursday: Germany import price; Canada GDP; US durable goods orders, personal income and spending, jobless claims, new home sales.

- Friday: Japan CPI, corporate service price index.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 127.37; (P) 128.17; (R1) 128.59; More….

Intraday bias in EUR/JPY remains mildly on the downside for retesting 127.36 support. Firm break there will resume fall from 133.44 and larger pattern from 134.11. Next target is 126.58 medium term fibonacci level. On the upside, above 128.43 minor resistance will delay the bearish case and turn intraday bias neutral first.

In the bigger picture, as long as 38.2% retracement of 114.42 (2020 low) to 134.11 at 126.58 holds, up trend from 114.42 is still in favor to continue. Break of 134.11 will target long term resistance at 137.49 (2018 high). However, sustained break of 126.58 will raise the chance of medium term bearish reversal. In this case, deeper decline would be seen to 61.8% retracement at 121.94, and possibly below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Nov | -864M | -1867M | -1286M | -1302M |

| 9:00 | EUR | Eurozone Current Account (EUR) | 20.3B | 18.7B | ||

| 11:00 | GBP | CBI Industrial Order Expectations | 20 | 26 |