- EUR/JPY is at risk of a downside correction should 128.10 give way to bearish pressures.

- 127.90 guards a deeper resumption of the dominant bear trend.

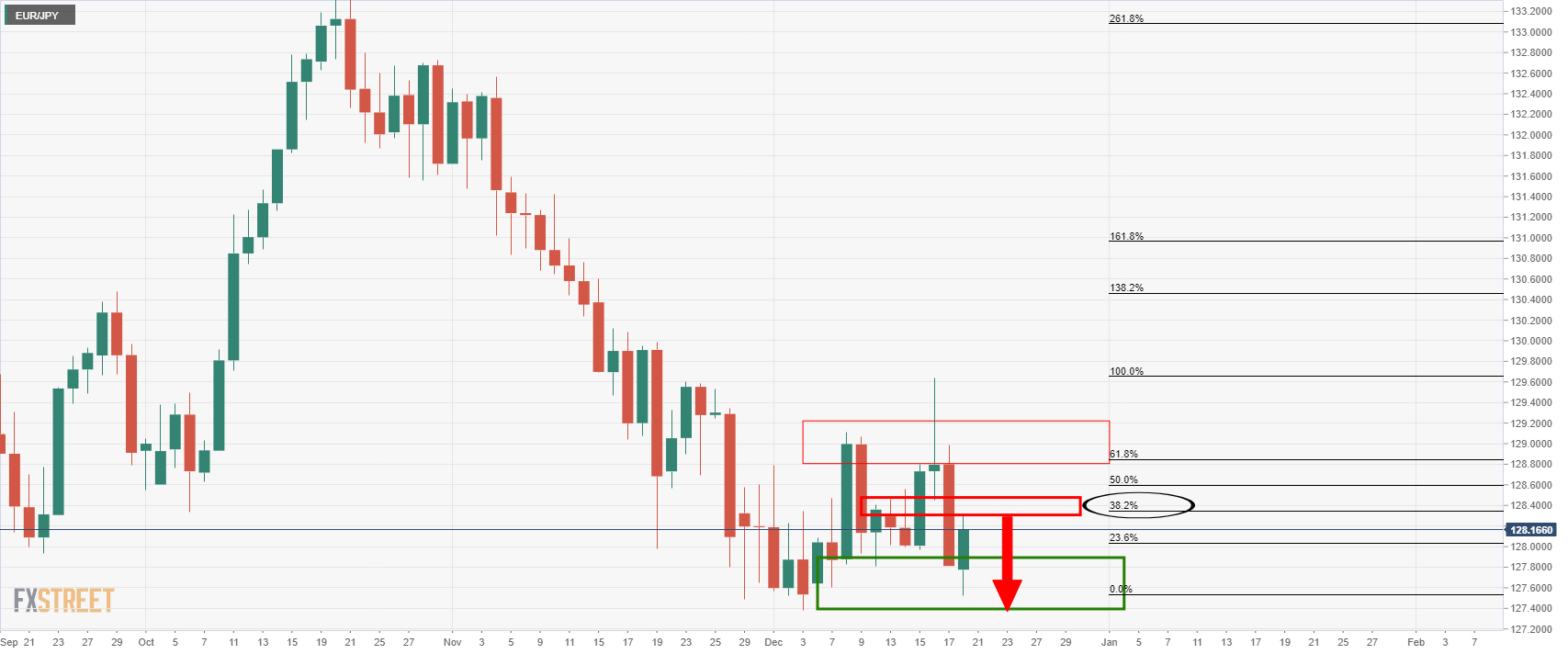

The daily chart shows that the price is consolidating and has reached a 38.2% Fibonacci retracement level. This would be expected to hold on to initial tests and then potentially lead to a downside test of support once again.

The following illustrates the market’s structure and the downside bias from both a daily and shorter-term perspective:

EUR/JPY daily chart

EUR/JPY H1 chart

From this hourly perspective, we can see that the price is struggling at a meanwhile resistance and given the temperament of the market, that is to say consolidative with a risk-off tone, the bias is to the downside. A break of the current trendline opens risk to test the prior hourly support near 127.90. If this were to give, then the daily support will be vulnerable near to 127.50.