Where is gold price headed? Markets are eagerly looking forward to the Fed decision, as the two-day FOMC meeting kicks off on Tuesday. Ahead of the Fed verdict, the Omicron covid variant fears have gripped the market, putting a fresh bid under the safe-haven US dollar at gold’s expense. Meanwhile, the Treasury yields hold steady on expectations of faster Fed’s tapering and hint at a mid-2022 rate hike.

Read: Gold Price Forecast: XAU/USD bull-bear tug-of-war likely to extend but upside risks likely

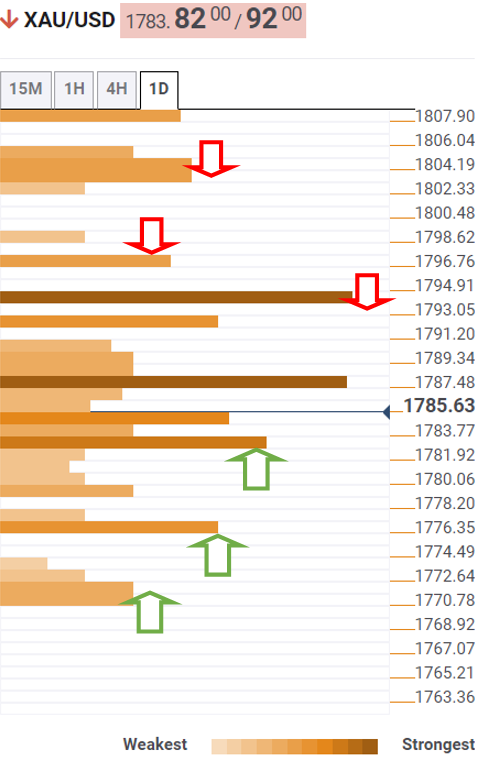

Gold Price: Key levels to watch

The Technical Confluences Detector shows that the gold price continues to run into strong offers at $1,790, which is the meeting point of the SMA100 one-day, Fibonacci 23.6% one-day and SMA100 four-hour.

A decisive break above the latter could unleash the additional recovery towards the next powerful resistance at $1,793. At that level, the SMA200 one-day coincides with the previous week’s high and pivot point one-week R1.

Gold bulls will then target $1,796, the confluence of the pivot point one-day R2 and SMA50 one-day.

A dense cluster of healthy resistance levels awaits at $1,804, the convergence of the Fibonacci 38.2% one-month, pivot point one-week R2 and pivot point one-day R3.

Alternatively, the selling momentum could accelerate below the pivot point one-day S1 at $1,781.

Gold bears will then challenge the downside target at $1,779, where the Fibonacci 38.2% one-week meets with the SMA10 one-day.

Further south, the intersection of the Fibonacci 161.8% and Fibonacci 23.6% one-week at $1,775.

The last line of defense for gold buyers is the previous week’s low of $1,770.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.