Dollar rises slightly in Asian session today, as markets await non-farm payrolls report from the US. Commodity currencies are generally lower despite to strong rebound in US stocks overnight. As for the week, Swiss Fran and Yen remain the strongest ones followed by Dollar. Aussie and Kiwi are the weakest. We’ll see how NFP would adjust market expectations on Fed tapering and rate hike, and thus trigger the movements in all financial markets.

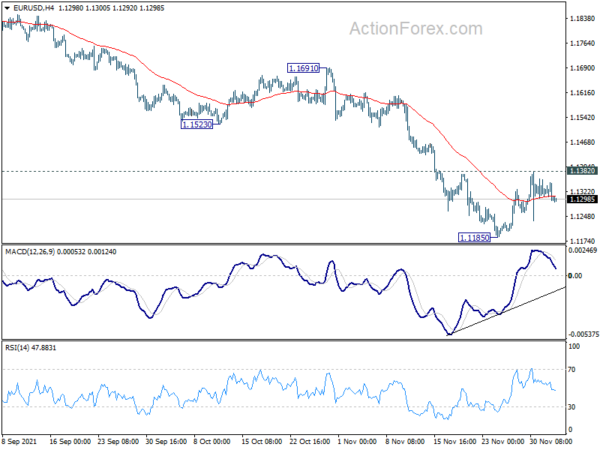

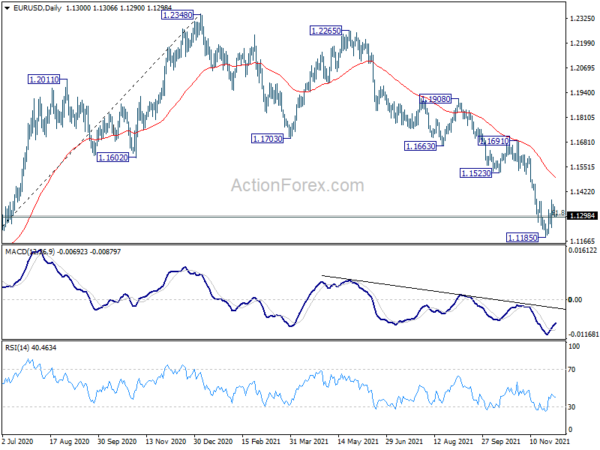

Technically, a major focus for today and whether EUR/USD would break through 1.1382 resistance firmly to confirm short term bottoming. Or, it would break through 1.1185 support will resume larger down trend. At the same time, we’d all watch the action in USD/JPY, on whether it would break though 112.71 support, or rebound to retest 115.51 high.

In Asia, at the time of writing, Nikkei is up 0.58%. Hong Kong HSI is down -0.80%. China Shanghai SSE is up 0.66%. Singapore Strait Times is up 0.10%. Japan 10-year JGB yield is down -0.0033 at 0.056. Overnight, DOW rose 1.82%. S&P 500 rose 1.42%. NASDAQ rose 0.83%. 10-year yield rose 0.014 to 1.448.

NFP Eyed as Dollar index holds above 95.51 support

US non-farm payroll report is back as a major focus for today, in particular with talk of faster Fed tapering in the background. Markets are expecting 525k job growth in November. Unemployment rate is expected to drop from 4.6% to 4.5%. Average hourly earnings are expected to have another solid 0.4% mom growth.

Looking at related data, ISM manufacturing rose slightly from 52.0 to 53.3. ADP private job grew 534k, just slightly down from prior month’s 570k. Four-week moving average of initial jobless claims dropped notably from 285k to 239k. Consumer confidence edged down from 111.6 to 109.5. Overall, the data point to a solid NFP report today.

Dollar index is still holding above 95.51 near term support despite a correction in the past two weeks. Technically speaking, consolidation from 96.93 should be relatively brief and larger rise from 89.53 is likely to resume sooner rather than later. However, firm break of 95.51 could bring deeper pull back to 55 day EMA (now at 94.68) before DXY finds a bottom.

Fed Bostic: Finishing tapering before end of Q1 is in our interest

Atlanta Fed President Raphael Bostic said yesterday that with robust growth, an improving job market and inflation more than twice Fed target, having tapering finished “some time before the end of the first quarter” would be “in our interest”.

Bostic also referred to OECD’s projection that inflation in the US could be above 4% for the year of 2022. He said, “if it is at that kind of level, I think there is going to be a good case to be made that we should be pulling forward more interest-rate increases and perhaps do even more than the one I have penciled in.”

Fed Daly: Might need to start crafting a plan on rate hike

San Francisco Fed President Mary Daly said, “if we didn’t have higher inflation readings, you might let the economy go a little bit more to see if we can get through COVID and have those individuals come back.”

However, “right now, we’re dealing with inflation that’s above our target and inconsistent in its current readings with our longer run views on price stability,” she added. “We have to deal with that.”

Fed might need to start dialing down some of the extra policy accommodation and “start crafting a plan to, at least, you know, think about raising the interest rate,” she said.

China PMI composite dropped to 51.2, inflationary pressure remained

China Caixin PMI Services dropped from 53.8 to 52.1 in November, above expectation of 51.2. PMI Composite dropped from 51.5 to 51.2.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Overall, conditions in the manufacturing sector remained stable in November, while for the service sector, expansion occurred at a slightly slower pace. The downward pressure to the economy grew, and inflationary pressure was partly eased….

“The government’s measures to stabilize commodity supplies and prices significantly eased cost pressures on manufacturing enterprises, but had a limited impact on the reduction of costs to service enterprises. Overall, inflationary pressure remained.”

Looking ahead

Eurozone retail sales and PMI services final will be released in European session. UK will release PMI services final too. Later in the day, Canada will release job data. US will release non-farm payrolls, ISM services and factory orders.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1281; (P) 1.1314; (R1) 1.1334; More…

Intraday bias in EUR/USD remains neutral for the moment. On the upside, firm break of 1.1382 resistance should confirm short term bottoming at 1.1186. Intraday bias will be turned back to the upside for 55 day EMA (now at 1.1495). On the downside, break of 1.1185 will resume larger fall from 1.2348.

In the bigger picture, there are various ways of interpreting the fall from 1.2348 (2021 high). It could be a correction to rise from 1.0635 (2020 low), the fourth leg of a sideway pattern from 1.0339 (2017 low), or resuming long term down trend. In any case, outlook will now stay bearish as long as 1.1703 support turned resistance holds. Sustained break of 61.8% retracement of 1.0635 to 1.2348 at 1.1289 would pave the way back to 1.0635.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Construction Index Nov | 57 | 57.6 | ||

| 01:45 | CNY | Caixin Services PMI Nov | 52.1 | 51.2 | 53.8 | |

| 07:45 | EUR | France Industrial Output M/M Oct | 0.40% | -1.30% | ||

| 08:45 | EUR | Italy Services PMI Nov | 54.5 | 52.4 | ||

| 08:45 | EUR | France Services PMI Nov F | 58.2 | 58.2 | ||

| 08:55 | EUR | Germany Services PMI Nov F | 53.4 | 53.4 | ||

| 09:00 | EUR | Eurozone Services PMI Nov F | 56.6 | 56.6 | ||

| 09:30 | GBP | Services PMI Nov F | 58.6 | 58.6 | ||

| 10:00 | EUR | Eurozone Retail Sales M/M Oct | 0.30% | -0.30% | ||

| 13:30 | CAD | Net Change in Employment Nov | 36.5K | 31.2K | ||

| 13:30 | CAD | Unemployment Rate Nov | 6.60% | 6.70% | ||

| 13:30 | CAD | Labor Productivity Q/Q Q3 | -0.70% | 0.60% | ||

| 13:30 | USD | Nonfarm Payrolls Nov | 525K | 531K | ||

| 13:30 | USD | Unemployment Rate Nov | 4.50% | 4.60% | ||

| 13:30 | USD | Average Hourly Earnings M/M Nov | 0.40% | 0.40% | ||

| 14:45 | USD | Services PMI Nov F | 57 | 57 | ||

| 15:00 | USD | ISM Services PMI Nov | 65.5 | 66.7 | ||

| 15:00 | USD | ISM Services Employment Index Nov | 51.6 | |||

| 15:00 | USD | Factory Orders M/M Oct | 0.50% | 0.20% |

#optionbuying #optionstrading#trading#nifty #scalping #sharemarket #shorts #ytshorts

#optionbuying #optionstrading#trading#nifty #scalping #sharemarket #shorts #ytshorts