Price is down for the 3rd week in a row

The GBPUSD traded to the lowest level since December 2020 this week. The move lower took the price down for the 3rd week in a row and take the price closer to its 100 week MA at 1.3277. The 200 week MA is at 1.3164 which is also the 38.2% of the move up from the March 2020 low.

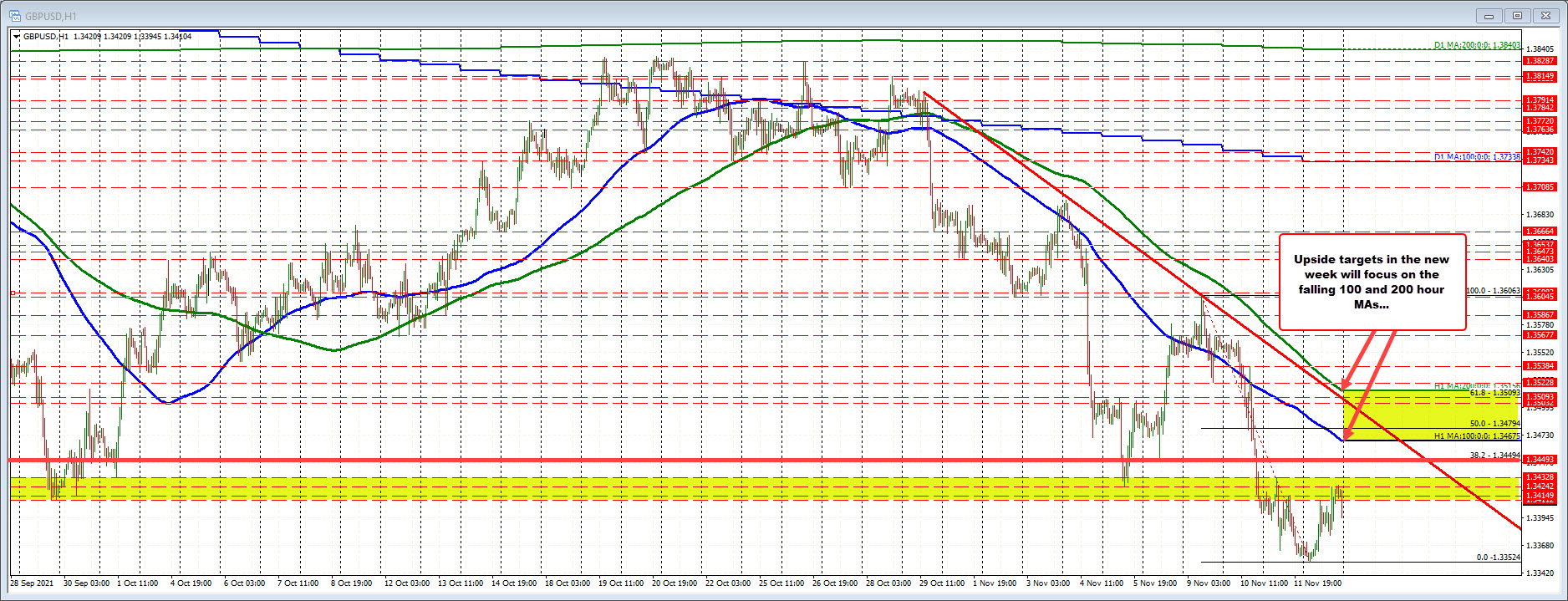

Drilling to the daily chart below, the high price on Tuesday stalled near a swing area between 1.35608 1.3601 (the high price reached 1.3606). The inability to move above that level gave sellers, and confidence to push lower. The CPI data on Wednesday also was a key catalyst for further downside momentum.

On Wednesday, the price dipped below the 1.3411 to 1.34498, and stayed below that swing area on Thursday and again on Friday on its way to the low price at 1.33524.

The early resistance in the new trading week will be at the high of the lower swing area at 1.34498. If the price can stay below that level early in the week, the sellers remain in firm control and in position to move lower. Move above, and further upside probing could be expected.

On the downside, moving away from the aforementioned swing area above would have traders targeting the lower trendline connecting the July and September lows. That level cuts across at 1.33117 (around 98 pips away). Move below that level and the 100 week moving average at 1.3277 (around 138 pips away) becomes the key target followed by the 200 week moving average and 38.2% retracement of the move up from the March 2020 low at 1.3164.

PS On more upside momentum, the falling 100 hour MA comes in at 1.34675 (and moving lower). Move above the 100 hour MA and stay above would have traders targeting the falling 200 hour MA at 1.35156 (around 100 pips away currently).