Two impressive days for gold

Central banks pulling back from hawkish talk has been a tailwind for gold in the back half of this week. That’s led to an impressive rebound from $1760 to $1813. At today’s high of $1815, gold traded at the best levels since September 6.

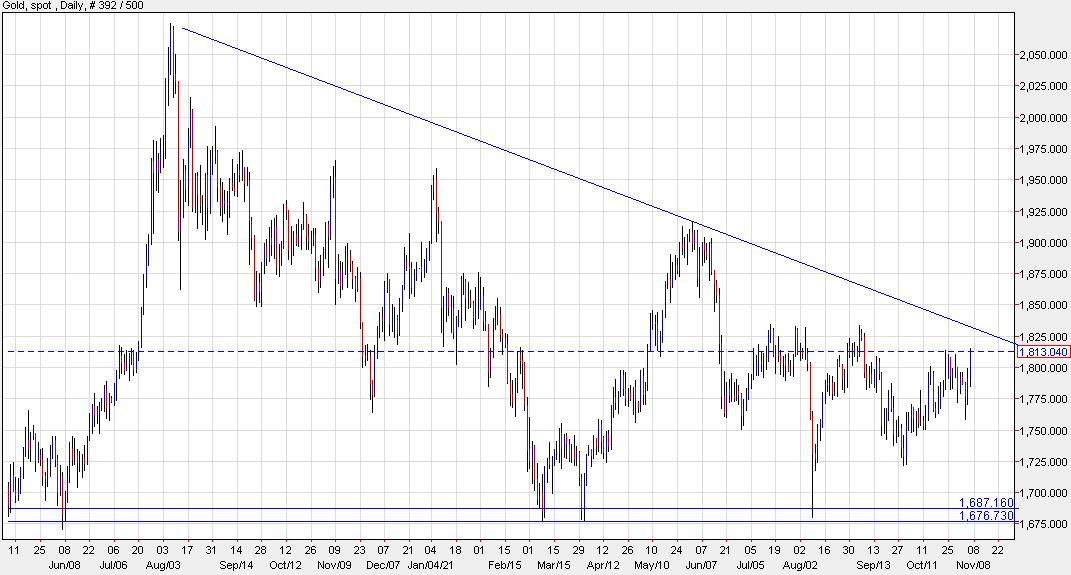

The gold chart is a fascinating one. It’s been in a long period of consolidation with a triple bottom at $1675 and a series of lower highs. With the rally today, that series of lower highs is being threatened but it will take a move above $1834 to confirm it.

With a rise to that level, we would also challenge the long-term downtrend.

I’ll be keeping a close eye on precious metals in the week ahead.

This article was originally published by Forexlive.com. Read the original article here.