Gold price cheers the markets’ re-pricing of the global tightening expectations, looking to recapture the $1800 mark. Gold price rallied hard, despite the resurgent US dollar demand on Thursday, as the dovish BOE rate decision added to the Fed’s push back of the lift-off bets. Gold traders now eagerly await the US Nonfarm payrolls data and the end of the week flows for a fresh direction.

Read: US Nonfarm Payroll October Preview: Inflation to the rescue?

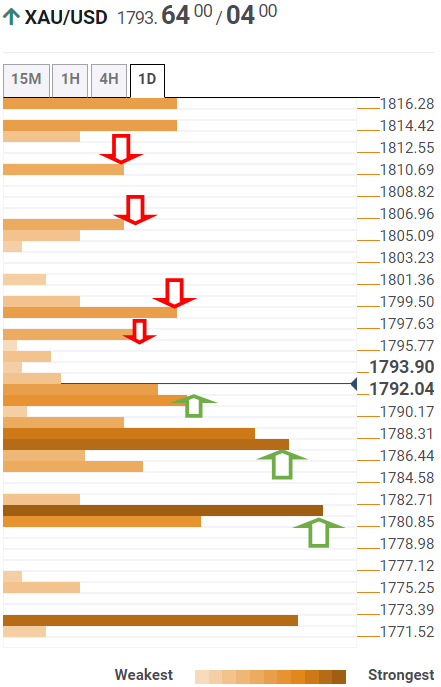

Gold Price: Key levels to watch

The Technical Confluences Detector shows that gold eyes immediate resistance at $1796, the Fibonacci 61.8% one-week.

The next upside barrier awaits at $1799, the Fibonacci 23.6% one-month and previous day’s high.

The confluence of the pivot point one-week R1 and pivot point one-day R1 around $1806 will be next on the buyers’ radars.

Buying resurgence will then see a rally towards the previous week’s high of $1810.

Alternatively, the bears test the bullish commitments at $1791, where the SMA10 one-day and Fibonacci 23.6% one-day coincide.

A fierce cushion appears around $1787, which is the intersection of the SMA100 four-hour, Fibonacci 38.2% one-day and one-month.

The line in the sand for gold bulls is seen at $1781. That level is the meeting point of the SMA50 one-day, Fibonacci 61.8% one-day and Fibonacci 23.6% one-week.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.