Kaisa shares and dollar bonds tumble amid fears of a liquidity crunch

After the firmed stated that its October sales plunged by over 30% compared to a year ago yesterday, its shares are dropping by more than 12% on the day with the low earlier being an all-time low (drop of more than 14%).

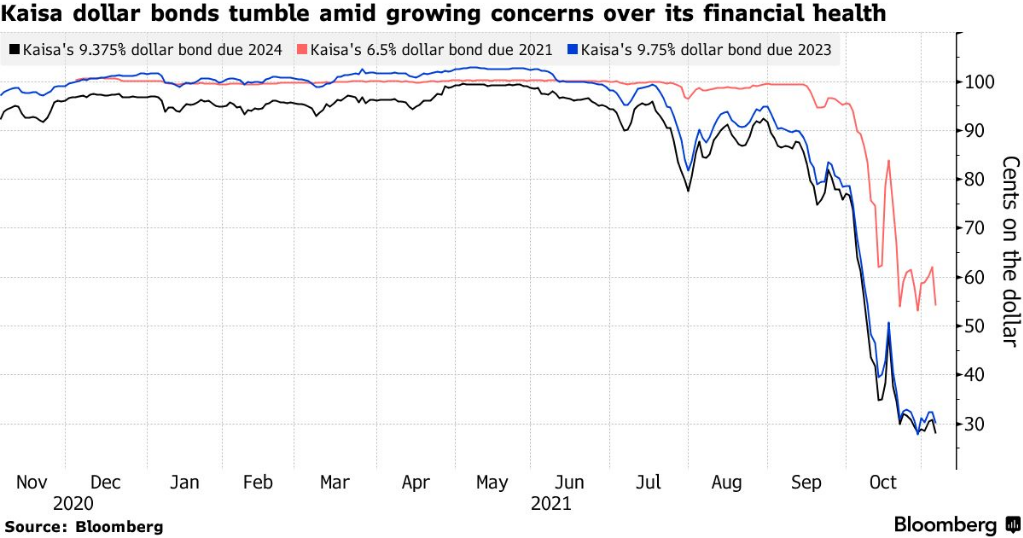

Meanwhile, its dollar bonds have also declined by as much as 5 cents on the dollar and has dropped rather considerably since the start of October.

Again, for some context, Kaisa has the most offshore debt coming due over the next one year of any Chinese developer, after Evergrande that is.

They have roughly $3.2 billion in offshore notes due in the next 12 months with the next maturity being on 7 December, worth $400 million.

As such, they are the next big name to watch in all of this and while the market has been rather sanguine about the risks in this space over the past few weeks, it is still something worth keeping an eye out for in case it comes back to bite again in the future.