Powell lays the framework for tapering to begin.

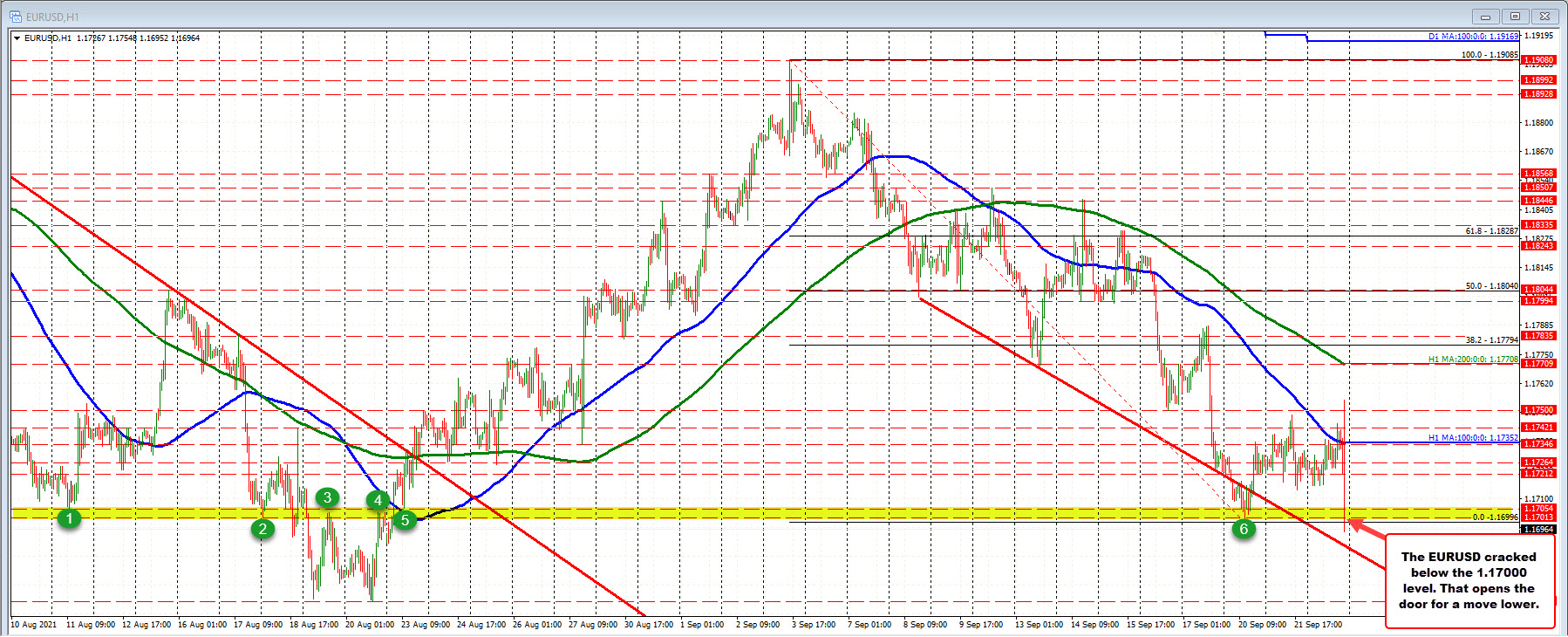

Fed Powell’s comment that set the timeline for the taper has push the EURUSD back down (higher dollar). In the process, the pair first fell back below the 100 hour moving average at 1.17352. Buyers turned sellers in the price has now extended more deeply to the downside

The EURUSD price is back down testing – and now moving below – the 1.1700 to 1.1705 support level. That area held on the first dip right after the rate decision.

The price just traded to a a new low of 1.16923. Stay below 1.17054 now (that would be the most bearish clue), and the bears remain fully in control. The low price from August 19 August 20 reached down to 1.1664 area. That would be the next major target on the downside. PS that level is also the low for the year. The range for the year is only 682 pips. By comparison, the range in 2020 was over 1600 pips.

This article was originally published by Forexlive.com. Read the original article here.