Swiss Franc and Yen are both under some selling pressure today, following rallying major global treasury yields. Sterling is weighed down by weak retail sales while Euro is not too far away. Dollar is mixed and Canadian and Aussie are the relatively stronger ones. The economic calendar is light in US session, and risk markets development would drive the forex markets towards the end of the week.

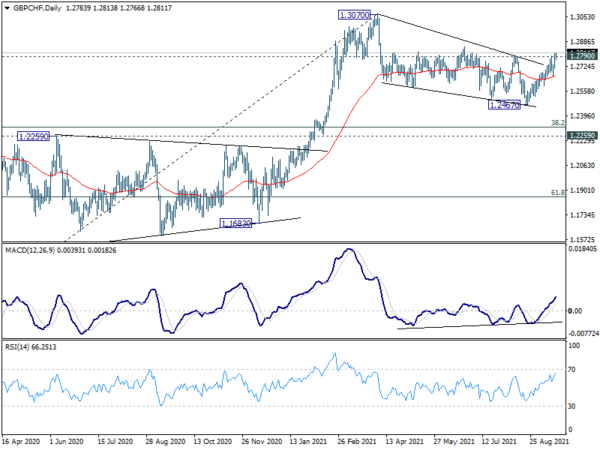

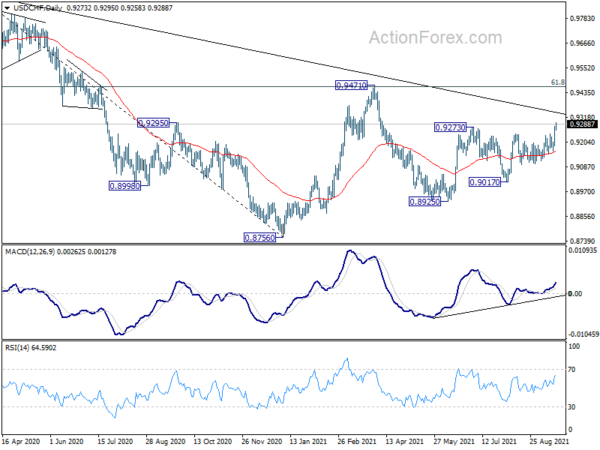

Technically, GBP/CHF could finally be making a decision to break through 1.2790 resistance in a firm way. The development would argue that corrective pattern from 1.3070 has completed at 1.2467. Further rise is now in favor as long as 55 day EMA holds, to retest 1.3070 high. EUR/CHF is on track to 1.0985 resistance and break will pave the way to retest 1.1149 high. USD/CHF is also resuming whole rise from 0.8925 to retest 0.9471 resistance.

In Europe, at the time of writing, FTSE is up 0.06%. DAX is down -0.02%. CAC is up 0.32%. Germany 10-year yield is up 0.0312 at -0.269. Earlier in Asia, Nikkei rose 0.58%. Hong Kong HSI rose 1.03%. China Shanghai SSE rose 0.19%. Singapore Strait Times rose 0.22%. Japan 10-year JGB yield rose 0.0047 to 0.050.

ECB Makhlouf: Fears of excessive euro area inflation are overstated

ECB Governing Council member Gabriel Makhlouf said, “I believe that, at the moment, fears of excessive euro area inflation are overstated and that the current price pressures reflect transitory factors that will fade out over time.”

But he also admitted, “there is considerable uncertainty about the persistence of price pressures and we need to interpret this (inflation) data and the outputs of our models with caution.”

ECB Kazaks: There are some decimals upside in inflation outlook

ECB Governing Council member Martins Kazaks said, “if Covid does not surprise on the negative side, there is some upside for the inflation outlook over the medium term.” But he added, “I am talking about decimals here.”

“There is perhaps some upside for those numbers to be revised up in the following forecasting rounds,” Kazaks said. “I agree with the current outlook, but I would say that the balance of risks for inflation are somewhat on the upside.”

“We hear some anecdotal evidence that there could be some wage pressures down the road, but we have not seen that yet in the data,” he said. “There is no reason to expect that inflation would be permanently very hot. If at some point inflation will be significantly higher than our strategy and monetary-policy mandate, then of course we will know how to react.”

Eurozone CPI finalized at 3% yoy in Aug, EU at 3.2% yoy

Eurozone CPI was finalized at 3.0% yoy in August, up from July’s 2.2% yoy. The highest contribution to the annual euro area inflation rate came from energy (+1.44%), followed by non-energy industrial goods (+0.65%) and food, alcohol & tobacco and services (both +0.43%).

EU CPI was finalized at 3.2% yoy, up from July’s 2.5% yoy. The lowest annual rates were registered in Malta (0.4%), Greece (1.2%) and Portugal (1.3%). The highest annual rates were recorded in Estonia, Lithuania and Poland (all 5.0%). Compared with July, annual inflation remained stable in one Member State and rose in twenty-six.

UK retail sales dropped -0.9% mom in Aug, ex-fuel sales dropped -1.2% mom

UK retail sales dropped -0.9% mom in August, well below expectation of 0.5% mom rise. For the 12-month period, headline sales rose 0.0% yoy versus expectation of 2.6% yoy.

Overall sales volume were still up 0.3% in the three months to August, compared with the previous three months. It’s also 4.6% higher than their pre-pandemic levels in February 2020.

Ex-fuel sales dropped -1.2% mom, well below expectation of 0.7% mom rise too. For the 12-month period, ex-fuel sales dropped -0.9% yoy versus expectation of 2.5% yoy.

New Zealand BusinessNZ manufacturing dropped to 40.1, economic pain being felt

New Zealand BusinessNZ manufacturing index dropped to 40.1 in August, down from 62.6, back in contraction. Looking at some more details, production tumbled from 63.9 to 27.7. Employment dropped from 57.9 to 54.5. New orders dropped from 63.7 to 44.4. Finished stocks dropped from 56.8 to 46.1 Deliveries dropped from 56.3 to 33.6.

BNZ Senior Economist, Doug Steel stated that “while many anticipate a bounce in activity as the country progresses down alert levels (all going well on the Covid front), today’s PMI clearly demonstrates the economic pain being felt. This should not be underestimated, even if there is hope for the future. GDP and manufacturing output are expected to fall heavily in Q3. It is something of a reality check in the afterglow of yesterday’s very strong Q2 GDP outcome.”

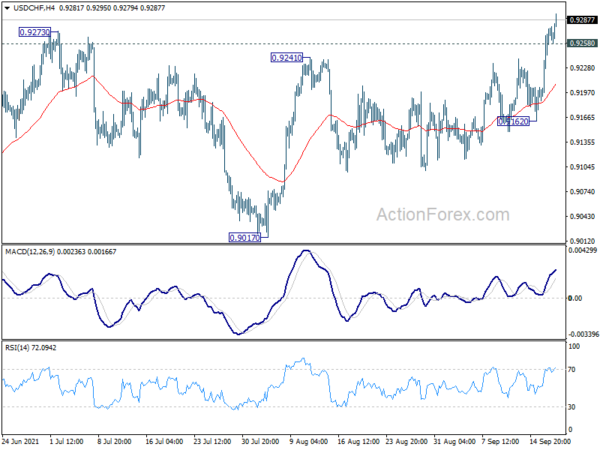

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9221; (P) 0.9249; (R1) 0.9307; More….

Sustained break of 0.9273 resistance confirms resumption of whole rise from 0.8925. Intraday bias remains on the upside for 0.9471 resistance next. Decisive break there will carry larger bullish implications. On the downside, below 0.9258 minor support will turn intraday bias neutral first, before staging another rally.

In the bigger picture, USD/CHF is still struggling around 55 week EMA (now at 0.9178) and outlook is mixed for now. Confirmed rejection by the 55 week EMA will retain medium term bearishness. That is, larger fall from 1.0342 would resume through 0.8756 low at a later stage. However, sustained trading above 55 week EMA will tilt favor to the case of bullish reversal. Focus would then be turned to 0.9471 resistance for confirmation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | BusinessNZ Manufacturing Index Aug | 40.1 | 62.6 | ||

| 6:00 | GBP | Retail Sales M/M Aug | -0.90% | 0.50% | -2.50% | -2.80% |

| 6:00 | GBP | Retail Sales Y/Y Aug | 0.00% | 2.60% | 2.40% | |

| 6:00 | GBP | Retail Sales ex-Fuel M/M Aug | -1.20% | 0.70% | -2.40% | |

| 6:00 | GBP | Retail Sales ex-Fuel Y/Y Aug | -0.90% | 2.60% | 1.80% | |

| 8:00 | EUR | Eurozone Current Account (EUR) Jul | 21.6B | 22.3B | 21.8B | |

| 8:30 | GBP | Consumer Inflation Expectations | 2.70% | 2.40% | ||

| 9:00 | EUR | Eurozone CPI Y/Y Aug F | 3.00% | 3.00% | 3.00% | |

| 9:00 | EUR | Eurozone CPI Core Y/Y Aug F | 1.60% | 1.60% | 1.60% | |

| 14:00 | USD | Michigan Consumer Sentiment Index Sep P | 70.2 | 70.3 |