- EUR/USD bulls step up at a critical level and target a break of hourly resistance for the final sessions of the week.

- ECB sentiment turns hawkish, lifting the euro out of the doldrums on Thursday.

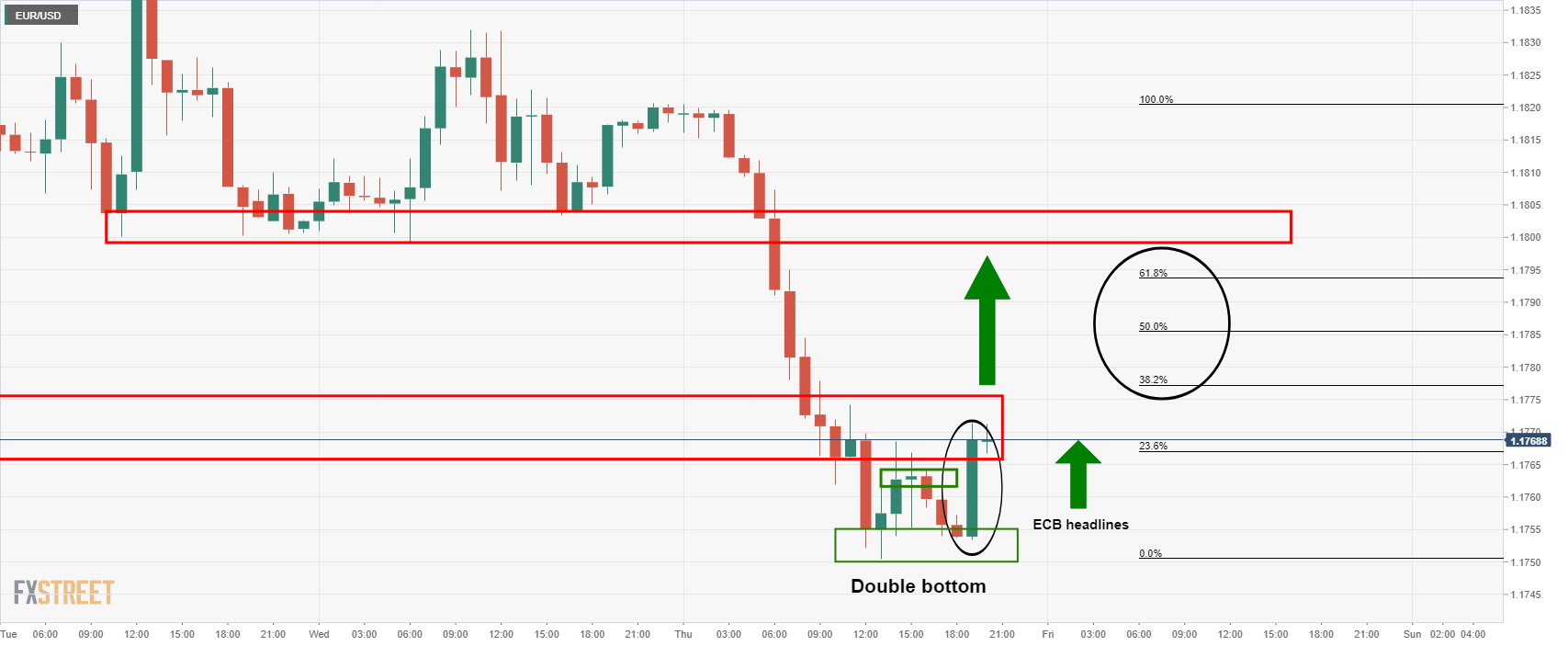

EUR/USD is attempting to correct the hourly bearish trend in late New York, running up to hourly resistance near 1.1770. At the time of writing the pair is down 0.42% at 1.1766 and has fallen on the day from a high of 1.1820 to a low of 1.1750.

The bears lost their footing on Thursday following a rally in the greenback. US Retail Sales rose 0.7% last month, boosted in part by back-to-school shopping and child tax credit payments, while data for July was revised down.

The data unexpectedly increased in August. The dollar rallied because the data has investors more optimistic about the US economic recovery that had started to look as though it was losing steam. The data has bolstered investor expectations for next week’s policy meeting and how soon the US central bank will start to taper stimulus.

ECB rate rises on the way

However, in more recent trade, the euro got a much-needed boost from critical hourly support on the back of news that the European Central Bank expects to hit its elusive 2 per cent inflation target by 2025, according to unpublished internal models that suggest it is on course to raise interest rates in just over two years.

More on this here: ECB inflation estimate raises prospect of earlier rate rise

In other data on Thursday, the US Initial Jobless Claims were higher than expected at 332,000 in the past week. ”This lift in claims was partially due to seasonal adjustments for Labor Day and it is possible that some claims were delayed due to the disruption caused by Hurricane Ida,” analysts at ANZ Bank.”Overall claims for out-of-work benefits are trending down and it is too soon to assume this has changed.”

EUR/USD technical analysis

The price is on the verge of a break of critical resistance that would open the pathway to a deeper correction, possibly all the way into the prior lows as resistance, potentially one Fibonacci at a time.

In the meantime, however, a retest of the current support and neckline of the W-formation near 1.1760 could be in order first.

On the other hand, a break of the double bottom lows will leave the bears in control again.