NZDCHF in focus

New Zealand was all set to become one of the first major central banks to embark on a hiking cycle as the economy began to run hot. Moving into the RBNZ meeting last month the expectations were that the RBNZ were going to hike rates. Unemployment was at a low (4.0%), inflation high (3.3% y/y), tapering had stopped on July 23 and the largest investment banks in the regions were predicting three hikes before year end. However, it was the resurgence of COVID-19 that seemed to hold the central bank back at the latest central bank meeting. A single case of COVID-19 was found and this sent the nation into an entire lockdown. However, immediately after the decision Governor Orr said that COVID cases alone will not stop a rate hike and needs to move on policy and cannot wait for uncertainty to lift. RBNZ’s Hawkesby later reinforced this view at the end of August when he said week that the RBNZ considered raising the official cash rate by 50 bps at the last meeting.

COVID-19 under control in New Zealand with ‘mystery cases’ risk.

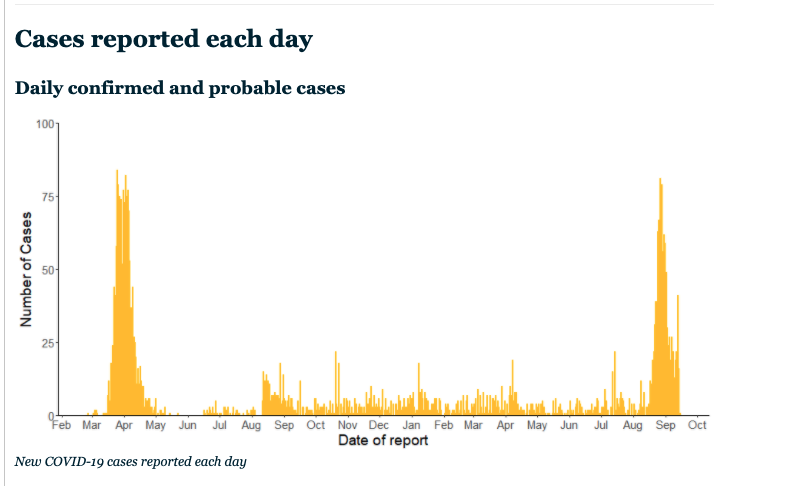

New Zealand are confident that their policy of elimination works. Since the first new case in August the peak has seemed to have passed (see cases below as of Sep 14).

However, one concern is that of so called ‘mystery cases’. This is cases of Covid with no apparent link of transmission that can be understood. The previous peak number of cases was 89 per day in April 2020 and New Zealand was quick to handle that outbreak.

The CHF is weak as SNB repeat need for negative rates

The SNB has the lowest interest rates in the world at -0.75% as they try to discourage inflows into the CHF. SNB’s Zurbruegg said earlier this week that native interest rates from the SNB are still needed to curb CHF gains. The SNB actively try to weaken the CHF in order to help their export market. A strong CHF means that Swiss exports are dear to the rest of the world, Also remember that as a safe haven currency CHF, alongside the JPY, often sees strength in risk off markets. So, any temporary bids into the CHF could see a fall in NZDCHF, but medium term the case for buyers remain.

The chart

Anywhere here remains good value for medium term NZDCHF buying as long as the case remains as outlined above.