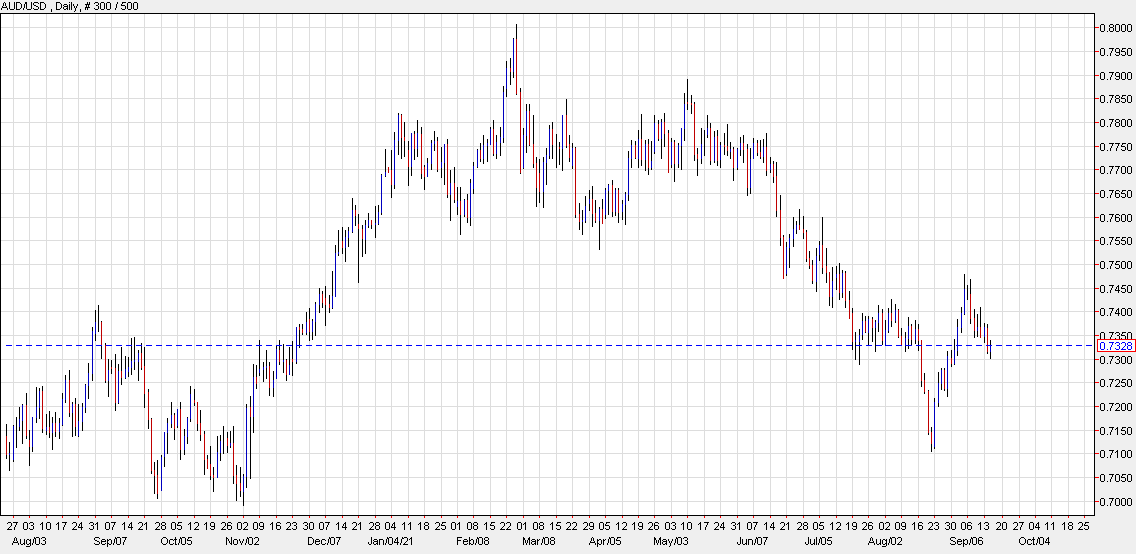

SocGen strategy thoughts on AUD, GBP and CAD

Societe Generale Research discusses its bias on AUD and GBP in the near-term.

“Our Chinese economics team reckons

the Chinese slowdown will prompt rate cuts, which is tangible, but when

will it weaken the yuan – which appears glued into a narrow range? Even

without that, however, we find no reason other than valuation (which doesn’t help) to like the Australian dollar,” SocGen notes.

“On the other hand, even transitory

inflation would be enough to make me wonder if the Bank of Canada might

be forced to rethink easy policies before too long. And the UK data will keep up pressure on the MPC to raise rates in 2022. So sterling should keep its mini-bid,” SocGen adds.

This article was originally published by Forexlive.com. Read the original article here.