GBP/USD prints fresh two-week highs above 1.3870 as the US dollar remains weak

Pound prints fresh highs across the board during the American session. US dollar consolidates post NFP losses, even as US yields rise sharply. GBP/USD up for the third day in a row, gains a hundred pips from a week ago. The GBP/USD printed a fresh two-week high during the American session at 1.3874. it remains near the top, holding onto most of its daily and weekly gains, on the back of a weaker US dollar across the board. Read more…

GBP/USD Weekly Forecast: Torn between mixed forces, data to determine next moves

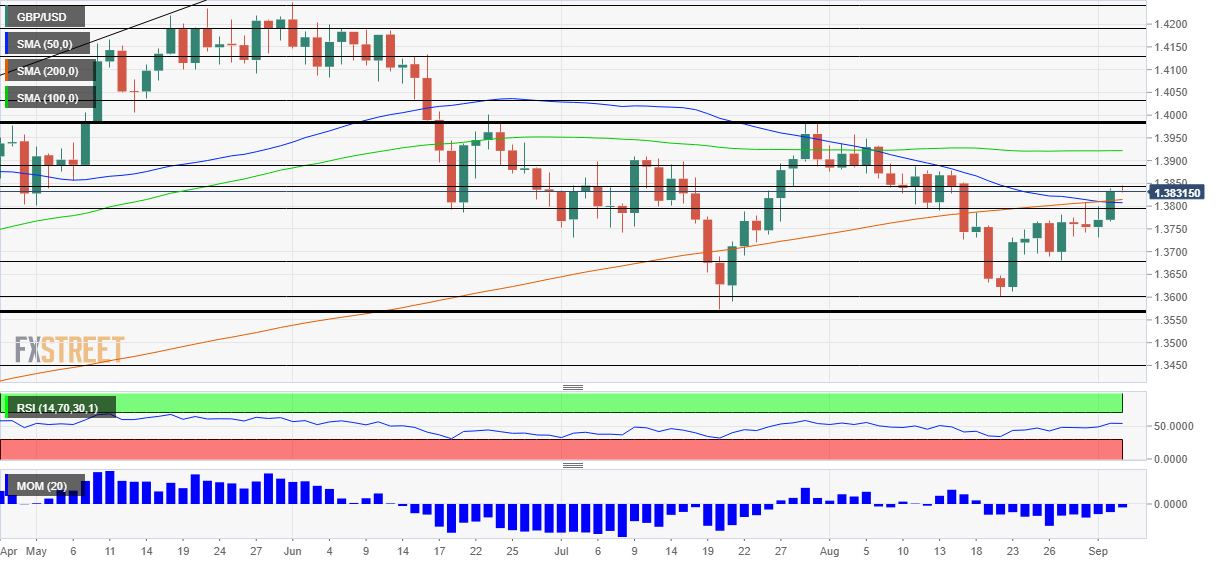

GBP/USD has been building on dollar weakness but less than its peers. UK GDP, US producer inflation and covid headlines are set to rock the currency pair. Early September’s daily chart is showing bears are in the lead. The FX Poll is showing cable is set to swirl around 1.39. Reluctant to rise – Sterling has been lagging behind its peers when it comes to benefiting from the dollar sell-off. Can GBP/USD find its feet or is it vulnerable to a change of course? Data on both sides of the pond is set to determine the next moves. Read more…

GBP/USD Forecast: Sterling finally shines, Nonfarm Payrolls could knock it back down

GBP/USD has topped 1.38 in the latest spell of dollar selling. Nonfarm Payrolls could send the overstretched dollar back up. Friday’s four-hour chart is painting a bullish picture for cable. Better late than never – that is what pound bulls have been thinking. GBP/USD has finally staged a convincing break above the tough 1.3785 line and the 1.38 round number. It owes to dollar weakness rather than sterling strength. Read more…