Texas in the winter of 2020 might be just a preview

Now, it’s happening.

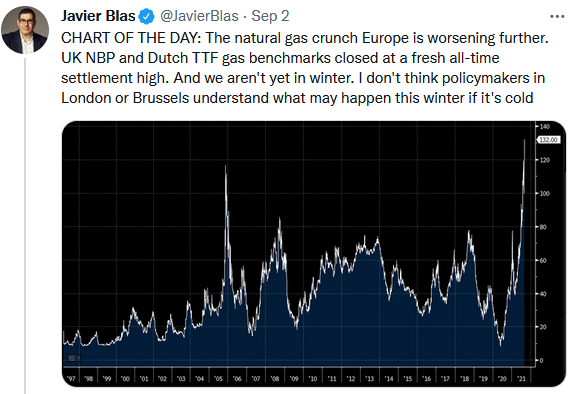

The coming winter may give the world a painful lesson in just how pervasive and vital gas has become for the economy.

Natural gas is a highly-seasonal trade. If you look at US gas, you’ll see that every spike has come in the winter months. That’s because the main use of gas is still home heating.

What’s different this time is that inventories are already tight and we’re not even close to the cold months.

What happened?

It’s been the perfect storm of:

- A collapse in energy prices that led to less drilling

- A market-led philosophical change in energy company governance, demanding deleveraging and return of capital rather than production growth

- ESG starving the energy industry of capital

- Conversions of power plants to natural gas from coal

- The LNG revolution

This winter is the reckoning and it will hit at a time when consumers are particularly agitated about inflation.

In the US, inventories are about 14% below average. I’d argue that understates the shortfall because of higher export and power demand — the market appears to agree.

The x-factor now is weather. We saw last winter what could happen in Texas as prices briefly went parabolic as supply overshot demand. That kind of extreme move nationally is still highly unlikely but significantly higher prices are certainly possible; and I’d argue likely.

While the most-visible impact will be on consumers’ bills, it will quickly reverberate through industry via higher power costs and then boomerang back to the consumer again as those are passed through the supply chain in difficult-to-predict ways:

Surging utility bills have “sabotaged” the business of Mughal Steels in Pakistan, according to Chief Operating Officer Shakeel Ahmad.

“We consume the gas first and get a high bill later,” he said. “How can I go back to a client saying that I need to add extra cost to the steel that I sold you?”

In short, the one-pandemic price hikes that the Fed is trying to look through are facing a new front — and Powell will be hoping it’s not a cold front. In emerging markets, fuel is a life-and-death necessity and it could destabilize governments.

The good news in the longer-term is that the shale revolution is really about natural gas. At $4.60 it’s suddenly a viable business again but delevering will keep the rig count flat-ish. At $6, it’s another round of ‘drill baby, drill!‘.