Selling of Swiss Franc is somewhat the biggest theme in a very quiet day so far, with UK on holiday. On the other hand, some buying is picking up in Canadian Dollar. But overall, markets are mixed without a clear direction yet. Main focus will firstly be on whether US stocks could extend last week’s record runs. Also, eyes are on whether Dollar would extend the post-Powell decline. It may take a bit more time to unveil the trend.

Technically, as noted before, we’d look at 1.1804 resistance in EUR/USD, 1.3785 resistance in GBP/USD, 0.9098 support in USD/CHF, 109.10 support in USD/JPY and 1.2577 support in USD/CAD. Break of these level would affirm Dollar’s underlying weakness. Also, Gold’s reaction to 1832.47 resistance would also double confirm Dollar’s move.

In Europe, at the time of writing, FTSE is up 0.32%. DAX is up 0.18%. CAC is up 0.21%. Germany 10-year yield is up 0.0125 at -0.408. Earlier in Asia, Nikkei rose 0.54%. Hong Kong HSI rose 0.52%. China Shanghai SSE rose 0.17%. Singapore Strait Times rose 0.69%. Japan 10-year JGB yield dropped -0.0048 to 0.020.

Eurozone economic sentiment dropped to 117.5, employment expectation rose to 112.8

Eurozone Economic Sentiment Indictor dropped from record high of 119.0 to 117.5 in August, below expectation of 118.6. Employment Expectations Indictor rose 1.2 pts to 112.8, hitting the highest level since November 2018. Looking at some more details, industry confidence dropped from 14.5 to 13.7. Services confidence dropped from 18.9 to 16.8. Consumer confidence dropped from -4.4 to -5.3. Retail trade confidence rose from 4.4 to 4.6. Construction confidence rose from 4.0 to 5.5.

EU ESI dropped -1.5 pts from record high 118.0 to 116.5. Amongst the largest EU economies, the ESI fell sharply in France (-4.5) and in the Netherlands (-3.0), and to a lesser extent, in Italy (-1.9), Poland (-1.7) and Spain (-1.2). Sentiment in Germany (-0.3) was virtually unchanged. Employment Expectation Indicator rose 1.0 pts to 112.6, highest since November 2018.

ECB Villeroy: No urgency to decide on asset purchases at Sep meeting

ECB Governing Council member, Bank of France Governor Francois Villeroy de Galhau told BFM Business radio that the economies in France and the euro zone should be back to pre-COVID levels in early 2022 or maybe earlier.

He added there is no risk of higher inflation at this stage, and there is no risk of a sustainable surge in inflation in the Eurozone. He expected PEPP purchases to be there until at least March 2022. There is no urgency to decide on asset purchases at the September meeting.

Swiss KOF dropped to 113.5, 4th wave of pandemic fueling doubts on economy

Swiss KOF Economic Barometer dropped for the third month in a row to 113.5 in August, below expectation of 126.3. However, it’;s still well above it’s average value of 100. KOF said, “the fourth wave of the pandemic, which is now becoming increasingly clear, is apparently fuelling doubts about largely unhindered economic activity in the near future.”

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9078; (P) 0.9139; (R1) 0.9172; More….

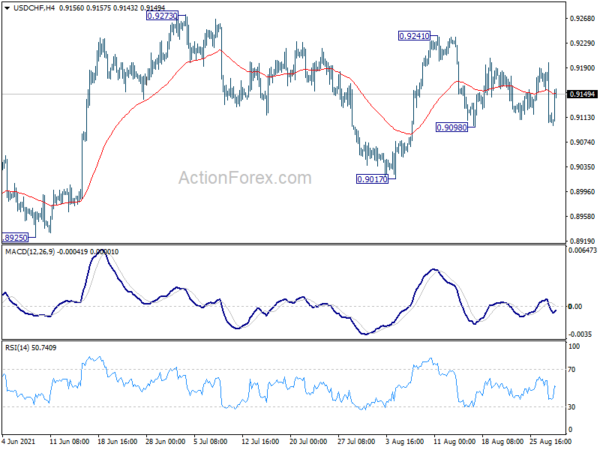

USD/CHF recovers again today but stays in range of 0.9098/9241. Intraday bias remains neutral for the moment. On the downside, break of 0.9098 will target 0.9017 support first. Further break there will likely resume the decline from 0.9471 through 0.8925 low. On the upside, break of 0.9241 resistance should resume the rise from 0.8925 through 0.927.

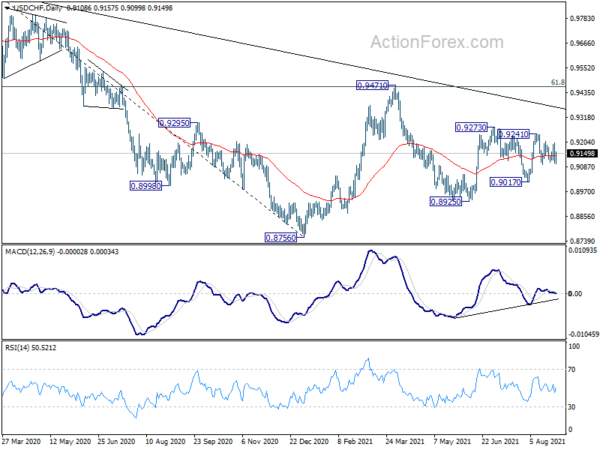

In the bigger picture, the failure to sustain above 55 week EMA (now at 0.9176) retains medium term bearishness in USD/CHF. Break of 0.8925 support should resume the whole decline form 1.0342 (2016 high) through 0.8756 low. However, break of 0.9273 resistance and sustained trading above 55 week EMA will be an early sign of bullish trend reversal. Focus will then turn to 0.9471 resistance for confirmation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Retail Trade Y/Y Jun | 2.40% | 2.10% | 0.10% | |

| 01:30 | AUD | Company Gross Operating Profits Q/Q Q2 | 7.10% | 3.00% | -0.30% | -0.60% |

| 07:00 | CHF | KOF Leading Indicator Aug | 113.5 | 126.3 | 129.8 | 130.9 |

| 09:00 | EUR | Eurozone Economic Sentiment Indicator Aug | 117.5 | 118.6 | 119 | |

| 09:00 | EUR | Eurozone Industrial Confidence Aug | 13.7 | 13.7 | 14.6 | 14.5 |

| 09:00 | EUR | Eurozone Services Sentiment Aug | 16.8 | 19.9 | 19.3 | 18.9 |

| 09:00 | EUR | Eurozone Consumer Confidence Aug F | -5.3 | -5.3 | -5.3 | -4.4 |

| 09:00 | EUR | Eurozone Business Climate Aug | 1.75 | 1.9 | 1.88 | |

| 12:00 | EUR | Germany CPI M/M Aug P | 0.00% | 0.10% | 0.90% | |

| 12:00 | EUR | Germany CPI Y/Y Aug P | 3.90% | 3.90% | 3.80% | |

| 12:30 | CAD | Current Account (CAD) Q2 | 1.5B | 1.2B | ||

| 14:00 | USD | Pending Home Sales M/M Jul | 0.50% | -1.90% |

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!) RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading