The markets turn to dollar buying

The Cleveland Pres. Mester is speaking on CNBC and has gotten in line on the sooners is better than later with regard to tapering. The comments are not that different from other Fed officials, but the market is reacting in a “buy the dollar” way.

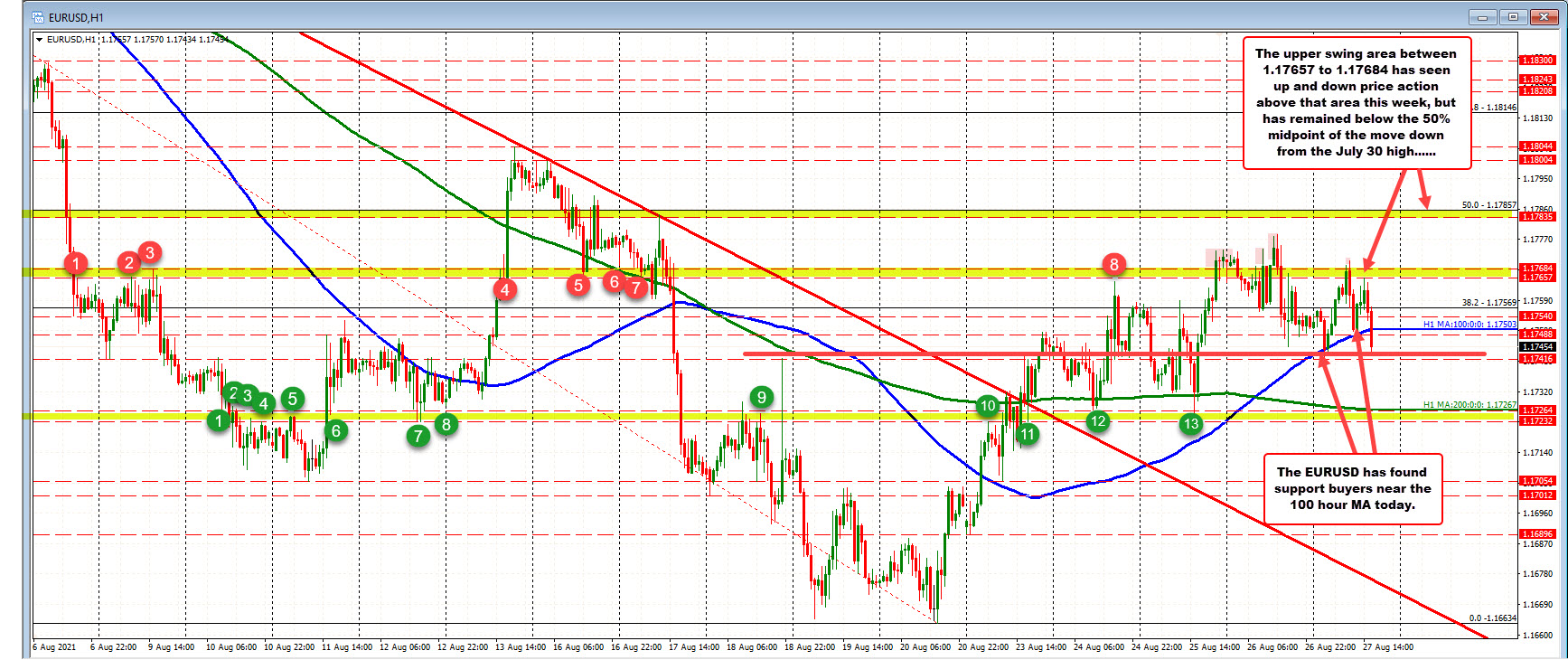

For the EURUSD, the pair move back below its 100 hour moving average at 1.17503, after finding support buyers near the level earlier today (it did dip below the level in the early Asian session but quickly rebounded).

On the downside, the 200 hour moving average 1.17267 is a target level. The price just drop below the low for the day at 1.17416 (as I type - not reflected in the chart above). The current price is trading at 1.1736. The 200 hour moving averages near a swing area (see green numbered circles) between 1.1723 and 1.17264. Move below that level should open the door for further downside. The price has not traded below that level since Monday. Lows on Tuesday and Wednesday stalled in that area.

Feds Kaplan is also speaking currently on Bloomberg TV. Kaplan was more hawkish yesterday versus his comments last week.

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)