Dollar bids coming through

It’s tough to find a fundamental underpinning to the latest move in the US dollar. It’s more likely flows or position squaring ahead of Powell.

IF anything, the bond market is dollar negative at the moment as US 10-year yields trail down to 1.299% from 1.310% earlier and that brings rates to flat on the day.

Perhaps that’s some risk aversion creeping in but it’s tough to find much evidence.

In any case, the dollar is at the best levels of the day against the euro, pound and yen after 10-15 pip moves in the past 15 minutes.

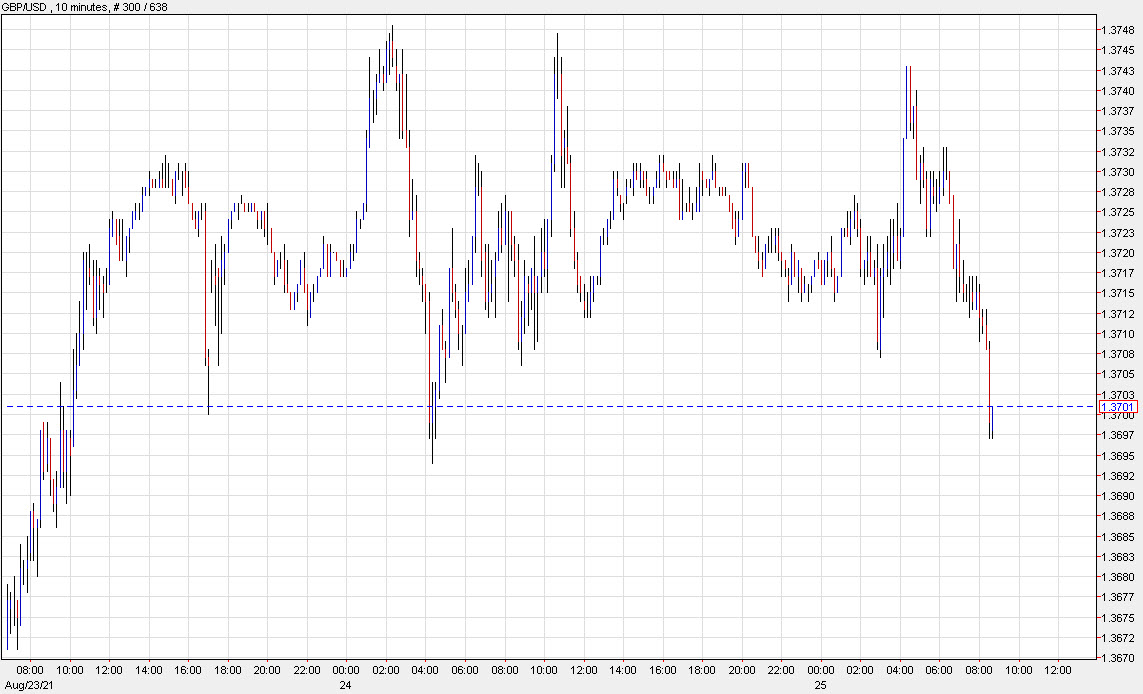

So far, cable is holding yesterday’s low:

This article was originally published by Forexlive.com. Read the original article here.