The day after the FOMC. China regulators ease market fears

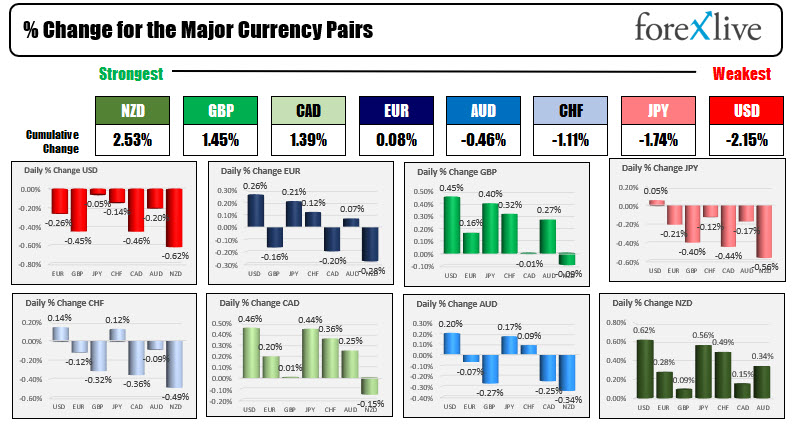

The NZD is the strongest and the USD is the weakest of the majors a night after the FOMC kept rates unchanged and Chair Powell indicated no rush to taper bond purchases (or raise rates) any time soon. China eased fears after a call with market participants in which they said the regulation against education companies is an isolated incident. The Shanghai index rose 1.49%. Today, in addition to the weekly claims, the long awaited US GDP for the 2Q is expected to show growth of 8.5% (claims are expected at 385K vs 419K last week). Robinhood will go publc with the price near the low end of the price expectations at $38. Facebook and Paypal shares are lower in pre-market trading after warning on expectations going forward, but the Dow and S&P are higher. The Nasdaq is down marginally after rising for the 6th time in 7 days.

In other markets as North American trading gets underway shows:

- Spot gold up $18.82 or 1.03% at $1825.30

- spot silver is up $0.57 or 2.23% at $25.52

- WTI crude oil futures are up $0.33 or 0.46% $72.71

In the premarket for US stocks, the Dow and S&P indices are higher while the NASDAQ is modestly lower/near unchanged.

- Dow up 150 points. The index fell -128 points yesterday

- S&P is up 10.3 points. The index fell -0.82 points yesterday

- Nasdaq is trading up one point and off the lows from earlier today. The index rose 102 points yesterday

In the European equity markets, the major indices are trading higher:

- German DAX, +0.46%

- France’s CAC is up 0.77%

- UK’s FTSE 100 is up 0.9%

- Spain’s Ibex is up 1.1%

- Italy’s FTSE MIB is up 0.9%

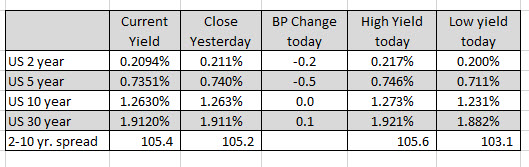

In the US debt market, yields are trading near unchanged with the 10 year yield at 1.2630%. The low reach 1.231% overnight.

breakout perfect entry #forex #crypto #trading #trending

breakout perfect entry #forex #crypto #trading #trending