Only one thing can explain the broad market moves this month

If you start with the assumption that the pandemic doesn’t matter to markets — and it hasn’t for a year — then the broad price action and macro picture doesn’t make sense.

Talk of a Fed policy error or bottleneck problems or anything else I’ve heard doesn’t add up. There are certainly unknowns but they’re increasingly being priced like bad outcomes are more likely.

On the flipside, I probably worried about the virus for too long. By this time last year, the market was increasingly dismissive of the virus. I caught on, but it took some time to understand that the dual bazookas of fiscal and monetary policy could so utterly vanquish covid-19.

My hope is that the Moderna chart above and its recent race higher only reflects the incredible power of MRNA technology. I expect it will ultimately save many more lives than have been lost in the pandemic. I hope it doesn’t mean that other types of vaccines are rendered virtually useless by the combination of ineffectiveness, side-effects and hesitancy.

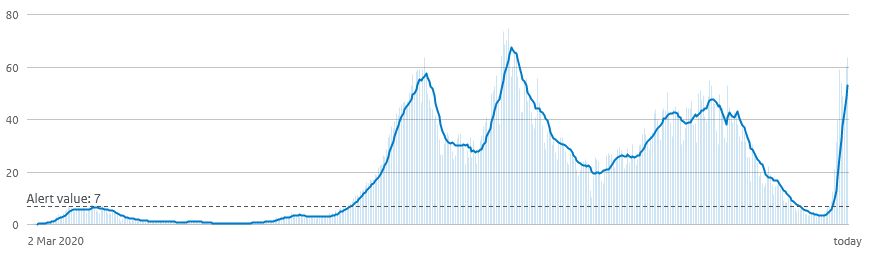

What worries me is that the message from that chart is ominous and fits like a hand in the glove of market moves elsewhere — particularly in bonds.

I hope — and still believe — that economies can power through what’s left of covid-19. That by vaccinating the vulnerable we can get back to normal.

It might be time to dig a bit deeper though, to be open minded about what the charts are saying. The only plausible answer for me, or at least the only one worth worrying about, is that covid is endemic. That evolving variants will forever keep most of the world one step behind the virus, leaving the world stunted and fearful.

For now, it remains only a worry, but charts like this of the delta variant exploding in the Netherlands two weeks after reopening can no longer be completely ignored.