Yen decline continues overnight and stays soft on the back of solid risk-on markets. DOW closed just shy of 35k handle overnight, but the three major indexes ended at record highs nonetheless. Solid buying is also seen in Asia, with Hong Kong HSI staging and impressive rebound. Australian and New Zealand Dollar are currently the stronger ones, followed by Sterling. Dollar is the second weakest, next to Yen.

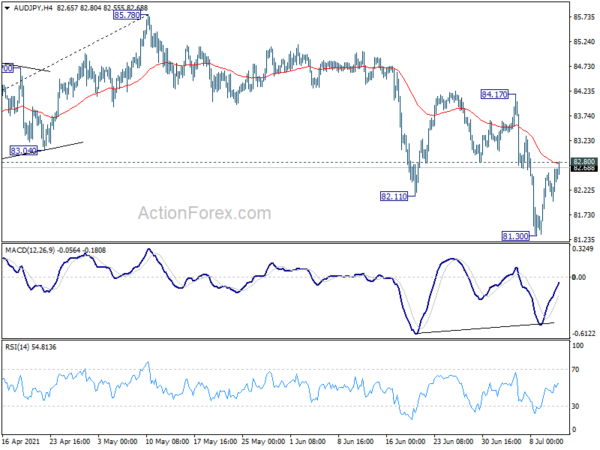

Technically, developments in both EUR/JPY and GBP/JPY suggest that stronger rally is underway. One focus is now on 82.80 support turned resistance in AUD/JPY. Firm break there will indicate short term bottoming at 81.30, on bullish convergence condition in 4 hour MACD. Stronger rise would then be seen back to 84.17 resistance and above. Such development would solidify the reactions in forex markets to broad based risk-on sentiment, and signal more downside in Yen elsewhere.

In Asia, at the time of writing, Nikkei is up 0.71%. Hong Kong HSI is up 1.87%. China Shanghai SSE is up 0.24%. Singapore Strait Times is up 0.62%. Japan 10-year JGB yield is down -0.0031 at 0.026. Overnight, DOW rose 0.36%. S&P 500 rose 0.35%. NASDAQ rose 0.21%. 10-year yield rose 0.007 to 1.363.

Australia NAB business confidence dropped to 11, conditions dropped to 24

Australia NAB Business Confidence dropped from 20 to 11 in June. Business Conditions dropped from 36 to 24. Trading conditions dropped from 45 to 35. Profitability conditions dropped from 39 to 25. Employment conditions dropped from 25 to 17.

“After reaching a record high last month, business conditions pulled back in the month. The decline in conditions was broad-based across states but led by a significant decline in Victoria coming off the back of the lockdown that started in late May but was eased, in a series of steps, over June” said NAB.

“Confidence took a hit in the month with the survey undertaken in the week of the NSW lockdown and with some overlap to brief shutdowns in the smaller capitals. The threat of closing borders also appears to have weighed everywhere”.

China exports rose 32.2% yoy in June, imports rose 23.1% yoy, trade surplus widened to USD 51.5B

In USD terms, China’s total trade rose 34.2% yoy to USD 511.3B in June. Exports rose 32.2% yoy to USD 281.4B, versus expectation of 23.1% yoy. Imports rose 36.7% yoy to USD 229.9B, versus expectation of 30.0% yoy. Trade surplus widened to USD 51.5B, above expectation of USD 44.4B.

Year-to-June, total trade with EU rose 37.0% yoy to USD 388.2B. Exports to EU rose 35.9% yoy to USD 233.0B. Imports from EU rose 38.8% yoy to USD 155.2B. Trade surplus came in at USD 78B.

Year-to-June, total trade with US rose 45.7% yoy to USD 340.8B. Exports to US rose 42.6% yoy to 252.9B. Imports from US rose 55.5% yoy to USD 87.9B. Trade surplus came in at USD 165B.

Year-to-June, total trade with Australia rose 35.0% yoy to USD 107.4B. Exports to AU rose 30.0% yoy to 29.7B. Imports from AU rose 37.0% yoy to AUD 77.7B. Trade deficit came in at USD -48B.

Fed Williams: Clearly, right not, we have not achieved substantial further progress

New York Fed President John Williams said Fed has a “very clear market” that “substantial further progress” needed to be achieved before tapering asset purchases. “That’s where I’m focused, clearly, right now we have not achieved that,” he said.

“This is a time of very high uncertainty,” he noted, adding that “I’m not going to give a forecast of when the committee will come to a decision around changing the pace of asset purchases.” He preferred completing tapering before raising interest rates but “that’s way off in the future for me”.

Looking ahead

Germany and France CPI final, Swiss PPI will be featured in European session. Main focus would be on US CPI to be released later in the day.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 152.64; (P) 152.99; (R1) 153.57; More…

GBP/JPY’s break of 153.14 resistance now suggests that corrective fall from 156.05 has completed with three waves down to 150.64, on bullish convergence condition in 4 hour MACD. Intraday bias is back on the upside for retesting 155.13/156.05 resistance zone next. On the downside, though, break of 152.38 minor support will dampen the bullish case and turn bias neutral first. In this case, correction from 156.05 might still extend with another falling leg.

In the bigger picture, rise from 123.94 is seen as the third leg of the pattern from 122.75 (2016 low). Focus remains on 156.59 resistance (2018 high). Sustained break there should confirm long term bullish trend reversal. Next target is 61.8% retracement of 195.86 (2015 high) to 122.75 at 167.93. On the downside, break of 149.03 support is needed to be the first sign of completion of the rise from 123.94. Otherwise, outlook will remain bullish even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Like-For-Like Retail Sales Y/Y Jun | 6.70% | 18.50% | ||

| 01:30 | AUD | NAB Business Confidence Jun | 11 | 20 | ||

| 01:30 | AUD | NAB Business Conditions Jun | 24 | 37 | ||

| 03:00 | CNY | Trade Balance (USD) Jun | 51.5B | 44.4B | 45.5B | |

| 03:00 | CNY | Exports (USD) Y/Y Jun | 32.20% | 23.10% | 27.90% | |

| 03:00 | CNY | Imports (USD) Y/Y Jun | 36.70% | 30.00% | 51.10% | |

| 03:00 | CNY | Trade Balance (CNY) Jun | 333B | 271B | 296B | |

| 03:00 | CNY | Exports (CNY) Y/Y Jun | 20.20% | 29.60% | 18.10% | |

| 03:00 | CNY | Imports (CNY) Y/Y Jun | 24.20% | 32.30% | 39.50% | |

| 06:00 | EUR | Germany CPI M/M Jun F | 0.40% | 0.40% | ||

| 06:00 | EUR | Germany CPI Y/Y Jun F | 2.30% | 2.30% | ||

| 06:30 | CHF | Producer and Import Prices M/M Jun | 0.40% | 0.80% | ||

| 06:30 | CHF | Producer and Import Prices Y/Y Jun | 3.20% | |||

| 06:45 | EUR | France CPI M/M Jun F | 0.20% | 0.20% | ||

| 06:45 | EUR | France CPI Y/Y Jun F | 1.90% | 1.90% | ||

| 10:00 | USD | NFIB Business Optimism Index Jun | 99.5 | 99.6 | ||

| 12:30 | USD | CPI M/M Jun | 0.50% | 0.60% | ||

| 12:30 | USD | CPI Y/Y Jun | 4.90% | 5.00% | ||

| 12:30 | USD | CPI Core M/M Jun | 0.50% | 0.70% | ||

| 12:30 | USD | CPI Core Y/Y Jun | 4.00% | 3.80% |

for beginner #shorts #crypto #forex #patterns #trading

for beginner #shorts #crypto #forex #patterns #trading

#optionbuying #optionstrading#trading#nifty #scalping #sharemarket #shorts #ytshorts

#optionbuying #optionstrading#trading#nifty #scalping #sharemarket #shorts #ytshorts