Overall markets lack clear direction today. Major European indexes are mixed in tight range. DOW future is down over -100 pts at the time of writing, but NASDAQ futures are up. Dollar recover mildly together with Yen and commodity currencies are the softer ones. But overall, major pairs and crosses are bounded inside Friday’s range. Breakout is still awaited.

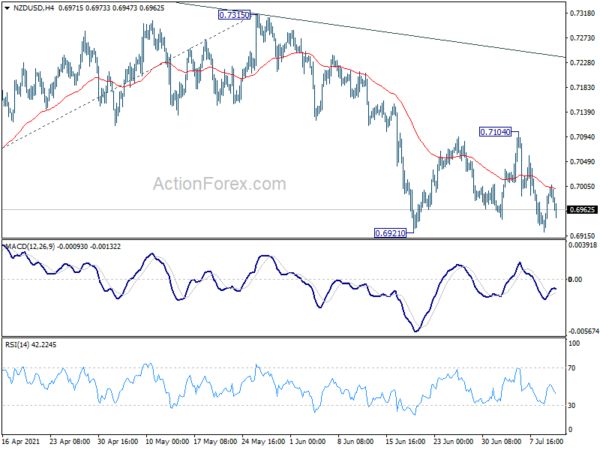

New Zealand Dollar turns softer as markets await RBNZ rate decision. Speculation of a November rate hike intensified last week. Yet, RBNZ will need to say something to affirm such speculations, or the Kiwi could face some pressure. NZD/USD softens mildly after rejection by 4 hour 55 EMA. But it’s staying in range above 0.6921. A breakout from range of 0.6921/7104 could hint on the next move this week.

In Europe, at the time of writing, FTSE is down -0.54%. DAX is flat. CAC is down -0.18%. Germany 10-year yield is down -0.0147 at -0.304. Earlier in Asia, Nikkei rose 2.25%. Hong Kong HSI rose 0.62%. China Shanghai SSE rose 0.67%. Singapore Strait Times rose 0.50%. Japan 10-year JGB yield dropped -0.0012 to 0.030.

Fed Barkin: Employment-to-population ratio to rise to north of 59% before tapering

Richmond Fed President Thomas Barkin told WSJ that labor market recovery doesn’t warrant tapering the asset purchase program yet. He said, “if the labor market can clear relatively quickly, then maybe it can happen sooner, but if it takes longer for the labor market to reopen, it goes a little later.”

Specifically, the “employment-to-population” ratio would be important to determine whether Fed could dial back the massive stimulus it’s providing to the economy. The ratio tumbled from pre-pandemic 61.1 in February 2020 to as low as 51.3% last April. It then gradually climbed back to 58% this June. Barkin said it should be something just north of 59% before he’d consider tapering.

Also he talked down the threat of inflation as it could “cool more than expected once the economic reopening process is complete.”

ECB Lagarde expects some interesting variations and changes in Jul meeting

ECB President Christine Lagarde told Bloomberg TV that there will be “some interesting variations and changes” in the upcoming July 22 meeting. “It’s going to be an important meeting,” she added. “Given the persistence that we need to demonstrate to deliver on our commitment, forward guidance will certainly be revisited.”

The immediate task for the Governing Council to align the statement and forward guidance with the result of the strategic review. “We’re going to look at the circumstances, we’re going to look at what forward guidance we need to revisit, we’re going to look at the calibration of all the tools we are using to make sure that it is aligned with our new strategy,” she said.

Regarding the PEPP program, she expected it to continue until “at least” March 2022, then followed by a “transition into a new format”, without elaboration. She emphasized, “we need to be very flexible and not start creating the anticipation that the exit is in the next few weeks, months.”

ECB de Guindos: We will discuss new forward guidance next week

ECB Vice President Luis de Guindos said in an event today, “next week we will discuss new forward guidance that includes new definition of price stability.”

“The formulation of the forward guidance has to be modified to include the new definition of price stability”, he added.

The comment was inline with President Christine Lagarde that there will be “some interesting variations and changes” in the upcoming July 22 meeting.

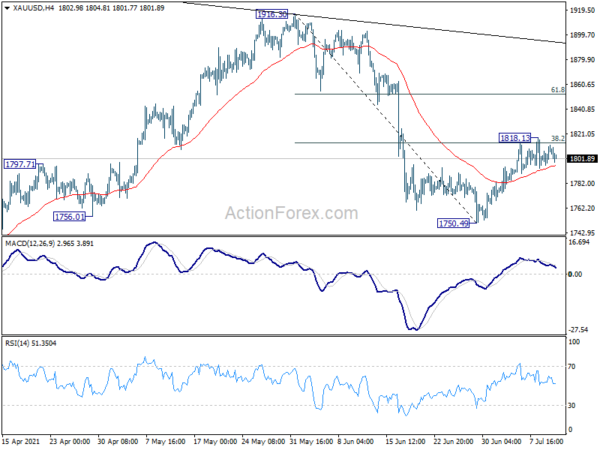

Gold at a near term juncture after rebound stalls at 55 D EMA

Gold is now at a near term juncture as rebound from 1750.49 halted after hitting 55 day EMA (now at 1813.31). It’s unsure whether the fall from 1916.30 has completed yet. But overall, such decline is still as just a falling leg inside the corrective pattern from 2074.84 high.

In case of another fall, we’d continue to expect strong support from 1676.65 to contain downside. The level is close to long term fibonacci support of 1046.27 (2015 low) to 2074.84 at 1681.62. Meanwhile, break of 1818.13 and sustained trading above the 55 day EMA will be an early signal that the correction has completed. Stronger rise should be seen back to 1916.30 structural resistance next.

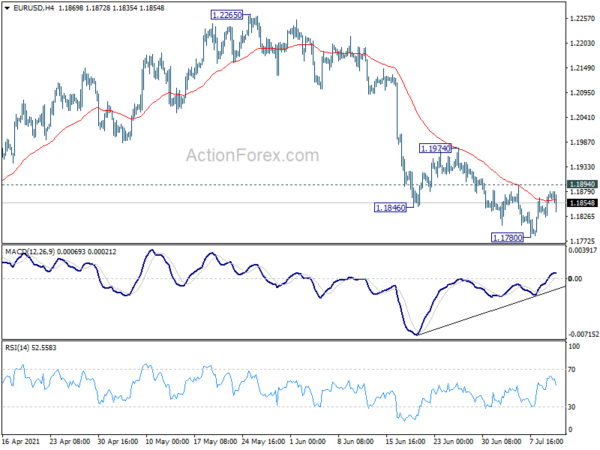

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1841; (P) 1.1861; (R1) 1.1897; More…

Range trading continues in EUR/USD above 1.1780 temporary low, and intraday bias remains neutral first. Considering bullish convergence condition in 4 hour MACD, beak of 1.1894 minor resistance will indicate short term bottoming at 1.1780. Corrective pattern from 1.2348 might have completed too. Intraday bias will be turned back to the upside for 1.1974 resistance for confirmation. Sustained break there will pave the way back to 1.2265/2348 resistance zone. On the downside, break of 1.1780 will extend the correction to retest 1.1703 support instead.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. Reaction from 1.2555 should reveal underlying long term momentum in the pair. However sustained break of 1.1602 will argue that the rise from 1.0635 is over, and turn medium term outlook bearish again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Jun | 5.00% | 4.70% | 4.90% | |

| 23:50 | JPY | Machinery Orders M/M May | 7.80% | 2.60% | 0.60% | |

| 6:00 | JPY | Machine Tool Orders Y/Y Jun | 96.60% | 140.70% | 141.90% |

#optionbuying #optionstrading#trading#nifty #scalping #sharemarket #shorts #ytshorts

#optionbuying #optionstrading#trading#nifty #scalping #sharemarket #shorts #ytshorts