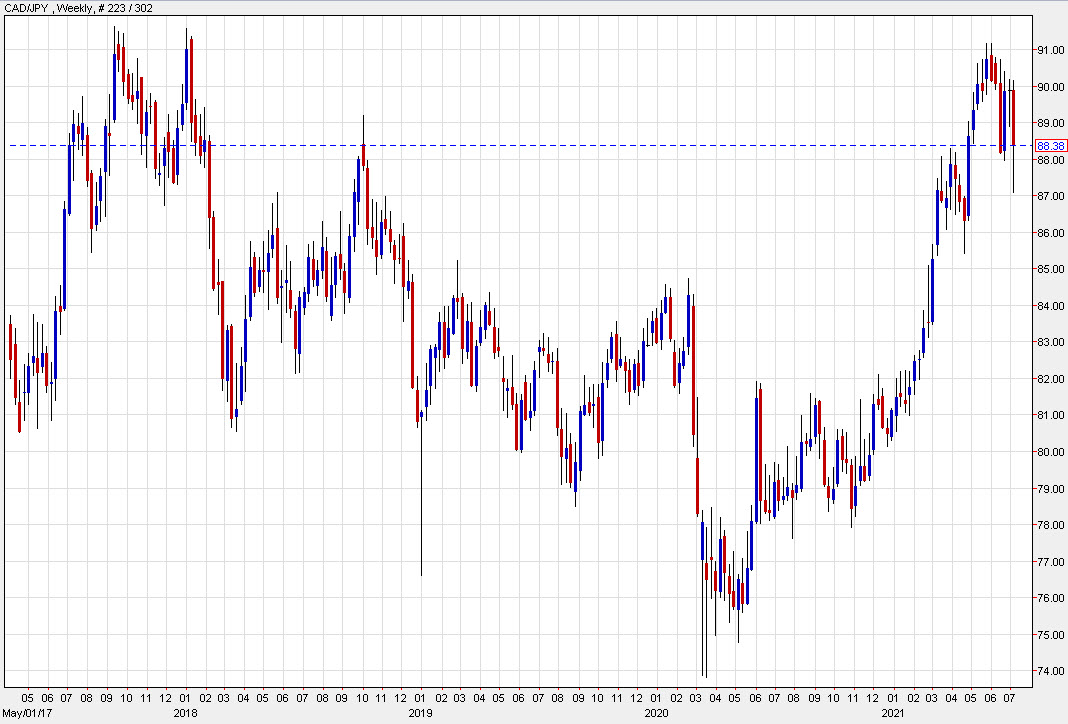

A look at the CAD/JPY weekly chart

Yesterday it looked like CAD/JPY could be headed for an ugly weekly pattern on the chart, falling straight through the June lows in the worst week in just over a year.

Today though, the pair has climbed 80 pips to back within the recent range to limit the damage and leave a more-nuanced technical picture.

The short term-bias is still lower but zooming out we’re reminded that this pair was the best performer in H1 and it stalled out at 91.00, which is just ahead of the old double tom from 2017.

Moreover, if you look back to earlier in the year, there was a similar inter-week decline down through 86.00 that looked like the start of a deeper pullback but was followed by rip higher.

More generally, there’s a case for consolidation around these levels as we sort through the reflation trade. If we ultimately see demand pickup and the delta variant doesn’t derail growth, this pair is a great place to be.

Today’s RRR cut from China is a good sign for commodities and commodity currencies. The next hurdle for this pair is Wednesday’s Bank of Canada decision. I get the sense that Macklem isn’t afraid of tapering.