Forex news for North American trading on June 29, 2021.

The housing data from the Case Schiller for April continue to show stronger again zero year. The case Schiller index of 20 cities showed a 14.9% year on year gain. The FHFA price index rose 15.7% year on year. Both are higher than the previous month. US consumer confidence for June also showed a sharp rise to 127.3 from 117.2 last month.

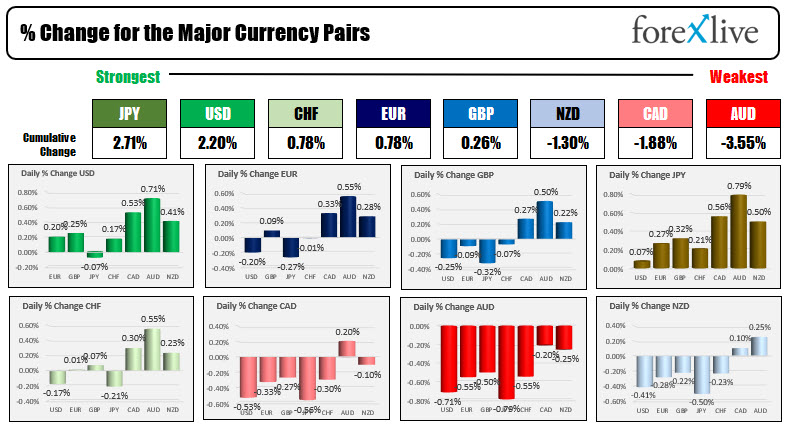

Good data helped to keep the USD bid. For the 2nd day in a row, the JPY was the strongest of the major currencies while the USD was just behind it as the 2nd strongest. The AUD was the weakest of the major currencies. Yesterday, the NZD was the weakest.

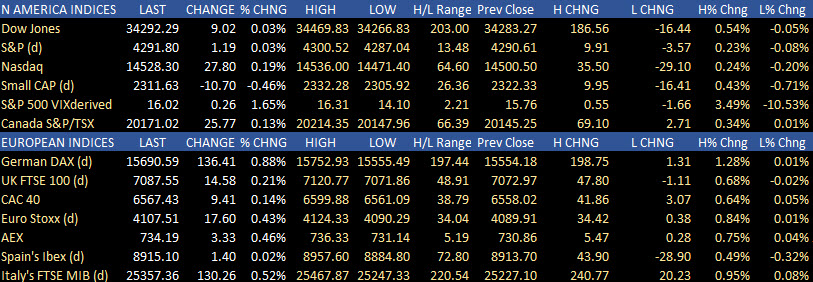

Stock price also closed higher with the S&P and NASDAQ closing a new all-time record highs but not by much. The Dow industrial average and S&P index each rose by 0.03%, while the NASDAQ index gain 0.19%. That was off their intraday high of 0.54% for the Dow, and +0.23% for the S&P. The NASDAQ fared better as it headed intraday high of 0.24% (and a low of -0.20%). . European shares today close higher across the board with your index up 0.88%. Italy’s FTSE MIB ended up at +0.52%. Below are a summary of the percentage changes and ranges for the major North American and European indices.

In other markets today:

- Spot gold is down $-19.10 or -1.07% at $1761.06. it’s high price reached $1779.15 while its low extended to $1750.02.

- Spot silver is down $0.35 or -1.35% or $25.87. The high price for the day reach $26.21, while the low extended to $25.61

- WTI crude oil futures are trading at $73.44 that’s up $0.53 or 0.73%.

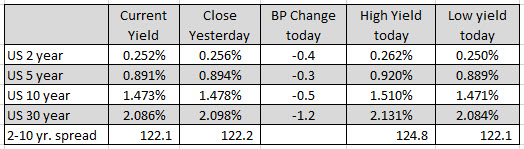

In the US debt market, rates were lower across the board with the 30 year yield moving the most that -1.2 basis point. The 10 year note remains below 1.50% level after an earlier rise to 1.471% stalled.