The chorus of Fedspeaks overnight provided little inspirations to the markets. Some policy makers expected tapering in the coming months, followed by rate hike next year. Some remained more cautious on the outlook. That’s what we already know from the Fed’s dot plot already. Major US indexes closed mixed in tight range. Yen and Dollar stayed soft but selling slowed somewhat in Asian session. On the other hand, focus is now turning to Sterling first with BoE as the main event today. Dollar could also come back to life with a string of economic data featured today and tomorrow.

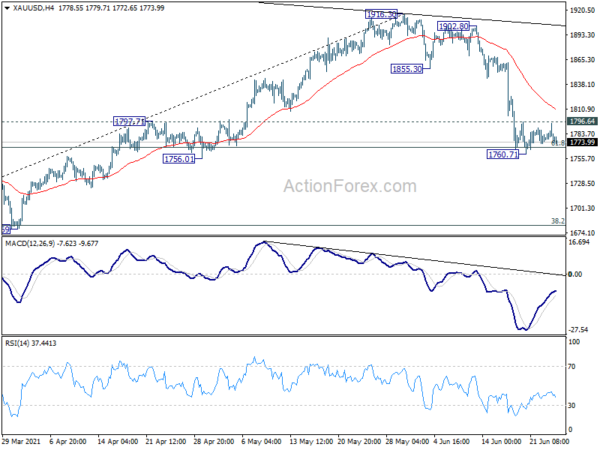

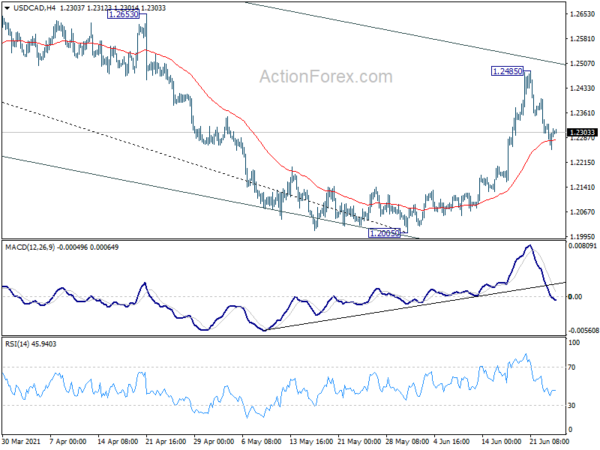

Technically, we’d maintain then the pull back in Dollar doesn’t warrant near term reversal yet. GBP/USD and USD/CAD are both touching 4 hour 55 EMAs. EUR/USD and USD/CHF are holding farther from the 4 hour 55 EMAs. Buying in the greenback could come back any time if these EMAs hold. Similarly, Gold’s recovery from 1760.71 has also been disappointing. Outlook stays bearish with 1796.64 resistance intact. A break through 1760.71 to resume the fall from 1916.30, to 1676.65 support, remains in favor.

In Asia, at the time of writing, Nikkei is up 0.03%. Hong Kong HSI is up 0.08%. China Shanghai is down -0.15%. Singapore Strait Times is up 0.25%. Japan 10-year JGB yield is u p0.0001 at 0.056. Overnight, DOW dropped -0.21%. S&P 500 dropped -0.11%. NASDAQ rose 0.13% to new record high at 14271.73. 10-year yield rose 0.015 to 1.487.

Fed Bostic expects tapering in next few months, one rate hike in 2022, two in 2023

Atlanta Fed President Raphael Bostic said yesterday,

“given the upside surprises in recent data points, I have pulled forward my projection for our first move to late 2022,”

followed by “two moves in 2023.”

“I think the economy is well on its way to recovering from the pandemic,” he added. “Much of the data recently has come in stronger than I expected. GDP is on a stronger trajectory, inflation has been higher and I recognize is well above our target.”

Additionally, he said if data “print at levels comparable to what we have seen recently” in the next few months, “we will have reached that standard” of “substantial further progress”. “Given that is a distinct possibility I think it is fully appropriate to be planning to start the tapering process.”

Fed Kaplan: I’d rather start tapering sooner rather than later

Dallas Fed President Robert Kaplan told Bloomberg News, “”As we make substantial further progress, which I think will happen sooner than people expect — sooner rather than later”.

“We’re weathering the pandemic, I think we’d be far better off, from a risk-management point of view, beginning to adjust these purchases of Treasuries and mortgage-backed securities,” he added.

“I’d rather start tapering, assuming we meet our conditions, sooner rather than later so that we have more flexibility in deciding what we want to do on rates down the road.”

“I think it’s a good thing for the Fed to emphasize that we’re vigilant and we’re committed to anchoring inflation at an average of 2% and that we’re committed to anchoring inflation expectations in a manner that’s consistent with 2% inflation,” Kaplan said. “I think just emphasizing that is probably a healthy thing.”

Kaplan expected one rate hike in 2022, without indicating his expectations for 2023.

Fed Bowman: Rise in inflation more than just measurement issues

Fed Governor Michelle Bowman said in a speech, “as the recovery in the labor market and spending on goods and services continues to gain momentum, we are seeing upward pressures on consumer prices.”

“This rise has reflected, in part, the fact that inflation numbers at the onset of the pandemic were very low,” she added. “But there is more to the recent rise in inflation than just these measurement issues.”

“The impressive upswing in economic activity has played an important role as it has led to a number of supply chain bottlenecks and put upward pressure on prices for many goods,” she said. “These upward price pressures may ease as the bottlenecks are worked out, but it could take some time, and I will continue to monitor the situation closely and will adjust my outlook as needed.”

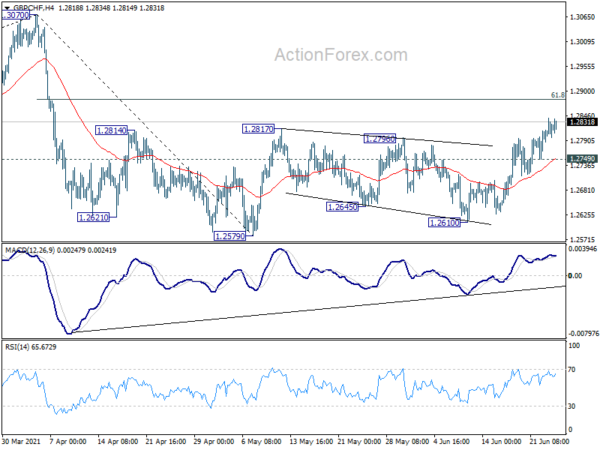

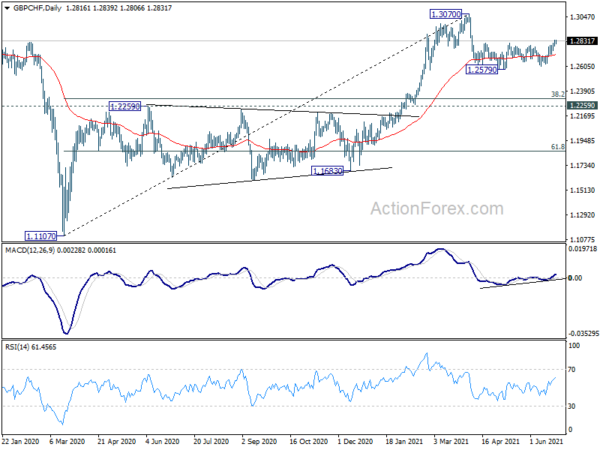

GBP/CHF extending rebound as BoE awaited, some upside prospects

BoE is widely expected to keep monetary policy unchanged today, with Bank Rate held at 0.10% and asset purchase target at GBP 895B. The overall tone on recovery should be upbeat given strong economy data flow. Yet, uncertainty remains high, in spite of high vaccination rate, regarding the third wave of the coronavirus pandemic that delayed restrictions easing. Headline inflation came in above BoE’s target in May. But the MPC would continue to view the movements as temporary and transitory.

Overall, BoE would wait until August meeting to decide on tapering. By then, new economic projections would be released with the Monetary Policy Report. Also, the situation regarding infections and reopening should be way clearer.

Here are some previews:

Sterling is currently the slightly better performer among European majors. There is prospect of further rally if BoE delivers some hawkish votings. In particular, GBP/CHF’s rebound from 1.2579 resumed by breaking 1.2817 resistance this week. The development also argues that correction from 1.3070 has completed after struggling around 55 day EMA.

Further rise is now in favor as long as 1.2749 minor support holds. Sustained trading above 61.8% retracement of 1.3070 to 1.2579 at 1.2882 will pave the way to retest 1.3070 high, and possibly resume whole up trend from 1.1107.

On the data front

Japan corporate service price index rose 1.5% yoy in May, above expectation of 1.4% yoy. Germany will release Ifo business climate in European session. Later in the day, US will release Q1 GDP final, goods trade balance, durable goods orders and jobless claims.

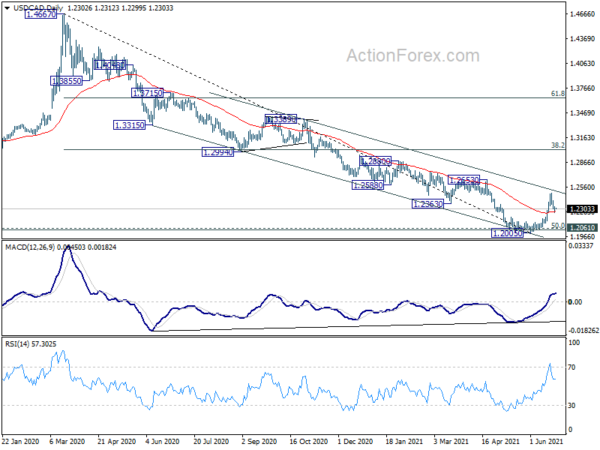

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2263; (P) 1.2296; (R1) 1.2339; More…

Intraday bias in USD/CAD remains neutral for the moment, with focus on 4 hour 55 EMA (now at 1.2280). Sustained trading below there will indicate that rebound form 1.2005 has completed after failing medium term channel resistance. Intraday bias will be back on the downside for retesting 1.2005. On the upside, above 1.2485 will resume the rebound to 1.2653 resistance. Firm break there should confirm near term bullish reversal and target 38.2% retracement of 1.4667 to 1.2005 at 1.3022 next.

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). It might have completed after hitting 1.2061 (2017 low) and 50% retracement of 0.9406 to 1.4689 at 1.2048. Sustained break of 38.2% retracement of 1.4667 to 1.2005 at 1.3022 will pave the way to 61.8% retracement at 1.3650. Overall, medium term outlook remains neutral at worst with 1.2048/61 support zone intact.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y May | 1.50% | 1.40% | 1.00% | 1.10% |

| 08:00 | EUR | Germany IFO Business Climate Jun | 100.4 | 99.2 | ||

| 08:00 | EUR | Germany IFO Expectations Jun | 103.5 | 102.9 | ||

| 08:00 | EUR | Germany IFO Current Assessment Jun | 97.8 | 95.7 | ||

| 08:00 | EUR | ECB Monthly Bulletin | ||||

| 11:00 | GBP | BoE Interest Rate Decision | 0.10% | 0.10% | ||

| 11:00 | GBP | BoE Asset Purchase Facility | 895B | 895B | ||

| 11:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–0–9 | ||

| 11:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | ||

| 12:30 | USD | Initial Jobless Claims (Jun 18) | 380K | 412K | ||

| 12:30 | USD | Durable Goods Orders May | 2.90% | -1.30% | ||

| 12:30 | USD | Durable Goods Orders ex Transportation May | 0.80% | 1.00% | ||

| 12:30 | USD | Wholesale Inventories May P | 0.90% | 0.80% | ||

| 12:30 | USD | Goods Trade Balance (USD) May P | -87.8B | -85.2B | ||

| 12:30 | USD | GDP Annualized Q1 | 6.40% | 6.40% | ||

| 12:30 | USD | GDP Price Index Q1 | 4.30% | 4.30% | ||

| 14:30 | USD | Natural Gas Storage | 64B | 16B |