The forex markets continue to be generally quiet today, stuck inside Friday’s range. Sterling is mildly lower on talks that UK Prime Minister Boris Johnson is going to delay easing of restrictions due to rise in the Delta variant infections. Yen is also trading lower together with Swiss Franc. Commodity currencies are generally firm, with New Zealand Dollar leading the way.

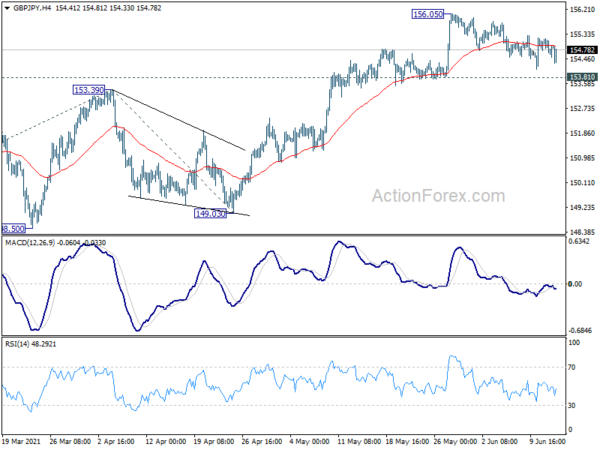

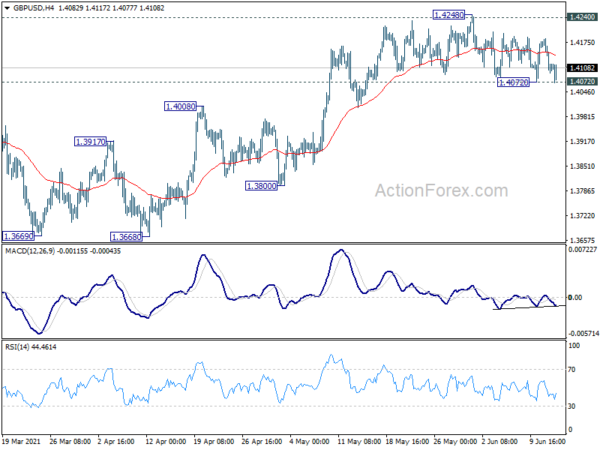

Technically, GBP/USD breached 1.4072 minor support today but quickly recovered. We’d see if the recovery could extend. But sustained break of 1.4072 will indicate near term bearish reversal. At this same time, eyes will also be on 153.81 support in GBP/JPY. Break there will suggest that GBP/JPY has topped up in the near term, and bring deeper pull back.

In Europe, at the time of writing, FTSE is up -0.19%. DAX is up 0.15%. CAC is up 0.10%. Germany 10-year yield is up 0.0048 at -0.265. Earlier in Asia, Nikkei rose 0.74%. Singapore Strait Times dropped -0.15%. Japan 10-year JGB yield rose 0.0102 to 0.040.

Canada manufacturing sales dropped -2.1% mom in Apr

Canada manufacturing sales dropped -2.1% mom to CAD 57.1B in April, much worse than expectation of 3.0% mom rise. Sales declined in 11 of 21 industrials, and much of the decline was attributable to lower sales of transportation equipment and petroleum and coal products.

Eurozone industrial production rose 0.8% mom in Apr, EU up 0.5% mom

Eurozone industrial production rose 0.8% mom in April, above expectation of 0.4% mom. Production of durable consumer goods rose by 3.4% mom, energy by 3.2% mom, capital goods by 1.4% mom and intermediate goods by 0.8% mom, while the production of non-durable consumer goods fell by -0.3% mom.

EU industrial production rose 0.5% mom. Among Member States for which data are available, the highest increases were registered in Belgium (+7.4%), Malta (+5.6%) and Estonia (+4.4%). The largest decreases were observed in Denmark (-3.8%), Hungary (-3.2%) and Lithuania (-2.4%).

Also released, Swiss PPI rose 0.8% mom, 3.2% yoy in May, above expectation of 0.2% mom, 2.8% yoy.

ECB Lagarde: We’re heading firmly towards a return to pre-COVID-19 level

ECB President Christine Lagarde said in a Politco interview, “you don’t remove the crutches from a patient unless and until the muscles have started rebuilding sufficiently so that the patient can walk on his or her own two legs. ”

“The same applies to the economy,” She added. “We are at a turning point where, bearing in mind alternative variants, we are on that recovery path, heading firmly towards a return to the pre-COVID-19 level.

She also reiterated that ECB has indicated the PEPP program will continue “until at least March 2022 and, in any case, until the Governing Council judges that the pandemic crisis phase is over.” Eurozone seems to be “heading in the right decision”. But it’s “far too early to debate” ending the PEPP program.

NZIER upgrades New Zealand growth outlook for next two years

NZIER said near term growth outlook for New Zealand has been revised up. Annual average growth in GDP is expected to reach 5% level in March 2022. Also, on average, annual growth is expected to reach 2.6% by March 2024. Inflation outlook is also revised up, reflecting that effects of cost increases are expected to persist over the coming years.

RBNZ has indicated that it would likely start raising interest rate in the second half of 2022. NZIER said it’s in line with forecasts for the 90-day bank bill rate. Also, expectation of higher inflation globally have driven up long-term interest rates. Outlook for long-term bond yields has also been revised up.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.4078; (P) 1.4131; (R1) 1.4167; More…

GBP/USD is holding above 1.4072 support despite breaching briefly. Intraday bias remains neutral first. On the upside, sustained break of 1.4240 resistance will resume larger up trend from 1.1409, for 1.4376 key resistance next. On the downside, however, firm break of 1.4072 support will extend the consolidation from 1.4240 with another falling leg. Intraday bias will be turned back to the downside for 1.4008 resistance turned support first.

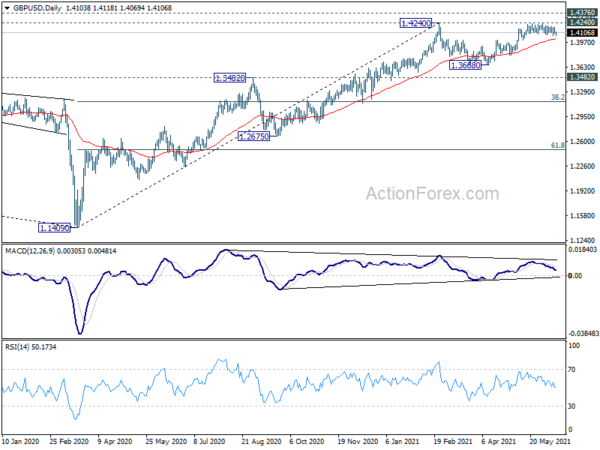

In the bigger picture, as long as 1.3482 resistance turned support holds, up trend from 1.1409 should still continue. Decisive break of 1.4376 resistance will carry larger bullish implications and target 38.2% retracement of 2.1161 (2007 high) to 1.1409 (2020 low) at 1.5134. However, firm break of 1.3482 support will argue that the rise from 1.1409 has completed and bring deeper fall to 1.2675 support and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 04:30 | JPY | Industrial Production M/M Apr F | 2.90% | 2.50% | 2.50% | |

| 06:30 | CHF | Producer and Import Prices M/M May | 0.80% | 0.20% | 0.70% | |

| 06:30 | CHF | Producer and Import Prices Y/Y May | 3.20% | 2.80% | 1.80% | |

| 09:00 | EUR | Eurozone Industrial Production M/M Apr | 0.80% | 0.40% | 0.10% | 0.40% |

| 12:30 | CAD | Manufacturing Sales M/M Apr | -2.10% | 3.00% | 3.50% |