US and Canada jobs reports to be reported at the 8:30 AM ET

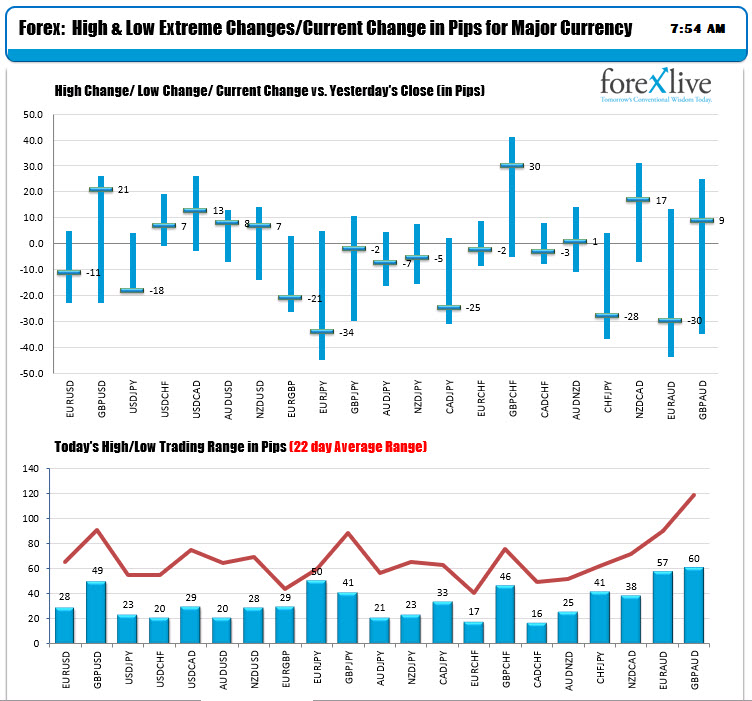

The JPY is the strongest currency and the CAD is the weakest currency as North American traders enter for the day. The US jobs report will be released at 8:30 AM ET with expectations for a change nonfarm payrolls to show a 674K increase (vs 266K last month). The unemployment rate is expected to dip to 5.9% from 6.1%. In Canada that change in employment is expected to decline by -25.0K after the huge decline of -207.1K last month (shutdown related). Full-time employment fell by -129.4K last month, while part-time employment fell by -77.8K. The unemployment rate is expected to move up to 8.2% from 8.1%

Looking at the ranges and changes the traders are taking a “wait and see” approach as ranges are very modest vs the 22 day averages (about a month of trading). The high trading range is only 49 pips for the majors vs the USD. THe USDCHF and AUDUSD both only have a 20 pip trading range. Clearly traders are locked and loaded, but not showing a preference.

- Spot gold is trading up $1.73 after yesterday’s sharp declines. That is up 0.09% at $1872.60

- Spot silver is trading down five cents per -0.21% $27.37

- WTI crude oil futures are trading up $0.19 or 0.28% at $69

- Bitcoin is trading down to thousand $385 or -6.16% at $36,324.80. That is near the session low of $36,250. The high price reached $39,291.24

In the premarket for US stocks, the major indices (implied by the futures) are trading mixed (marginal changes).

- Dow industrial average +1 points points after yesterday’s -23.34 point decline

- NASDAQ index up 35 points after yesterday’s 141.82 point decline

- S&P index up six points points after yesterday’s -15.27 point decline

In the European equity markets, the major indices are mixed as well.

- German DAX, +0.1%

- France’s CAC, unchanged

- UK’s FTSE 100, -0.15%

- Spain’s Ibex, -0.6%

- Italy’s FTSE MIB +0.15%

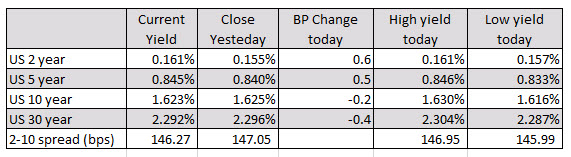

In the US debt market, the yields are mixed with the short end up marginally, and the longer end down marginally:

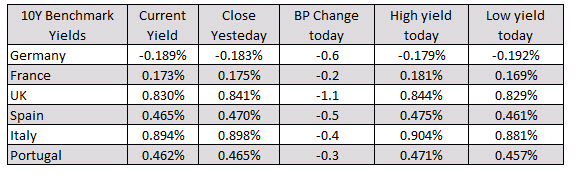

In the European debt market, the benchmark 10 year yields are mix but little changed: