All eyes on employment

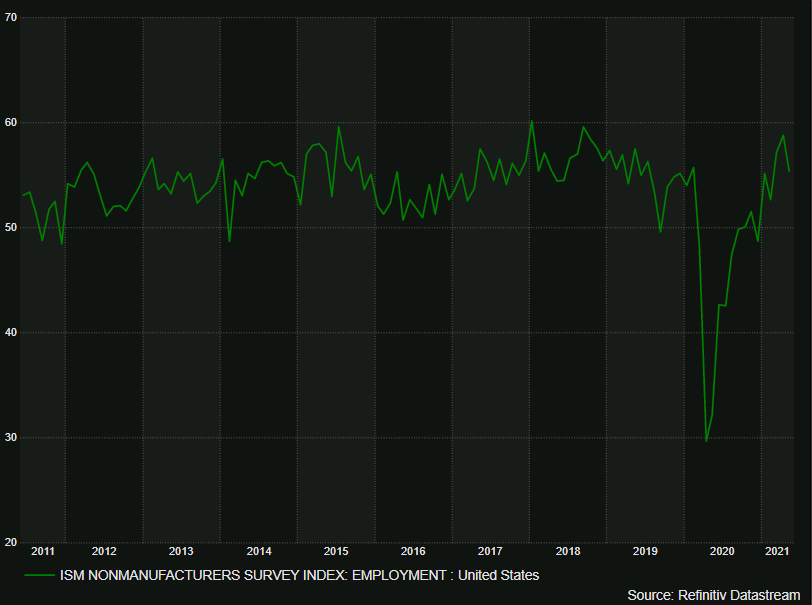

The numbers today emphasized just how important non-farm payrolls are tomorrow. The turn we’re seeing in markets is all about the employment component of ISM services. It’s often a better predictor of the jobs report than ADP. It fell to 55.3 from 58.8 in April.

With that, the US dollar has come off the boil and equity markets are turning around.

There’s a fear of a +1m jobs report right now and I don’t think that’s going away but the ISM number is one indicator that shows there isn’t a strong jobs market, but it’s not sizzling.

The turn in equities here shows just how eager the market is to buy the dip but I think the nerves will creep back in late, because it will be an ugly day on a +1m jobs report.

This article was originally published by Forexlive.com. Read the original article here.