The gold price was in the hands of the bears in London following an initial spike to score fresh highs at $1,916.61 as per XAU/USD.

Gold ended the North American session down 0.35% resting around the 50% mean reversion mark of the latest daily bullish impulse at $1,899 and slightly higher than the lows for the day of $1,892.44.

At the start of Asia, the gold price is flat and better offered as it tries to cling to the $1,900 psychological level.

Gold was under pressure despite a softer DXY index that was only able to eke out a 0.1% gain by the end of Wall Street after data showed that while US manufacturing activity picked up last month but showed a soft employment segment of the ISM report.

”Employment dropped to 50.9 vs 55.1 previously – with some suggesting that enhanced unemployment benefits are weighing on labour supply,” analysts at ANZ Bank explained.

Subsequently, DXY dropped to a low of 89.6630, having risen as high as 90.447 on Friday when a measure of US inflation closely watched by the Fed posted its biggest annual rise since 1992.

However, the overall strength in the US manufacturing data weighed on investor demand for gold when the bond market fell which pushed yields on 10-year Treasuries up 2bps to the highs of the day within the 3.7% rally, denting the demand for the non-interest bearing bullion.

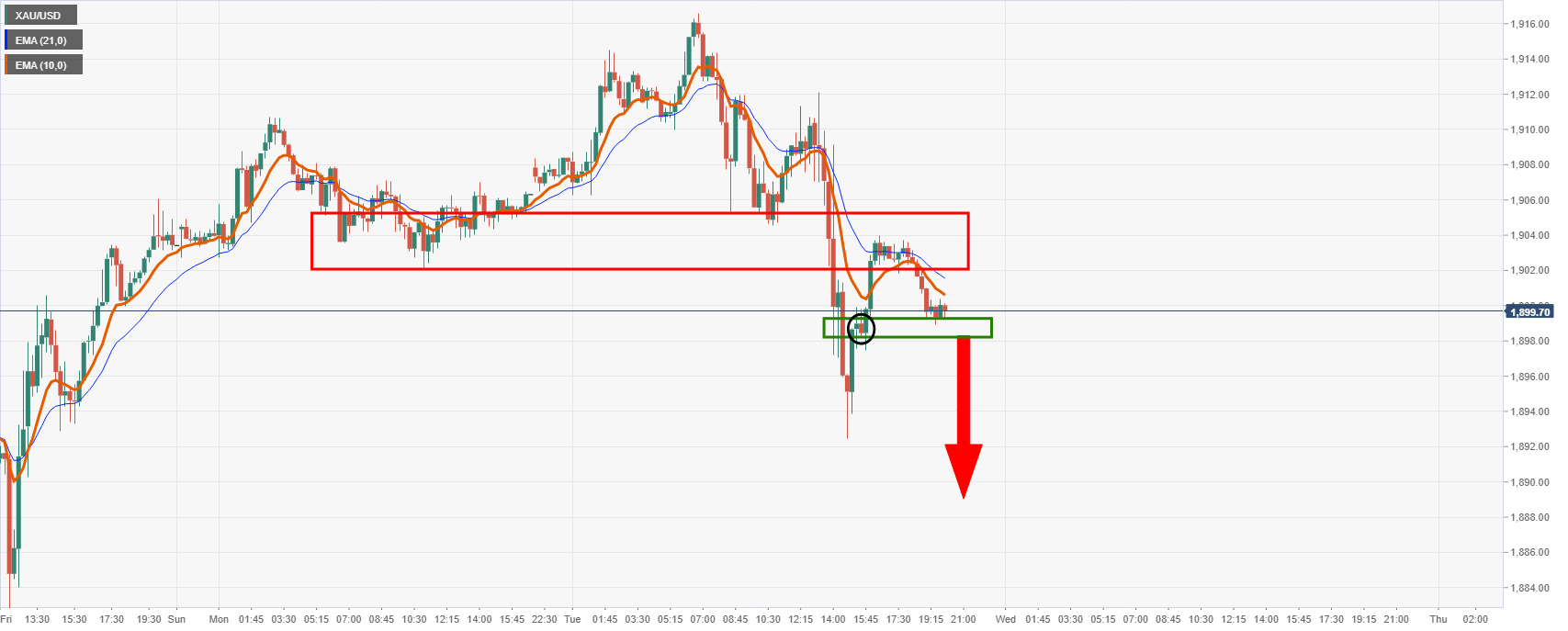

Gold technical analysis

As per the Chart of the Week forecasted, the Gold (XAU/USD) price rallied to score a fresh daily high following a retest of the support structure. However, it failed to extend with momentum and has started to carve out a bearish closing candle for the day.

As identified in the prior New York session on Tuesday, the price of gold is being held up at a critical 15-min level of support.

Prior analysis

Live market analysis

On a break of the support, there are prospects of a downside extension for the day ahead in accordance with the hourly price action:

With that being said, the territory below the current support is treacherous for the bears given the level of historic demand over the past week.

Any fresh lows in the current bearish cycle could be short lived.

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading