Commodity prices hit all-time highs – What’s next? [Video]

Update: Gold price is dragged down, trading around $1,830. However, a big miss on US CPI may drive XAU/USD above the 200-day moving average (DMA) at $1850, FXStreet’s Dhwani Mehta informs.

See – Gold Price Analysis: XAU/USD bulls come out of the shadows to mull a test of $1850 – DBS Bank

US dollar’s haven demand lifted on Middle East tensions

“Heading into the US CPI showdown this Wednesday, gold returns to the red zone, as the US dollar’s safe-haven demand remains in vogue amid an escalation of tensions between Israel and Gaza. Further, markets remain unnerved ahead of the US CPI April month report amid concerns of a potential acceleration in price pressures and its implication on the economy.”

“A CPI disappointment could tame inflation fears and squash Fed’s tapering and tightening expectations, which is likely to trigger a renewed burst of demand for the gold price.”

“A daily closing above the 200-DMA at $1850 could revive the bullish bets towards the $1900 mark.”

“Gold prices could challenge Tuesday’s low of $1818, below which the May 7 low of $1813 will be on the sellers’ radars. The 100-DMA at $1796 could act as a strong support if the correction from multi-month highs of $1846 regains traction.”

Update: Gold prices lose a part of the previous day gains, backed by the emergence of constructive bids against the US dollar. The rising Middle-East escalation and inflationary anxiety spooked the market participants. US Treasury yields remain elevated at 1.62% ahead of the US Consumer Price Index (CPI) data.

US inflation expectations rose to 3.4% in April, the highest in a decade amid economic reopening from covid related lockdowns. This might lead to higher prices and economic overheating, eventually, the Fed would end the ultra-loose monetary policy to curb the inflationary pressure.

Update: Gold price justifies the risk-off mood, down 0.26% intraday around $1,832, to register the first daily decline in six days during early Wednesday. Market sentiment seems to have soured amid the pre-US Consumer Price Index (CPI) caution. Also spoiling probing the bulls could be the geopolitical tensions in the Middle East and mixed vaccine updates, which in turn weighs on the gold prices.

Although risk catalysts and a busy economic calendar during the European session can direct immediate moves of the bullion, the gold traders will be more interested in the softer US CPI figures for April, expected 3.6% YoY versus 2.6% prior.

Read: US Consumer Price Index April Preview: The two base effects of inflation

At the time of writing, gold price is flat in Asia following a mixed day overnight. The price is consolidated at $1,836 following a choppy trading day and steep correction where the dip was an attractive discount for the bulls. Asia’s sharp equity declines at the start of the week were mirrored as the Europeans came online which transpired into a sour day on Wall Street as well. The US dollar was mixed against the G10 and gold took advantage of bouts of weakness.

On the eve of the US Consumer Price Index, investors bet that rising inflation could erode the greenback away and the US dollar hit a 2-1/2-month low early in the New York session. However, the greenback then firmed around those levels on Tuesday afternoon. Overall, markets believe the Federal Reserve will keep its commitment to low rates and hefty asset purchases which is a supportive factor for the precious metal in the longer run.

Gold price forecast could be affected by the US bond markets situation, the inflationary concerns amidst the commodities boom pushed yields higher. The 2-year government bond yields added 1bp from 0.15% to 0.16%, and the 10-year government bond yields rose 3bps from 1.60% to 1.63%. As for the key data ahead, the market expects that April CPI will rise 0.2%, ”which will push the year-ended pace to 3.6% on base effects,” analysts at Westpac explained.

Elsewhere, the April monthly budget statement deficit is on tap and we will also hear from the Federal reserve’s Vice Chair Clarida who will talk on the US economic outlook.

Gold forecast technical analysis

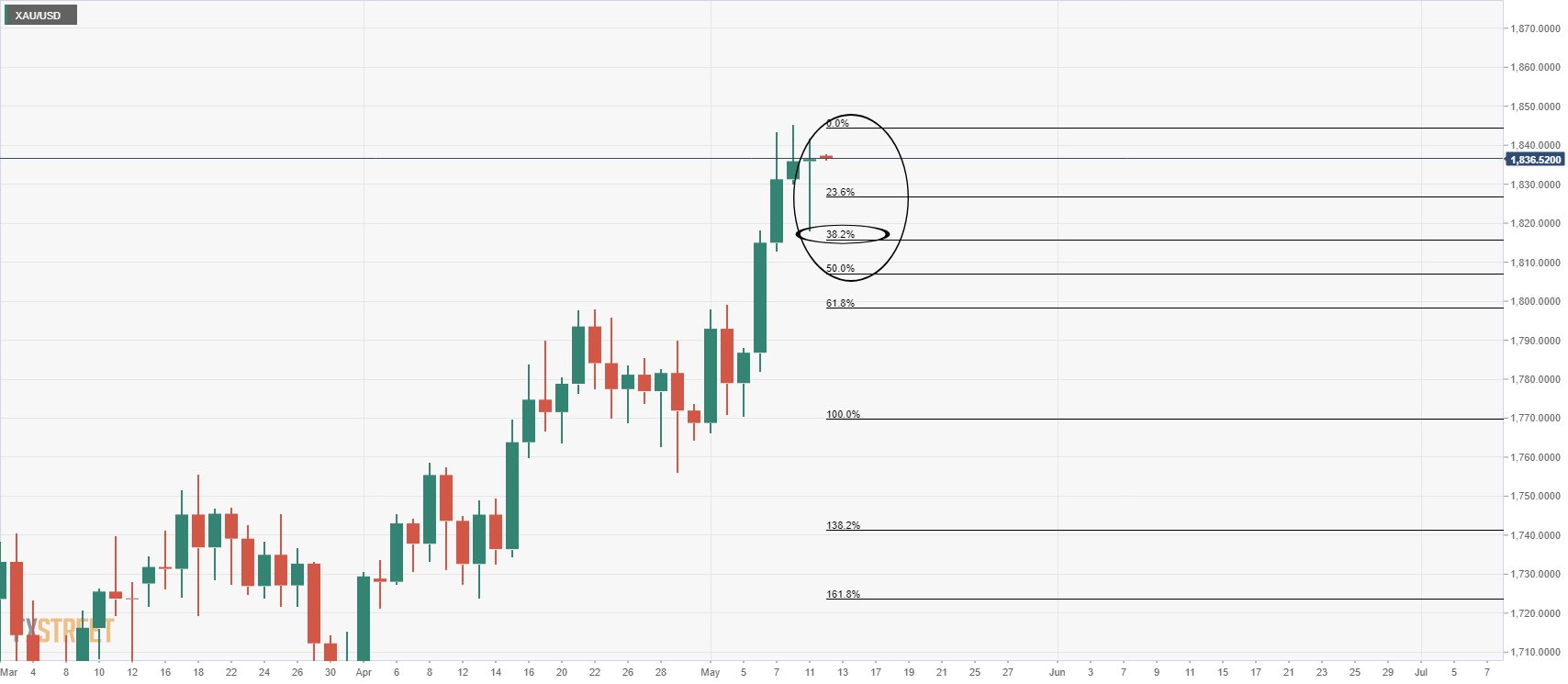

Meanwhile, as per the prior analysis, the price did indeed correct to the 38.2% Fibonacci level as follows:

Prior analysis, daily chart

As pointed out, the current bullish leg is somewhat overextended and the daily chart illustrates just that.

A correction to at least a 38.2% Fibo that meets structure on the lower time frames, such as the 4-hour chart, would have a confluence with the 8 EMA.

If bulls step in there, then it could be the making for an onwards daily bullish market to test deeper into the monthly supply zone, with 1,850 the first port of call.

Live market, daily chart

As illustrated, there was a perfect touch of the level.

However, the bears may not have thrown in the towel just yet and the lower time frames can be monitored for bearish structure.

Gold 4-hour chart

The price of gold is in a bullish environment on the 4-hour time frame, so a continuation to the upside is a more likely scenario at this juncture.

That being said, if the support breaks, the 8 and 20 EMA bearish crossover coupled with a restest of the old support, that would be expected to then act as resistance, will tip the balance in favour of the bears.

Bears could target a 61.8% Fibonacci retracement of the daily impulse that meets the prior highs and the psychological 1,800s.