The forex markets are relatively quiet in Asia, with Japan and China on holiday. Main theme is extended selloff in the Japanese Yen despite steep decline in Hong Kong and Singapore stocks. Aussie and Kiwi are the mildly firmer ones while Swiss Franc is softer. Also, a major talking point is the strong rises in cryptocurrencies, as led by ethereum which hits record high.

Technically, despite the late rebound in Dollar last week, there is no clear sign of bullish reversal yet, except versus Yen. In particular, we’ll keep an eye on 0.9180 minor resistance in USD/CHF and 0.7676 minor support in AUD/USD. As long as these levels holds, we’d expect selloff in the greenback to come back sooner or later.

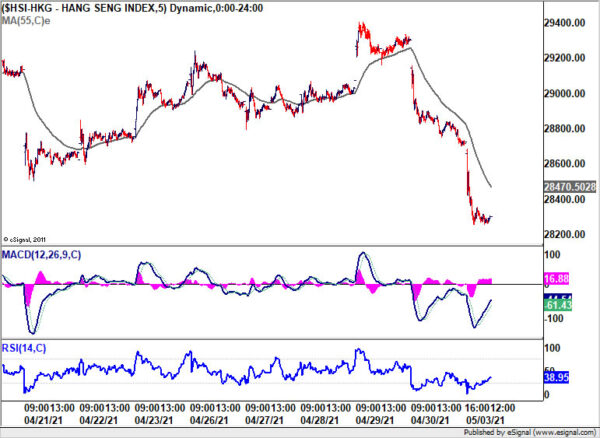

In Asia, at the time of writing, Hong Kong HSI is down -1.48%. Singapore Strait Times is down -1.32%. China and Japan are on holiday.

Bitcoin back at 58k as Ethereum hits record

Ethereum surged to record high above 3000 handle as recent up trend continues with strong momentum. Fresh buying came last week after European Investment Bank announced to issue its first even digital bond last week, on the ethereum blockchain network.

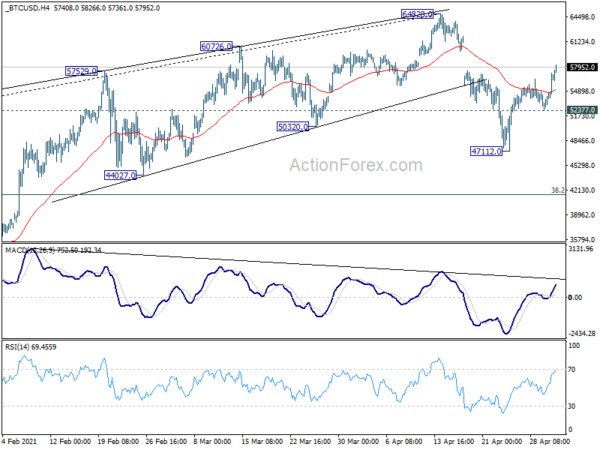

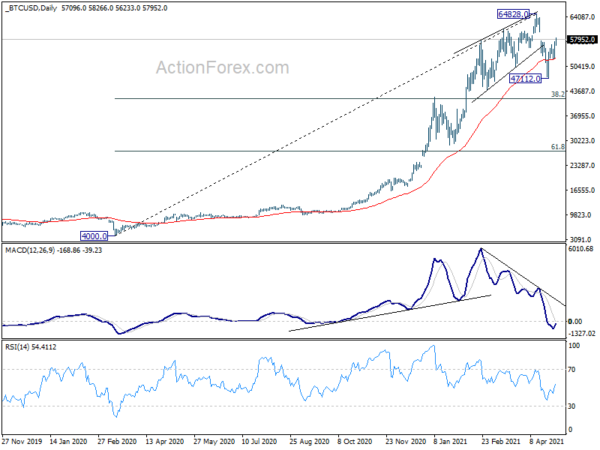

Bitcoin also follows higher and breaches 58000 handle today. As the first leg of the corrective pattern from 64828 has completed at 47112 already, Further rise is now in favor back to retest this high. However, we’d not expecting a firm break there. We’re still viewing price actions from 64828 as a medium term correction, and expect at least another falling leg before it completes.

Break of 52377 support will bring another fall to 47112 support, and possibly further to 38.2% retracement of 4000 to 64828 at 41591, which is close to the top of prior range of 20283/41964.

Australia AiG manufacturing rose to 61.7, no adverse effect from strong Australian Dollar

Australia AiG Performance of Manufacturing Index rose 1.8 pts to 61.7 in April. that’s the seventh straight month of rise, and the strongest reading since March 2018. All six manufacturing sectors expanded, as did all seven activity indicators.

Ai Group Chief Executive Innes Willox said: “Australia’s manufacturing industry showed no signs of slowing in the month following the end of the JobKeeper wage subsidy…. There was a large lift in manufacturing production, sales and exports and employment continued to grow solidly – although not at the very rapid pace seen in March. To date the sector as a whole has not been adversely affected by the stronger Australian dollar although a number of businesses are keeping a close eye on where the currency goes from here.”

RBA and BoE to meet, ISMs and NFP to be released

Two central banks will meet this week. RBA should monetary policy generally unchanged. Cash rate and 3-year government yield target will be held at 0.10%. The central bank has also just started the second round of AUD 100B in asset purchases. Though, yield curve control would probably be extended to from April 2024 bonds to November 2024 bonds. Attention will mostly be on the new economic projections, where RBA could lower unemployment rate forecast.

BoE is also generally expected to keep monetary policy unchanged, with Bank rate at 0.10% and asset purchase target at GBP 895B. Eyes will be on the monetary policy report and new forecasts. GDP growth outlook could be upgraded, together with near term inflation view. Also, more importantly, Sterling bulls would be eager to hear the word “tapering” as vaccinations are making good progresses in the UK.

BoJ will release minutes while ECB will also publish monthly economic bulletin. But the busy economic data releases will be more importantly, including US ISMs and NFP, Canada and New Zealand employment,. Here are some highlights for the week:

- Monday: Australia MI inflation; Germany retail sales; Swiss PMI manufacturing; Eurozone PMI manufacturing final; Canada PMI manufacturing; US ISM manufacturing, construction spending.

- Tuesday: RBA rate decision, Australia trade balance; UK PMI manufacturing final, mortgage approval, M4 money supply; Swiss SECO consumer climate; Canada building permits, trade balance; US trade balance, factory orders.

- Wednesday: Australia AiG construction, building approvals; New Zealand employment; Swiss CPI; Eurozone PMI services final; US ADP employment, ISM services.

- Thursday: New Zealand ANZ business confidence; BoJ minutes; Germany factory orders; ECB monthly bulletin, Eurozone retail sales; UK PMI services final, BoE rate decision; US Challenger job cuts, jobless claims, non-farm productivity, unit labor costs.

- Friday: Australia AiG services, RBA MPS; Japan monetary base, average cash earnings; China Caixin PMI services, trade balance; New Zealand inflation expectations; Swiss unemployment rate; Germany industrial production, trade balance; France industrial production, trade balance; Swiss foreign currency reserves; UK PMI construction; Canada employment, Ivey PMI; US non-farm payroll employment.

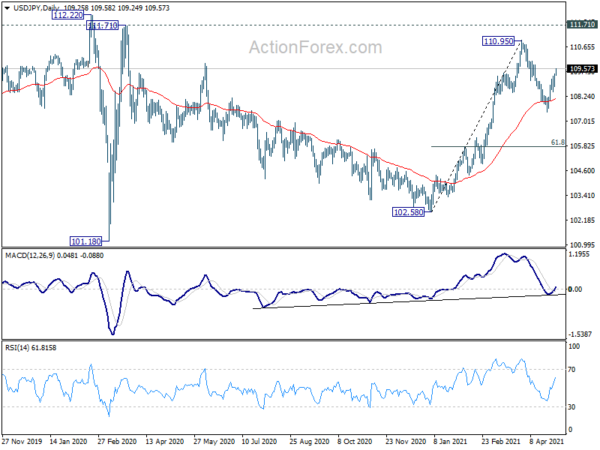

USD/JPY Daily Outlook

Daily Pivots: (S1) 108.91; (P) 109.13; (R1) 109.54; More…

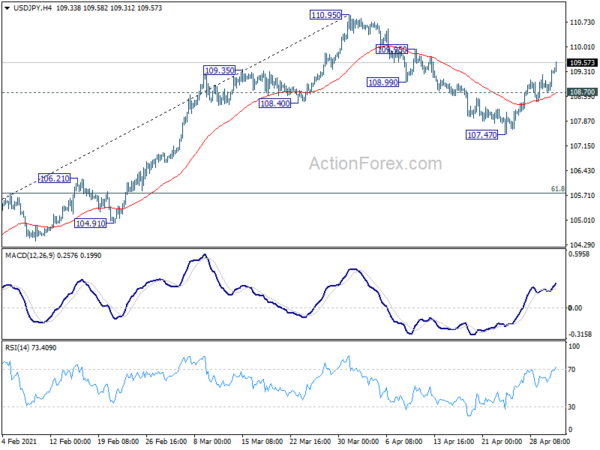

USD/JPY’s rebound from 107.47 continues today and hits as high as 109.58 so far. Intraday bias stays on the upside for 109.95 resistance first. Break there will pave the way to retest 110.95 high. On the downside, though, break of 108.70 minor support will turn bias back to the downside for 107.47 support again, to extend the pattern from 110.95.

In the bigger picture, rise from 102.58 might have completed at 110.95. But strong support from 55 day EMA retains near term bullishness for the pair. Break of 110.95 resistance will carry larger bullish implications and target 112.22 resistance next. Though, break of 107.47 support will shift favor to the case of long term sideway trading between 101.18/111.71.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:00 | AUD | TD Securities Inflation M/M Apr | 0.40% | 0.40% | ||

| 06:00 | EUR | Germany Retail Sales M/M Mar | 3.00% | 1.20% | ||

| 07:30 | CHF | SVME PMI Apr | 66.4 | 66.3 | ||

| 07:45 | EUR | Italy Manufacturing PMI Apr | 60.9 | 59.8 | ||

| 07:50 | EUR | France Manufacturing PMI Apr F | 59.2 | 59.2 | ||

| 07:55 | EUR | Germany Manufacturing PMI Apr F | 66.4 | 66.4 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI Apr F | 63.3 | 63.3 | ||

| 13:30 | CAD | Manufacturing PMI Apr | 58.5 | |||

| 13:45 | USD | Manufacturing PMI Apr F | 60.6 | 60.6 | ||

| 14:00 | USD | ISM Manufacturing PMI Apr | 65 | 64.7 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Apr | 86 | 85.6 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Apr | 59.6 | |||

| 14:00 | USD | Construction Spending M/M Mar | 2.00% | -0.80% |

#optionbuying #optionstrading#trading#nifty #scalping #sharemarket #shorts #ytshorts

#optionbuying #optionstrading#trading#nifty #scalping #sharemarket #shorts #ytshorts